Private debt has established itself as a resilient and diversified market, according to the latest report by Union Bancaire Privée (UBP).

“It is said that private debt emerged as an asset class following the global financial crisis. The contraction of bank lending, combined with quantitative easing and zero interest rate policy, created conditions where both borrowers and investors turned to private debt. This perspective of private debt, as a relatively new asset class associated with specific monetary policy conditions, raises questions about the sustainability of private debt and, in particular, how it will remain relevant for borrowers and investors now that interest rates have normalized,” they explain.

In this regard, their response is clear: the entity expects private debt to continue evolving and growing. “This growth will continue as long as there is an insufficient supply of bank financing and non-bank financial intermediaries, such as funds, to channel financing to potential borrowers. In particular, although the period of low interest rates spurred the growth of private debt, its continued growth does not depend on any specific monetary policy. Over the past decade, direct lending and, to a lesser extent, commercial real estate have been the dominant segments within private debt,” they explain in the report.

Additionally, they are convinced that investors will increasingly seek to diversify away from these segments and favor those that offer both resilience and attractive returns. “We believe that real economy sectors, such as residential real estate and asset-backed financing, meet these requirements and will attract investors. Origination will be an important differentiator among asset managers. The real economy is more fragmented than the world of private equity firms or commercial real estate. Originating transactions in the real economy will require origination capabilities through which asset managers will differentiate themselves,” they argue.

Delving into Assets

Interestingly, private debt has existed in various forms for over 4,000 years, thanks to its very nature: it is privately negotiated between the borrower and the lender. “The strength of private debt lies in its diversity of strategies and transactions. Its longevity is due to its flexibility and its ability to reinvent itself for new financing opportunities. The recent growth of private debt is due to the scarcity of bank loans and the evolution of non-bank financial intermediaries. We expect private debt to continue growing, particularly in strategies different from those that have been predominant in the last decade,” notes the UBP report.

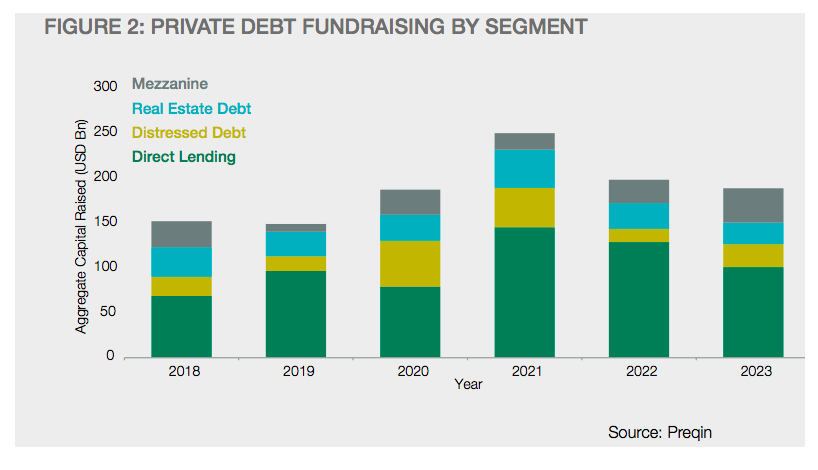

In this regard, one of the report’s conclusions is that the increase in demand for private debt among borrowers is driven by a shift in the supply of credit from the banking system. “In the absence of a change in the supply of bank credit, which we believe is unlikely, the demand for private debt will continue to grow,” they insist. This has led to direct lending being the fastest-growing segment, according to Preqin data, followed by distressed debt, real estate debt, and mezzanine debt.

Another notable conclusion of the UBP report is that direct lending has dominated the narrative around private debt since the global financial crisis. “Private equity fund managers have been able to deploy a significant amount of capital for transaction financing, resulting in the origination of borrowers by private equity firms. Increasingly, according to the report, fund managers seek to diversify away from these sponsor-backed loans and towards other sectors, such as asset-backed financing,” they explain.

Furthermore, the report indicates that investors in direct lending funds likely have indirect exposure to the private equity sector. “We have observed recent reports of delays in private equity exits and an increase in loans within portfolio companies to finance private equity dividends and payments to their investors. These reports are likely short-term cyclical, but they serve as a reminder that transaction origination is a determinant of diversification,” they clarify.

The Demand for Private Credit

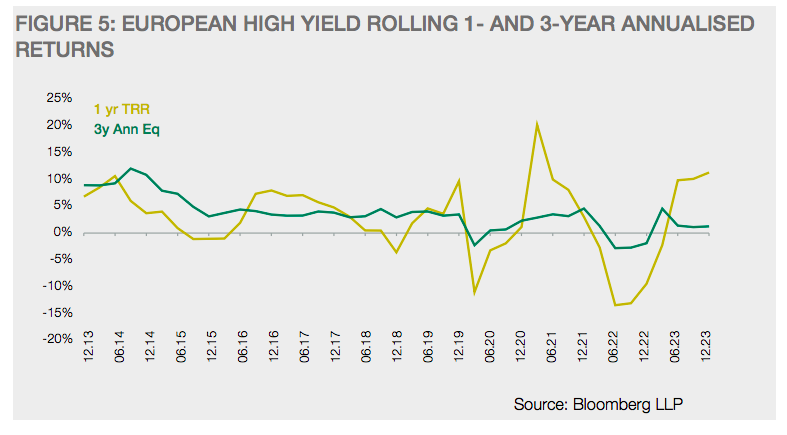

In UBP’s view, not all investors have the resilience needed to maintain their investment allocations during market downturns. “An allocation to private debt offers diversification relative to public debt markets. Within private debt, there are many opportunities for diversification, and the four major segments offer diversification among themselves and relative to public debt markets. Greater diversification can be found outside of sponsor-backed direct lending and commercial real estate financing. We believe that investors will increasingly be drawn to other strategies,” the report indicates.

Lastly, the report notes that the market’s expectation is that the transition to normalized interest rates is complete and that short-term rates have peaked. This implies that market commentary has shifted to when rates will begin to fall and how quickly they will do so, and, in response, bond markets have already moved. “Credit spreads have fallen significantly, anticipating better times ahead. However, some sectors still need to emerge from the transition and will likely continue to face headwinds. For highly leveraged borrowers, it is not enough that rates have peaked; they need rates to fall. In the commercial real estate sector, it could take several years to overcome the oversupply and financing gap. We believe it makes sense to invest now, entering a period of falling rates. However, we suggest it is better to choose strategies that do not depend on a rapid fall in rates, are less leveraged, and are not expected to face headwinds in the coming years,” they conclude from UBP.