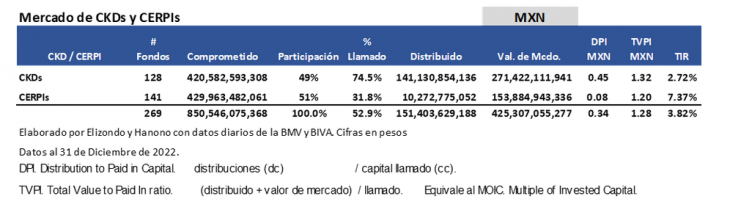

The international investments of the CERPIS in Private Equity, have improved the returns on this asset class by a ratio of three to one. The 128 outstanding CKDs (including those that have been amortized) have a net IRR weighted by 2.7% net in Mexican pesos (MXN) as of December 31, 2022, while the IRR of CERPIs is 7.4%. IRRs are in MXN and not US, because institutional investors who invest in CKDs and CERPIs have their portfolios evaluated in MXN.

The CKDs are the vehicles registered in the Mexican Stock Exchange (BMV and BIVA) that allow institutional investors to invest in local private equity and the CERPIs are the ones that can invest globally.

The weighted IRR of both is 3.8%. There would be several considerations:

- The CKDs (128) were born in 2009 (almost 14 years ago) and have called 75% of the capital to date.

- The CERPIs (141) although they were born in 2016 it was from 2018 that they began to invest globally, which means that they are almost 5 years old and have called 32%.

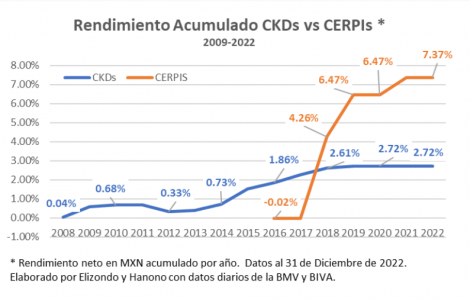

With less time and capital called, CERPIs have improved profitability in this asset class. If the AFOREs had only invested in CKDs today the return would be 2.7% and if they had only invested in CERPIs it would be 7.4% net in MXN. This data is weighted for the 128 CKDs and 141 CERPIs respectively. When graphing the IRR of the CKDs, its evolution year after year has been gradual, while the behavior of the IRR of the CERPIs shows a steeper slope.

The great diversity of options available when investing in global private equity has allowed the AFOREs to select those global funds that have practically no “j curve”. The “j curve” is the investment period of private equity funds in which investments in this asset class show an initial loss (investment period) followed by a dramatic rise. On a chart, this pattern of activity would follow the shape of a “capital J”.

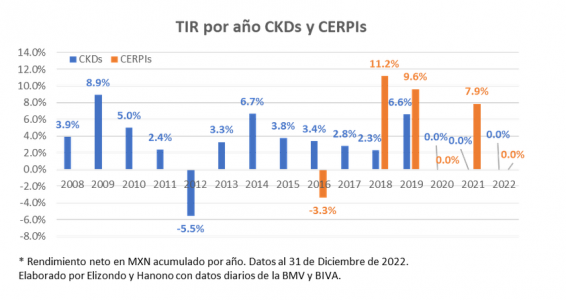

When reviewing the yields per vintage, it is observed that in four years (2009-2010-2014 and 2019) CKDs had yields greater than 5%, the rest being lower; while for CERPIs there are three years with yields above 8% and only one year with negative IRR corresponding to the issuance of the first CERPI (j curve effect).

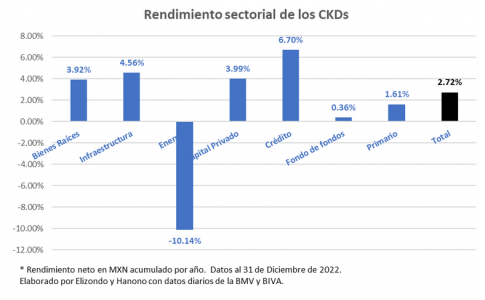

When presenting the net IRR in MXN for CKDs in a sectoral manner as of December 31, 2022, the Credit (17/128 CKDs) and Infrastructure (17/128) sectors are the ones that have offered the best IRRs to date. It is important to recognize a “J curve” with less slope for the most unfavorable sectors. These results change over time by capital calls and market valuation, among other variables.

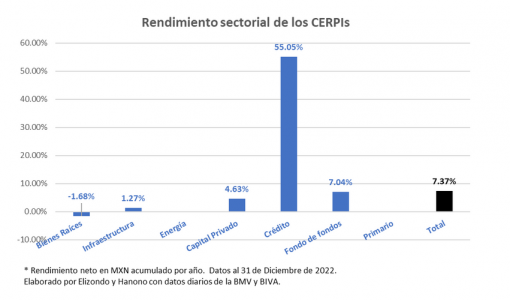

In the case of CERPIs, the Fund of Funds/Feeder sector (130/141), which concentrates 87% of the market value, has an IRR of 7.0% that weights the market value of the Credit sector (1/141), as well as the other sectors that allow the net IRR weighted in MXN to be raised to 7.4%.

If the 8% rate (preferential rate) is considered as a threshold to distinguish the most profitable funds; with IRR greater than 8% net in MXN there are 37 of 128 CKDs (29%); if those with IRRs greater than 10% are considered, there are 22 CKDs and if those with IRRs greater than 15% net are considered, there are 4 CKDs. Of a total of 64 CKD administrators (GPs) only 19 have IRR greater than 10%, so there are few administrators who present competitive IRR to date.

In the case of CERPIs, 36 of 141 CERPIs (26%) have IRR greater than 8% as of December 31; with IRR greater than 10% there are 30 and with IRR greater than 15% there are 25 CERPIs with data as of December 31. Being an important number of CERPIs Funds of Funds that act as Feeders, if in each CERPI there are two global funds (conservative number) in total there are more than 280 funds, although many of them are the same in the different CERPIs. Diversification is proving important in CERPIs.

Where is the market going?

Historical IRR makes CERPIs look like an alternative that has helped institutional investors to diversify and improve the returns in this asset class.

The competition that has occurred between local and foreign GPs has allowed the institutional investor to compare between the options in the market, selecting those sectors and managers with proven experience and attractive results.

Of course, these comparisons may change as the investment cycle of CKDs and CERPIs concludes, however, today the numbers are skewed in favor of CERPIs.

Column by Arturo Hanono