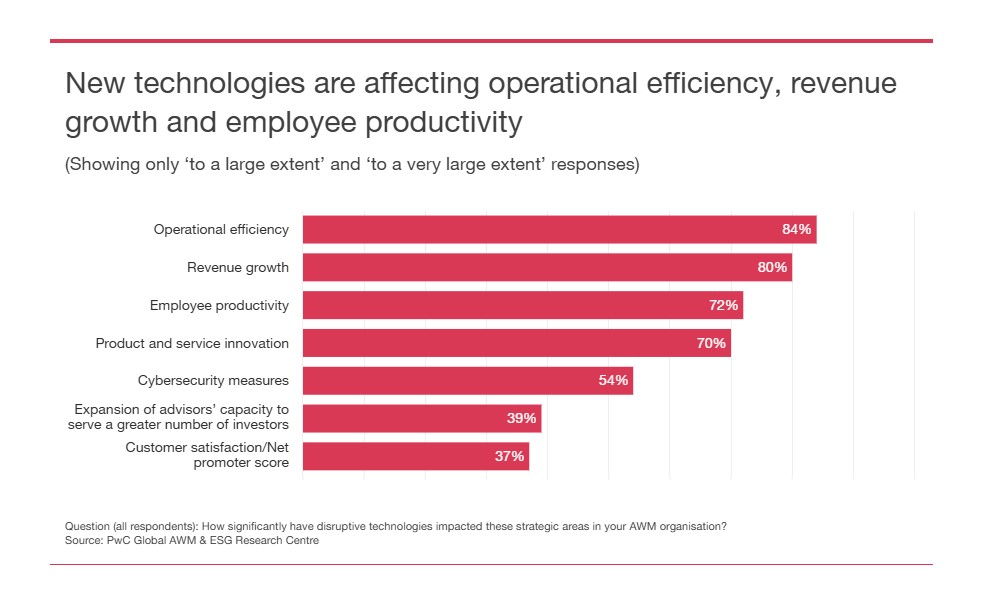

80% of asset management and wealth management firms state that AI will drive revenue growth, while the “technology-as-a-service” model could boost revenues by 12% by 2028, according to the Asset and Wealth Management 2024 report by PwC. A significant finding is that 73% of organizations believe AI will be the most transformative technology in the next two to three years.

The report reveals that 81% of asset managers are considering strategic alliances, consolidations, or mergers and acquisitions (M&A) to enhance their technological capabilities, innovate, expand into new markets, and democratize access to investment products, in a context marked by a significant wealth transfer. According to Albertha Charles, Global Asset & Wealth Management Leader at PwC UK, disruptive technologies, such as artificial intelligence (AI), are transforming the asset and wealth management industry by driving revenue growth, productivity, and efficiency.

“Market players are turning to strategic consolidation and partnerships to build technology-driven ecosystems, eliminate data management silos, and transform their service offerings amid a major wealth transfer, where affluent individuals and younger audiences will play a more significant role in shaping demand for services. To emerge as leaders in this new digital market, asset and wealth management organizations must invest in their technological transformation while ensuring they reskill and upskill their workforces with the necessary digital capabilities to remain competitive and innovative,” explains Charles.

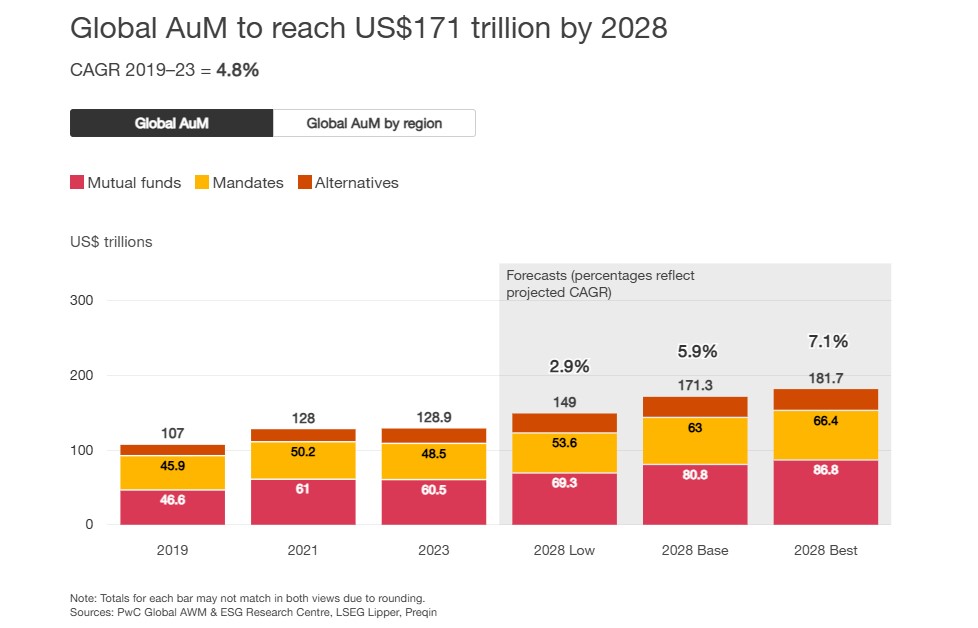

This focus will be critical in addressing an industry whose assets under management are expected to reach $171 trillion by 2028. According to PwC projections, the sector will see a compound annual growth rate (CAGR) of 5.9%, compared to last year’s 5%. Notably, alternative assets stand out, expected to grow even faster with a CAGR of 6.7%, reaching $27.6 trillion during the same period.

“Despite the potential of alternative assets, only 18% of investment firms currently offer emerging asset classes, such as digital assets, though eight out of ten firms that do report an increase in capital inflows,” the report notes in its conclusions.