Innovation in investment products is essential for asset managers to adapt to new market opportunities and shifting investor preferences. In the past, financial engineering played a key role in the evolution of investment vehicles, but now, technology is emerging as the primary driver of innovation.

According to the 2024 Asset and Wealth Management Report by PwC, one of the most prominent trends is the growth of tokenized investment products.

“In our base-case scenario, we project that assets under management in tokenized investment funds—including mutual funds and alternative funds, but excluding mandates—will grow from $40 billion in 2023 to over $317 billion by 2028,” the report states.

PwC explains that while this still represents a small fraction of the total market, it is expanding at an impressive compound annual growth rate (CAGR) of over 50%. This surge is driven by the need for greater liquidity, enhanced transparency, and broader investment access, particularly within alternative funds, which may include private equity, real estate, commodities, and other non-traditional assets.

The PwC report highlights that tokenization is providing investors with greater opportunities to diversify their portfolios into digital asset classes, especially as regulatory restrictions gradually ease.

According to the report’s conclusions, this innovation allows asset and wealth management firms to diversify portfolios, access non-correlated asset classes, and attract a new generation of tech-savvy clients.

“Currently, 18% of surveyed asset and wealth managers offer digital assets within their product offerings. While these products are still in their early stages, investor interest is growing. Eight out of ten managers who offer digital assets have reported an increase in inflows,” the report states.

PwC identifies a second major advantage of tokenized investment products: the ability to develop applications and platforms that enable retail investors to purchase fractional shares in private markets or tokenized funds.

“Tokenized fractional ownership could expand market opportunities by lowering minimum investments and allowing traditionally illiquid assets to be traded on secondary markets,” PwC analysts explain.

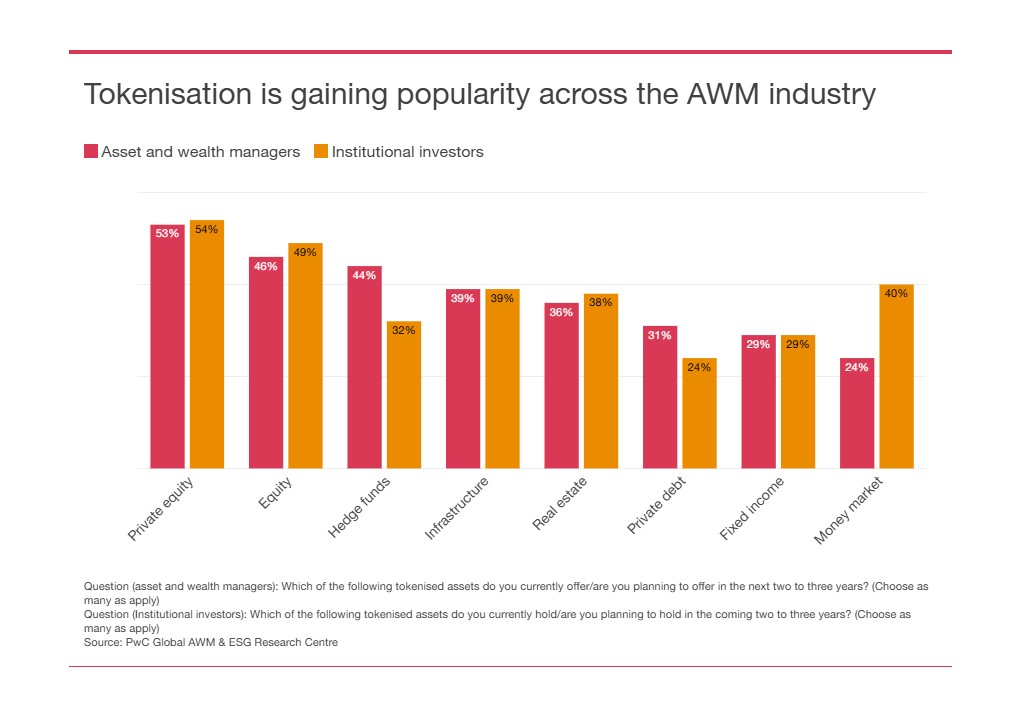

In fact, the survey highlights strong interest in tokenized private market assets from both asset managers and institutional investors, with more than half of each group identifying private equity as the primary tokenized asset class.