The level of compliance risk facing alternative fund managers is rising and is expected to grow further over the next two years, according to a survey conducted by Ocorian and Bovill Newgate, a firm specializing in regulatory and compliance services for funds, corporates, capital markets, and private clients. Based on the experience of both companies, more investment is urgently needed to address the issue.

Following an international survey among senior compliance and risk leaders from alternative fund investment firms, it was found that 88% believe compliance risks have increased and will continue to rise over the next two years. Specifically, one in ten respondents expects this increase in risks to be dramatic.

This trend is occurring in a context where compliance teams report insufficient resources and a high level of fines. In fact, 64% of respondents stated that their compliance management team is already under-resourced, with over half of these (34%) feeling their resources are severely lacking.

The number of firms facing fines and sanctions is already high, with 67% of respondents admitting that their organization has been subject to risk and compliance fines or sanctions in the past two years. An additional 9% acknowledged receiving a request for information or a visit from the regulator within the same period.

In response to these findings, Matthew Hazell, Co-Head of Funds for the UK, Guernsey, and Mauritius at Bovill Newgate, remarked: “Our survey reveals a concerning backdrop of fines, sanctions, and under-resourced compliance teams within alternative fund managers, against which nine out of ten respondents believe the level of compliance risk their firms face will only increase over the next two years. It is encouraging that leaders within these firms recognize these future challenges and understand the need to act now to stay ahead.”

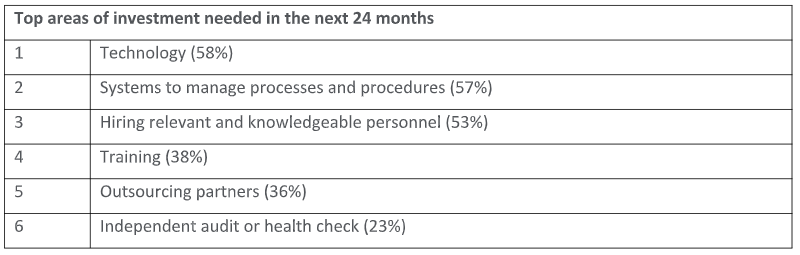

The Ocorian study highlights the three key areas where alternative fund managers believe investment is required in the next 24 months to address the issue: technology (58%), systems for managing processes and procedures (57%), and hiring knowledgeable, relevant personnel (53%).

Matthew added: “Firms need to have a deep understanding of their own compliance and risk needs, and any potential changes due to growth or organizational shifts, in order to invest wisely in the right systems, processes, and people to protect against these future risks. We recommend following a three-lines-of-defense approach to safeguard their businesses: first, implementing robust procedures, policies, and training; second, thoroughly monitoring these aspects; and finally, reviewing and challenging them through independent audits.”

Ocorian’s three-lines-of-defense approach to addressing compliance and risk challenges consists of the following:

– Line One: Establish clear and robust processes and procedures on the front line, complemented by online and in-person training programs for staff.

– Line Two: Build and empower a comprehensive compliance oversight function that monitors and evaluates processes and procedures while advising and supporting staff and senior management in meeting the company’s obligations.

– Line Three: Seek the review and challenge of the company’s AML framework through annual independent audits.