Schroders has announced three senior appointments in the US to underpin the strong growth of its US fixed income business.

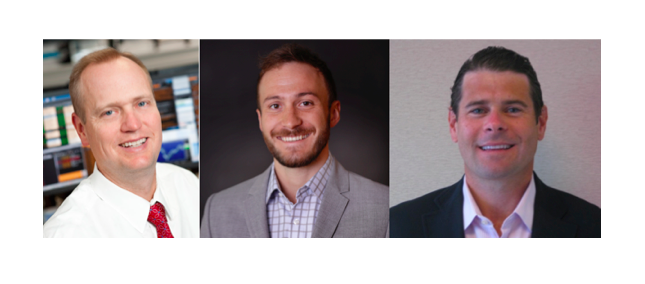

David Knutson has joined the US Credit team as Head of Credit Research – Americas. He will be based in New York and report into Wes Sparks, Head of US Credit. David will be covering large US banks. David brings almost 25 years of research experience to Schroders; he joins from Legal and General Investment Management America, where he had been a Senior Analyst in Fixed Income Research for ten years. Prior to this, David spent three years as Director of Fixed Income Research at Mason Street Advisors and seven years working in Credit Research and Debt Capital Markets at UBS. David replaces Jack Davis who transitions internally into a Senior Analyst role.

Eric Skelton joined the Global Fixed Income and FX trading team as US Credit trader for US investment grade credit, based in New York. He will report into Gregg Moore, Head of Trading, Americas and will work closely with US Credit Portfolio Managers, Rick Rezek and Ryan Mostafa and the rest of the US Fixed Income trading desk. Eric Skelton joins Schroders from Achievement Asset Management (formerly Peak6 Advisors), where he was a Credit Trader. Prior to joining Achievement Asset Management in 2014, Eric spent three years at Nuveen Investments.

Chris Eger joins the US Credit team in a newly created role as Portfolio Manager, reporting to Wes Sparks. Chris is based in the New York office. He joins Schroders with 14 years of experience in Investment Grade – in both Trading and Portfolio Management capacities. He joins from J.P. Morgan Chase, where he held the role of Executive Director – Credit Trader, Investment Grade Domestic and Yankee Banks. Prior to joining J.P. Morgan in 2007, Chris spent five years at AIG Global Investment Group where he held two Vice President positions, firstly as a Credit Trader and then as a Total Return Portfolio Manager.

Karl Dasher, CEO North America & Co-Head of Fixed Income at Schroders, said: “Investors globally are increasingly attracted to US credit markets in the search for yield and we have been beneficiaries of that trend. To support continued client demand and process evolution, we have made three strategic hires. These additions will further strengthen our in-house research and execution capabilities in the USD credit domain.”