A Surprising Gift for Chinese New Year

| For Elena Santiso | 0 Comentarios

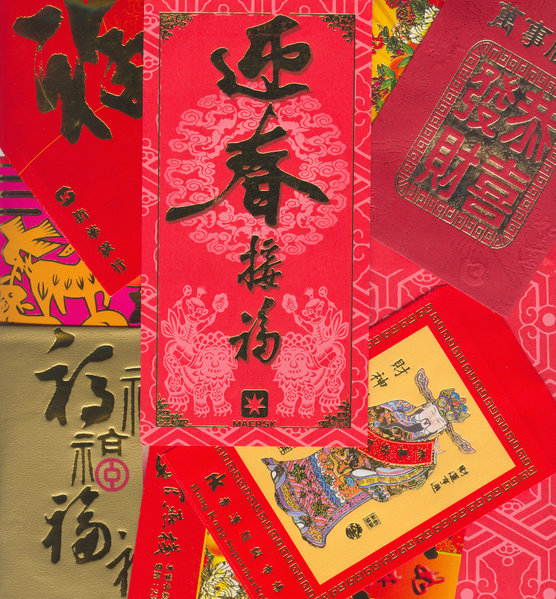

Beijing-based China Credit Trust Company, a firm that operates as a non-banking financial institution in China, announced this week it reached an agreement to restructure a risky high-yield product that had earlier ignited worries over the health of China’s trust industry. Just in time for the Lunar New Year, investors in the troubled trust may receive a big (metaphorical) red envelope—a monetary gift traditionally given during Chinese New Year or other special occasions—or at least avoid a financial hit.

China Credit Trust unveiled its plan to arrange a bailout for buyers of the product. It plans to restructure the loan behind the approximately US$496 million high-yielding investment product that is slated to mature on the Lunar New Year holiday, January 31.

Trust products in China are privately placed investment vehicles similar to private equity or hedge funds in the West. These products are not allowed to solicit public investment, and are available only to certain qualified (sufficiently wealthy) investors through commercial banks and securities companies. Given the flexibility of their investment universe, ranging from commodities to equities, the trust industry has seen rapid growth in the past several years. The industry’s total assets under management now stands at about US$1.6 trillion (or 9.6 trillion renminbi).

One factor behind this significant growth has been the off-balance sheet lending activity of Chinese banks. During the phase of rapid credit expansion since 2009, Chinese banks increasingly found that their own lending capacity no longer satisfied strong loan demand. To escape regulatory constraints, some banks moved loans into trust products, then sold them to investors who were attracted to generally higher annual yields of approximately 10%.

The problem came when these products went bad. Who should be held responsible for the loss to investors? Bankers who sold these products said they were just helping to distribute the products. Trust managers blamed banks, often the entities from which the products originated. In reality, several trusts facing the risk of default were bailed out by local governments. This is partly because borrowers were state-owned enterprises, and valuable collateral assets can be auctioned.

The situation with China Credit Trust is a bit different. The struggling private coal mining company, which was the borrower of the funds from the trust, recently found the value of its mining assets collapse with the slumping price of coal. It is therefore surprising that “strategic investors” would be willing to take over the assets and pay back investor principal in full. It has been widely reported that local government officials helped arrange the bailout behind the scenes. However, the financial market is clearly nervous over whether the potential for default of a trust product may trigger more serious systematic risk. This concern might be overblown for the following reasons:

- Unlike many troubled structured products during the global financial crisis, trust products in China were primarily simple straight-forward credit instruments. Trust products do not employ leverage and there are no derivatives linked to trust products. Thus, the ripple effect caused by a default on a trust product tends to be better contained.

- In contrast to wealth management products, which were sold to mass market retail investors as a deposit alternative, trust products are sold to qualified individual and institutional investors. Such investors generally have a higher risk tolerance than the average investor. Losses suffered by such investors are generally unlikely to result in street protests and widespread unrest. Instead, they may lead to legal court disputes.

In my view, the moral hazard that comes from bailing out these investors outweighs the short-term stability of a bailout. So long as trust investors continue to believe their high returns are implicitly guaranteed by Chinese banks or the government, China‘s real risk-free interest rate may be much higher than the current government bond yield suggests. Thus, the cost of borrowing for many Chinese companies has exceeded the lending rate set by the central bank. At the same time, equity investors of Chinese banks continue to worry about the potential risk of bailing out troubled trust products. If China’s government is serious about economic reform, based on true market principles, then allowing the market to allocate credit, based on the risk/reward analysis of its market participants, is the possibly the most important step it needs to take.

Even in the spirit of the Chinese New Year tradition, red envelopes are primarily for children. It may be time for trust product investors to face consequences as grown ups.

Sherwood Zhang, CFA, Research Analyst at Matthews Asia

The views and information discussed represent opinion and an assessment of market conditions at a specific point in time that are subject to change. It should not be relied upon as a recommendation to buy and sell particular securities or markets in general. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Matthews International Capital Management, LLC does not accept any liability for losses either direct or consequential caused by the use of this information. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific geographic location. Investing in small- and mid-size companies is more risky than investing in large companies, as they may be more volatile and less liquid than large companies. This document has not been reviewed or approved by any regulatory body.