Reinsurers facing shrinking balance sheets amid rising rates and increasingly volatile catastrophic losses have effectively utilized the insurance-linked securities (ILS) market to manage risks and to pay insured losses. However, ILS investors not properly compensated for risk or facing elevated losses amid fallout from Hurricane Ian may choose to reinvest capital elsewhere, which would exacerbate the demand/supply imbalance of the reinsurance sector, which is especially acute in the Florida property market, Fitch Ratings says.

ILS include catastrophe (cat) bonds, collateral reinsurance, sidecars and industry loss warranties, representing around 20%, or $100 billion, of global reinsurance capacity. Cat bonds are approximately 30% of the ILS market. Commentary from the Monte Carlo Rendezvous 2022 indicated a pipeline of ILS deals of $5 bil. of additional reinsurance capacity, which would benefit insurers facing a hardening market.

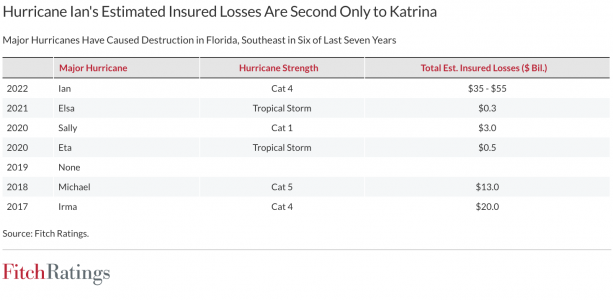

However, the ILS market will assume a fair share of losses from Ian, with Fitch estimating total insured losses of $35 billons.-$55 billons., second only to Hurricane Katrina at $65 bil. ($90 bil. in 2021 dollars).

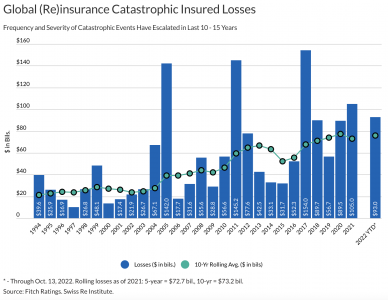

As frequency and severity of losses have increased in the past 10 to 15 years, modeling catastrophic losses and pricing risk effectively is challenged by secondary peril costs and potential effects of climate change on catastrophe events. Escalating inflation and litigation expenses also make controlling claim costs more difficult.

Major hurricanes have hit Florida in five of the past six years, following a 10-year reprieve after Katrina (2005). The state remains attractive with its population growing over 16%, or three million people from 2010 to 2020. Estimated losses from Ian will make the tenuous Jan. 1 renewal season much more difficult.

ILS investors are compensated for possible principal loss due to natural catastrophe risk. Since 2017, with insured losses from Hurricanes Harvey, Irma and Maria, the number of cat bonds not returning full principal to investors totals 55 individual tranches with either a full or partial loss to investors, a dramatic increase compared to 75 tranches in totality since 1990.

Nearly 33%, or $10 billons (bil.) of outstanding cat bonds, have some exposure to Florida wind damage. ILS investments exclusively or predominantly exposed to Florida wind or the southeast region and Hurricane Ian are $2.9 bil.

Without proper compensation, investors will look elsewhere. Cat bonds become unattractive if investors perceive they are not adequately compensated for “loss creep” and “trapped capital” due to settlement delays, which can last three to four years. During this time, Cat bond investors may forego investment opportunities from other asset classes or be stuck with ILS deals at lower spreads. ILS-trapped capital from Hurricane Ian is estimated at $15 bil. – $18 bil. according to Trading Risk.

Fitch rates two catastrophe bonds, Stratosphere Re Ltd., 2020-1 and Long Point Re IV Ltd., 2022-1. These bonds are not at risk of principal loss given the former’s structural features and the latter’s predominantly northeast U.S. insured property value.

Several cat bond indices provide initial market reaction to Ian, reflecting preliminary estimates based on pricing sheets and not reported claims from sponsors. September sequential-month returns for Swiss Re Global Total Return, Eurekahedge ILS Advisers Index and Plenum Indexes were -8.6%, -7.6% and -5.2%, respectively, versus the ‘BB’ High Yield index return of -3.8%.

ILS indices prior to September were positive and performing very well in 2022 to financial asset classes, showcasing non-correlation benefits. However, ILS performance has trailed the 3 to 5-year ‘BB’ rated High Yield Index over the past five years. Spread attractiveness and diversification benefits for ILS investors may fall with rising interest rates, which may reduce investor appetite in dedicating time and resources to a sector that has plateaued between $90 bil. and $100 bil. of outstanding issuance.

By Fórmate a Fondo

By Fórmate a Fondo