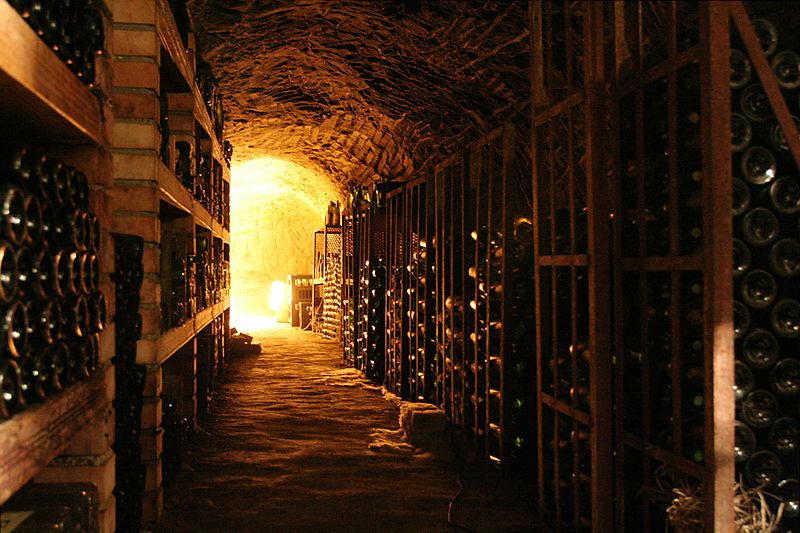

The Bottled Asset Fund (BAF), the wine investment fund launched in 2010 and directed by Sergio Esposito, a leading authority on Italian wine, today announced the acquisition of a historic collection of vintages of Biondi-Santi Brunello di Montalcino valued at $5 million (€4 million). This 7,000-bottle acquisition spans 1945-1975 and includes hundreds of bottles of the cult 1955 and 1964 vintages, representing a unique addition to the BAF portfolio. It is the largest vertical collection sale in history of “blue chip” Italian wines from a single source and with perfect provenance, as well as the largest single purchase in the history of Italian wine.

The deal was struck on March 19, 2013, only a few weeks before the sad passing of Franco Biondi-Santi on April 7th, 2013. Mr. Biondi-Santi was the fourth generation patriarch of one of the world’s most important winemaking families. The Biondi-Santi estate is widely recognized as the creator of Italy’s most important wine, Brunello di Montalcino, and, more importantly, it almost single-handedly introduced wines for long-term ageing to Italian wine culture. The family was the first to adopt the “Bordeaux model,” whereby wines are re-tasted and re-corked every few years, often with media present to extend their brand exposure. This model fosters a much higher quality that leads to greater market exposure and price appreciation over the long-term. At the time of Biondi-Santi’s adoption of the model, the protocol was unique for Italian wines.

“Biondi-Santi’s collection is legendary,” said Mr. Esposito, Director of the BAF’s investment board and Founder and CEO of Italian Wine Merchants, the premier Italian wine consultant in the US. “I’m highly confident that we reached a fantastic deal for our investors and for Italy itself. The quality of these bottles directly from cellar is incredible and their value will undoubtedly increase throughout the years as they are an Italian natural treasure.” Mr. Esposito’s long-term goal is to elevate the status of Italian wine as an investment asset, creating consistency, transparency and objective value in the Italian wine market.

The market for Italian wine is growing globally, with export markets, especially Asia, driving up value. The BAF value is currently seeing stunning profits, upwards of 30% and is projected to return profits to its investors, net of fees, of over 30%. By the end of 2013, Vino Management Corporation, the administrative body behind BAF, plans to launch another fund with the goal to commit $25 million.