The bursting of the housing bubble in Spain and the subsequent financial crisis have left Spanish real estate prices at levels which, for the first time in years, investors are beginning to consider attractive. Therefore, the asset’s positioning begins to pick up, either directly or through listed vehicles such as the SOCIMIs, the Spanish REITs.

“The question which investors were asking themselves in recent years, on whether the time was right to invest in Spanish real estate or not, is no longer relevant. The question now is the type of asset in which to invest, and in which market. The response will depend on investors’ risk profiles, their expectations on the return and the investment term,” as told to Funds Society by Juan José Zaragoza, managing partner of Exan Capital, a real estate advisory and management independent firm based in Miami. The expert believes that “property deals currently offered in Spain and investors’ return expectations finally fall together.” And, in his opinion, some of the clearest opportunities are “in some types of assets which offer investors attractive returns with adjustments in both asset prices and rents or leases in prime areas of Spain’s two main markets (Madrid and Barcelona).”

Bankinter also points out that the Spanish property market will be an attractive investment opportunity over 2014. The recovery will begin this year with a stabilization, followed by a significant recovery in demand and prices in 2015, and development reactivation in 2016. They particularly mention that there will be structural changes: the demand will not be the same as it was in the past and the prices of poorly located homes will continue to fall. They remind investors to consider a long-term vision. “It will be an attractive investment opportunity once again but taking a five to ten year timeframe into account.”

Gross and Soros, the Interested Gurus

This period of recovery is attractive to all investors. “It is not just international vulture funds or foreign real estate investors who wish to invest in the Spanish real estate market, but also the local investors,” Zaragoza pointed out. Nevertheless, the recovery is currently relying on large institutional investors and international fortunes.

Thus, over the past few weeks, we are seeing how the big international investors have put the Spanish real estate sector in the spotlight. Just days ago Bill Gross, guru of the largest fixed income manager in the world, Pimco, agreed to purchase five million shares in the new Grupo Lar SOCIMI, or REIT, which will begin trading on the Spanish market on March 6 in the hands of the Pereda family; representing an investment of 50 million Euros and a fund weight of 12.5%.

More recently, it was made known that George Soros, the U.S. investor who bought 3% of FCC some months ago, has committed with the Azora team, to be anchor investor of Hispania Activos Inmobiliarios, its 500 million Euro SOCIMI, by contributing 50 million euros, equivalent to 10% of the fund. Currently, and as explained by the institution, Hispania is undergoing talks with several major global financial investors in connection with their participation as anchor investors.

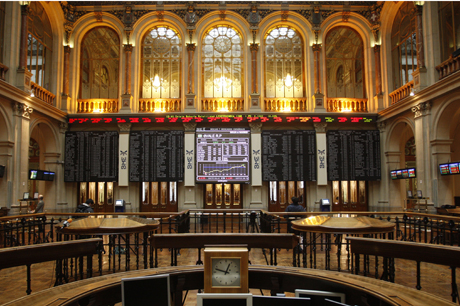

On Thursday, Hispania Activos Inmobiliarios, a newly established Spanish real estate company, announced its intention to launch an offer for subscription of shares to obtain a capital of 500 million Euros through global positioning for qualified and sophisticated investors, with Goldman Sachs International and UBS Limited as coordinators for the offer. The company intends to build a portfolio of quality real estate assets by investing primarily in residential properties, offices and hotels in Spain. The company, which prompted the listing of its shares in the Spanish stock market after having obtained the approval of the prospectus by the CNMV, will be managed and advised by a company of the Azora Group (over 2,000 million Euros in assets under management).

The Appeal of the SOCIMI (REIT)

These last two are a couple of examples of the appeal which the SOCIMI have as a vehicle to channel investors’ interest for Spanish real estate beyond direct investment. “It can be a very interesting vehicle for families as well as for the international investor. Now is the time to have SOCIMIs within the product portfolio,” said Juan Antonio Gutiérrrez, CEO of the Wealth Management Company Mazabi Gestión de Patrimonios, at a recent conference organized by iiR. These vehicles are fit “for investors in Latin America and elsewhere.”

Experts believe they have already laid the legal and taxation foundations for their development and that they shall continue to grow in numbers. According to Mazabi, there are international investors with Spanish real estate who are considering entering or forming a SOCIMI; and he estimates that by the end of 2015 there could be between 15 and 20 companies of its kind in the Spanish market, both of domestic and international investors. “There are currently many families working on the establishment of SOCIMIs” confirms Enrique López de Ceballos Reyna, RHGR-ONTIER partner. One of the key advantages is the liquidity which they can provide in the future, when they go public, an activity for which there is a two year margin. Taxation wise they are very advantageous, although they are required to distribute 80% of rental earnings in dividends, which are taxable.

It is precisely those dividends which could be the attraction for investors. “A lot more money will flow in when SOCIMIs are clearly invested: pension plans and other institutional investors will want to access the coupon provided by the SOCIMI,” explains Gutierrez.

Two Types of SOCIMIs

In late November, the new segment trading SOCIMIs in the Alternative Stock Market (MAB) was launched in Spain, with the addition of Entrecampos Four SOCIMI S.A., and Promorent a few days later. Although at Mazabi they believe that there are two types of SOCIMI: those promoted mostly by families with low assets of less than 100 million euros and which seek tax status or liquidity for their real estate, and others promoted by institutional investors, with assets above 300 million, seeking tax breaks and as Soros does, seeking to benefit from the rules of a game which is well known to them to enter the asset. As the cost of the SOCIMI is around 100,000 euros, scalable depending on the volume, and they require great administrative work, Gutierrez relies more on the development of the latter, or SOCIMIs formed by integrating several family groups with higher volumes.