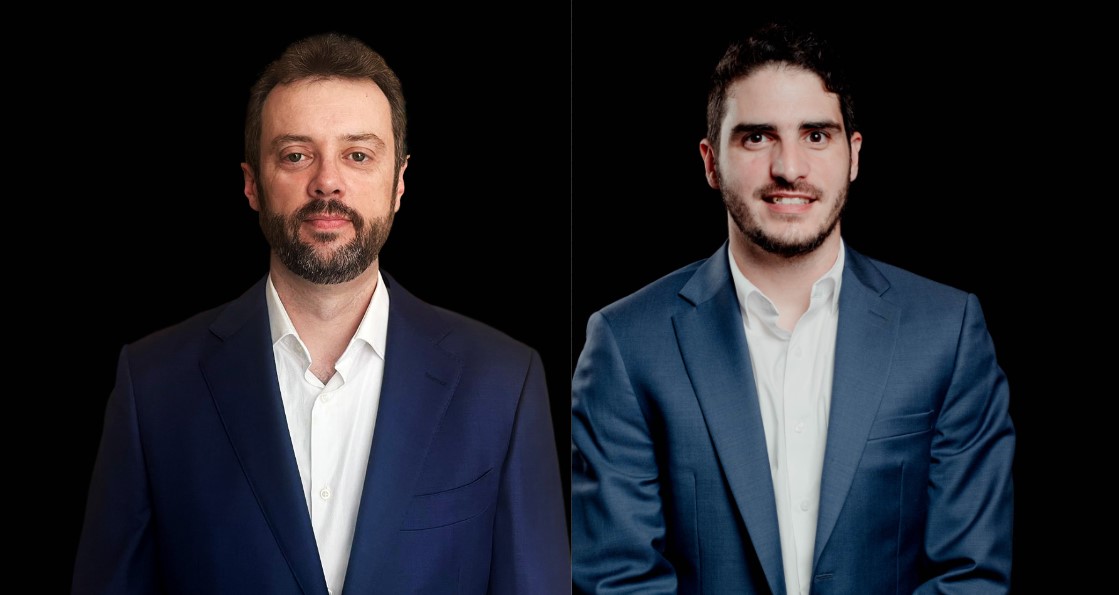

FlexFunds announced the strengthening of its team with the appointments of Wilson Gomes and Carlos Andón.

“This solidifies FlexFunds’ position in the Brazilian financial market, from acquiring prominent local clients and placing Andón as the leader of its operational innovation project”, the firm said in a press released.

With over 20 years of experience in the Brazilian financial market, Wilson Gomes joins as Business Development Manager in Sao Paulo.

Gomes has held managerial roles in Bank of Boston, Bloomberg, and MarketAxess. With a degree in Business Administration from the Pontifícia Universidade Católica de São Paulo and postgraduate studies at UC Berkeley, “his deep knowledge of the local market and successful track record make him a valuable asset to the FlexFunds team”, the company added.

“The addition of Wilson will allow us to expand our growth horizons in the Brazilian market, adapting our solutions to the needs of local asset managers. We see significant potential for asset securitization through local sub-custody, driving the distribution of portfolio managers’ investment strategies,” said José Carlos González Navarro, CEO of FlexFunds.

FlexFunds’ solutions currently have Brazilian clients such as CIX Capital, Leste and Fortune Wealth Management, which have securitized more than $200 million in assets, the press release adds. Additionally, the company has recently launched a solution specifically developed for the Brazilian market, allowing the securitization of a portfolio of local assets through sub-custodians in Brazil.

Meanwhile, based in Miami, Carlos Andón is promoted as Director of Product Operations. A veteran of FlexFunds, Andón has played a crucial role in achieving the automation of key architecture, policies, and procedures for the firm. He has also overseen the establishment of trading lines with over 50 counterparts worldwide and coordinates the global notes program with over USD 1.5 billion in assets under service. Andón will lead the operational innovation project for client reporting and automating the pricing calculation of FlexFunds’ ETPs, according to the firm.

“Carlos’s appointment is a source of pride and reflects the worth of our team. His leadership will be essential to continue offering our clients a world-class asset securitization program, enabling them to expand the distribution of investment strategies cost-effectively,” stated Emilio Veiga Gil, Executive Vice President of FlexFunds.

By Pablo Gegalian

By Pablo Gegalian