The increasing allocation to private markets in response to market evolution by wealth managers and financial advisors is a clear trend in the industry. In fact, according to the Global Investor Insights Survey (GIIS) by Schroders, more than half of these professionals are currently investing in private markets, with an additional 20% expecting to do so within the next two years.

The survey, which includes 1,755 wealth managers and financial advisors globally—representing $12.1 trillion in assets—reveals that private equity (53%), private multi-asset solutions (47%), and renewable infrastructure equity (46%) are the top three private market asset classes where advisors and wealth managers expect their clients to increase allocations in the next 1-2 years.

Regarding how they expect client allocations to private market asset classes to change over the next 1-2 years, two-thirds of wealth managers and financial advisors highlight the potential for higher returns compared to public markets as the primary benefit of private market investing for their clients. This was closely followed by the ability to achieve diversification through different return drivers (62%). Additionally, on average, most investor allocations to private markets represent between 5%-10% or 1%-5% of their total portfolio exposure.

According to Carla Bergareche, Global Head of Wealth Management at Schroders’ Client Group, while many wealth managers and financial advisors are already investing in private markets on behalf of their clients, allocation sizes remain significantly lower than the 20% or more seen in family office and institutional investor portfolios.

“This gap represents a significant opportunity to strengthen client engagement with private markets. We therefore expect these markets to play an increasingly important role in wealth investment portfolios as investors become more aware of the potential for strong and diversified returns,” explains Bergareche.

Access to Private Market Investments

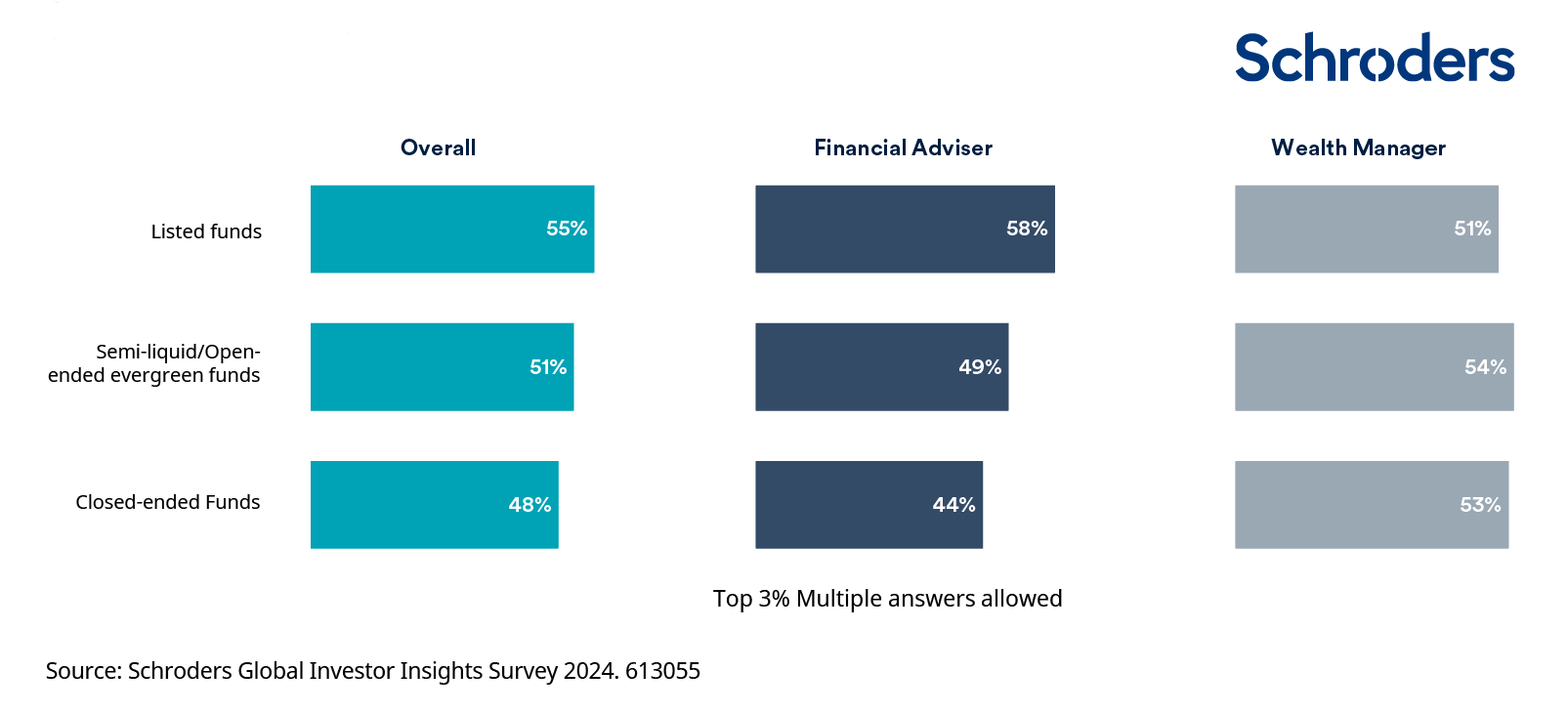

Another key finding is that just over half of surveyed wealth managers and advisors indicated that they access private market opportunities through exchange-traded funds, closely followed by semi-liquid or open-ended indefinite-duration funds (51%). Despite these opportunities, lack of liquidity is cited as the main challenge when discussing private markets with clients.

According to Schroders, 49% of respondents stated that greater financial education for clients would help drive demand, followed by better-suited product structures (42%) and lower investment minimums (42%).

“There is no doubt that private wealth will play a very significant role in private markets in the future. Until now, wealth managers and advisors have had limited options to access these markets compared to their institutional counterparts, which explains why, despite their intent, we still see relatively low allocations,” says Tim Boole, Head of Private Equity Product Management at Schroders Capital.

However, in his experience, the emergence of new vehicles, such as semi-liquid funds, has expanded available access points, representing a significant advancement in providing greater flexibility for investors to achieve their financial goals through private markets. “It’s no surprise that these structures are favored by this client segment,” Boole adds.

Wealth Transfer as a Key Priority

Additionally, the firm highlights that wealth transfer has been identified as a priority for 59% of wealth managers and financial advisors worldwide. In North America, 66% consider it a priority, compared to 57% in the UK, 57% in Asia-Pacific, and 58% in EMEA.

The report shows that wealth transfer discussions are more deeply embedded in the Americas. Specifically, Latin America has the highest level of engagement globally, with 58% of advisors stating they have addressed this topic with more than half of their clients. In EMEA and Asia-Pacific, participation is lower, with 43% and 46% of advisors engaging in these discussions, primarily due to cultural sensitivities.