Startups led by a solo founder have more than doubled in the past decade, while new companies with three, four, or five founders have become less common. However, solo founders are less likely to secure venture capital funding. At the same time, equal equity splits are becoming more common among founding teams, and founder ownership decreases more sharply in the early stages of financing.

These are the main takeaways from the Founder Ownership Report 2025 by Carta, a software and services platform for private equity firms. The report, based on the analysis of anonymized data from over 45,000 startups founded between 2015 and 2024, sheds new light on how startup ownership works across the U.S. entrepreneurial ecosystem.

“How should a company spend this valuable resource? We hope this data helps founding teams and their investors think through this question at every stage of the financing journey,” write the report’s authors, Peter Walker and Kevin Dowd, in its introduction.

Key Highlights

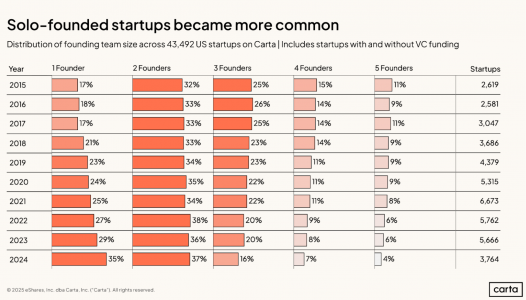

In recent years, the percentage of all Carta-tracked startups with a solo founder has been rising, with the trend accelerating in 2024. About 35% of all new startups last year had a single founder, compared to 29% in 2023 and 17% in 2017.

Conversely, larger founding teams are becoming less frequent. In 2024, only 16% of all new startups had three founders, 7% had four, and 4% had five—each representing the lowest levels in the past ten years.

These shifts in founding team sizes have continued steadily, even as the broader venture capital market has experienced considerable volatility, the report notes.

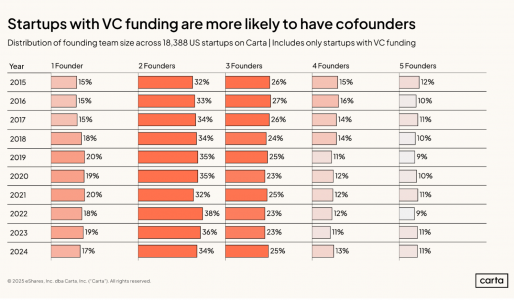

The report also highlights that solo founders are less likely to receive venture capital funding compared to larger founding teams. While solo founders made up 35% of all startups launched in 2024, they accounted for just 17% of those that also closed a VC round before the end of the year.

On the other hand, startups with three, four, or five founders tend to outperform expectations. Roughly 11% of startups founded last year that had already raised VC funding had five founders.

“While the data doesn’t show the exact reasons behind this observed preference for co-founders, we can speculate that investors seek both a safety net (in case a lead founder exits the company) and complementary skill sets (perhaps a commercial founder paired with a technical one) to reduce the risk of early-stage bets,” the report explains.

Another important point highlighted by Carta’s research is the growing trend toward equal equity splits. While most founding teams still choose to split equity unequally, an increasing number of co-founders are opting for equal division. The data shows that in 2024, 45.9% of two-person founding teams split their equity equally, up from 31.5% in 2015.

The report also underscores that founder ownership declines the most in the earliest stages: after raising an initial funding round, the average founding team collectively holds 56.2% of their startup’s equity. By Series A, that figure drops to 36.1%, and to 23% by Series B.

“In some cases, the founding team consists of just one person—a solo entrepreneur eager to do it all. In others, it includes multiple co-founders looking to leverage their complementary skills to win in the market,” the report states. “From the beginning, deciding how to split equity among co-founders, investors, employees, and other stakeholders is a strategic choice, and it remains critical as the company grows,” it adds.

The report also analyzes startups across different industries. One finding: in general, software-focused startups tend to have smaller founding teams compared to startups in research-intensive sectors that produce physical products.

Carta, with 12 years of experience in private equity and five offices across different continents, supports over 45,000 venture-backed companies and 2.4 million security holders, helping them manage more than $3 trillion in equity.