The latest guidelines approved by the EU on the naming of funds that claim to be ESG could force more than 1,600 investment vehicles to rebrand or divest up to 40 billion euros, according to an analysis by Morningstar.

The requirements include a minimum of 80% of investments that meet environmental or social characteristics or sustainable investment objectives, and exclusions as established by the EU regulations for the Paris-aligned benchmarks (PAB) and climate transition benchmarks (CTB). In this regard, the PAB exclusions are particularly important, as they would exclude investments in companies that derive a certain level of revenue from fossil fuels. Additionally, funds with the key term “sustainable” in their names will need to invest “significantly” in sustainable investments, and funds using terms related to “transition” or “impact” will be subject to specific qualitative requirements.

“While it is impossible to predict the full impact of these guidelines, we expect their implications to be significant. They have the potential to completely reshape the landscape of ESG funds in Europe, with possibly thousands of ESG funds changing names and/or adjusting their portfolios to comply with the new rules. It might be tempting to assume that the upcoming major adjustment means many ESG funds could have been greenwashing, but the reality is that there were no standards until now, and it is a complex area. The guidelines have the benefit of setting minimum standards for ESG products and, hopefully, will provide greater clarity to investors about what they are investing in,” says Hortense Bioy, Head of Sustainable Investment Research at Morningstar Sustainalytics.

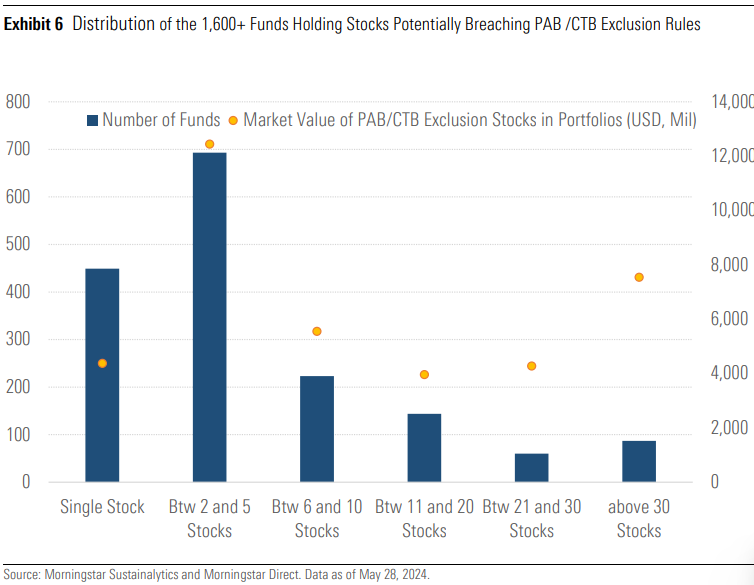

Morningstar has identified around 4,300 EU funds with terms related to ESG or sustainability in their names that could fall within the scope of the new guidelines. According to Morningstar, of the 2,500 funds with equity holding data, more than 1,600 are exposed to at least one stock that could be violating the PAB and CTB exclusion rules. “This represents a significant number (two-thirds) of funds that may need to consider divesting from the stocks or rebranding,” they indicate.

Morningstar explains that if all these funds retained their names, it could lead to stock divestments worth up to 40 billion dollars. “The sectors most affected by potential divestments include energy, industries (e.g., railroads, defense), and basic materials. The countries most impacted would be the USA, France, and China in terms of market value, but China, the USA, and India in terms of the number of companies,” states the latest Morningstar report.

Morningstar explains that when interpreting the PAB/CTB exclusion rules and obtaining data, managers will decide how far they want to go in the companies’ value chains and assess the related investment implications. “Due to the rigorous nature of the PAB exclusions, we expect many funds to remove terms like ESG and related terms from their names, while some will reposition as transition funds, which are subject to the less restrictive CTB exclusions, provided they can demonstrate a clear and measurable transition trajectory,” they add.

According to their estimates, in the best-case scenario, only 56% of funds with the specific term “sustainable” in their names could retain the term if the minimum threshold for a “significant” allocation to sustainable investments is set at 30%. Meanwhile, “the remaining 44% of funds would need to increase their allocation to sustainable investments, adjust their sustainable investment methodology, or rebrand.”