While Europe Changes Course, the Markets Focus on the Key Event of the Week: the Fed Meeting

| For Amaya Uriarte | 0 Comentarios

The European Parliament elections have yielded three clear conclusions: far-right parties with an anti-establishment nuance have gained influence; a centrist majority persists; and the results have significantly impacted local politics in France and Belgium. The market’s immediate concern, however, remains on the upcoming decisions by the U.S. Federal Reserve.

According to the initial official results published by the European Parliament, far-right political groups have increased their presence. Nevertheless, the European People’s Party (EPP) emerged victorious with 191 seats, followed by the Socialists and Democrats (S&D) with 135 seats, and the Liberals (Renew) with 83 seats. These results have prompted a snap election in France, as President Emmanuel Macron dissolved the National Assembly and called for legislative elections later this month, and the resignation of Belgian Prime Minister Alexander de Croo, both due to their parties’ losses and the rise of more extreme right-wing parties.

According to Gilles Moëc, chief economist at AXA Investment Managers, the results of the European elections were not expected to trigger a significant shift in the EU’s stance. “Although the overall political space of the major parties is shrinking, the European Parliament has a long tradition of cooperation among the main groups – center-right, liberals, and social democrats – which, based on the national results seen so far, will likely maintain a comfortable majority of the seats together. It may be more difficult to reach the necessary compromises, and changes in public opinion will need to be considered, but a radical change of course is not to be expected. However, the decision of the French president to dissolve the National Assembly, the lower house of the French Parliament, in response to the European vote, changes the perspective,” he says.

Regarding Macron’s decision, Lizzy Galbraith, a political economist at abrdn, explained that “while these elections won’t affect Macron’s presidency, they might force him to work with opposition parties in Parliament, complicating his legislative agenda”. Axel Botte of Ostrum AM highlighted the uncertainty in France, questioning whether the far-right RN could secure a majority government, potentially leaving Macron’s centrist party as the viable option.”In any case, these elections are extremely important with a view to the upcoming presidential elections in 2027.”

According to Mabrouk Chetouane, head of global strategy at Natixis IM Solutions, “the economic and financial consequences of this political thunder are already palpable” in France, where the main stock index, the CAC 40, opened with sharp declines, reflecting market operators’ concerns about the visibility of the French economy’s trajectory. “Reform plans could be abruptly halted by the likely formation of a coalition, which would result in a coalition government in a context where the state of public finances leaves no room for maneuver for the future government. France, a pillar of the eurozone, could find itself in a possible deadlock. This would reduce investor visibility, increase national stock market volatility, and raise the cost of debt… A deleterious trio that would temporarily deter foreign investors from French markets,” Chetouane points out.

Where is the Market Looking?

Against this new political backdrop, the markets are currently calm and focused on what they consider to be the key event of the week: the monetary policy meeting of the U.S. Federal Reserve. The crucial question is whether the Fed will announce its first rate cut of the year this Thursday, following the ECB’s rate cut last week.

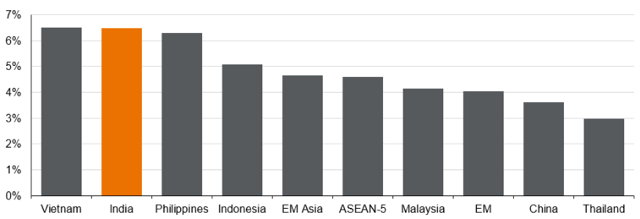

To understand what the Fed might do, it’s essential to look at the data. “The latest U.S. employment data gave mixed signals. The ratio of job openings to unemployed workers fell to 2019 levels, suggesting a relaxation in labor market tension. However, the strong growth in non-farm payrolls and the 0.5% increase in average hourly earnings for production and non-supervisory workers could indicate wage inflation pressures. This week’s CPI could help clarify whether the U.S. is enjoying a Goldilocks moment of slowing inflation combined with resilient employment or if inflationary pressures persist,” says Ron Temple, head of market strategy at Lazard.

According to Javier Molina, senior market analyst at eToro, following the latest data on the state of the U.S. economy, the Fed faces significant challenges in achieving its 2% inflation target, given the solid performance of the economy and labor market. “At the next Federal Open Market Committee (FOMC) meeting on June 12, it is unlikely that the Fed will change its guidance on future rate cuts given the lack of confidence in the sustainability of the current disinflationary trajectory,” Molina notes.

Meanwhile, Paolo Zanghieri, senior economist at Generali AM, part of the Generali Investments ecosystem, recalls that in recent weeks, members of the Federal Open Market Committee (FOMC) have called for more patience in easing policy, which will likely result in an upward revision of the median appropriate level for the federal funds rate by year-end. “Our baseline scenario remains two rate cuts (in September and December), with a single cut as the second most likely scenario. More important for long-term rates, the FOMC is likely to continue raising its estimate of the long-term neutral interest rate, an indicator of the level at which the easing cycle will stop. The current median of 2.6%, which corresponds to a real rate of 0.6%, is well below what most analysts think: market-based estimates are consistent with a rate above 3%.”

Implications for Investors

According to Reto Cueni, economist at Vontobel, the election results show a strengthening of far-right “anti-system” parties in Europe, but they have not exceeded expectations. This means the centrist majority remains intact in the European Parliament, likely securing more than 55% of the total votes, while green parties across Europe have lost parliamentary seats.

In his view, this has three implications for investors. Firstly, Cueni notes that this centrist majority provides stability in a Europe facing high geopolitical uncertainty. “For now, this is positive news for investors. However, in the coming weeks, it will be seen if the centrist parties can work together and elect a centrist president of the European Commission for the new five-year term,” he asserts.

Secondly, Cueni believes that the shift towards right-wing “anti-system” parties, which politically oppose the “Green New Deal” and prioritize national security and border control, demonstrates a change in Europe’s political focus. “Investors need to pay attention to the presentation of the programs of the candidates for the next EU presidency, scheduled for mid-July, to understand the parties’ agendas and the political momentum in Europe,” he advises.

Lastly, Cueni adds that the early parliamentary elections in France will increase uncertainty about the political course of Europe’s second-largest economy. Given that the country’s political system makes foreign and defense policy largely a presidential prerogative, “the uncertainty about France’s future cooperation in Europe and geopolitically remains controlled, at least until the spring of 2027, when the next French presidential elections are scheduled.”

Views on the European Elections

Experts from investment firms had already warned that there could be a greater presence of the far right, as some polls had predicted. Nicolas Wylenzek, a macroeconomic strategist at Wellington Management, noted before the elections that these could accelerate a shift in the EU’s political priorities, which could have potentially significant implications for European equities. However, he clarified that this adjustment would depend on several factors, such as the composition of the European Commission, changes in the political landscape of member states, and international events like the war in Ukraine and the U.S. elections.

“While a reduction in administrative burden could be clearly positive for EU companies, I consider the overall shift to be marginally negative. Reforms that promote greater integration, such as banking union and capital markets union, would strengthen the resilience of the EU economy and facilitate growth, while allowing and encouraging the immigration of skilled labor could be important to help limit inflation and improve trend growth,” he explained.

Similarly, John Polinski, vice president and fixed income portfolio manager at Federated Hermes, recently pointed out how the 2024 European Parliament elections could result in the first center-right coalition in the EU, with the European People’s Party joining forces with the European Conservatives and Reformists and Identity and Democracy. According to Polinski, this change could moderate environmental and migration policies and alter spending and debt dynamics within the EU. “We believe a political shift to the right will have a moderate effect on European fixed income markets in the short term. But in the longer term, a change could significantly affect the markets, especially concerning cross-border mergers and acquisitions, and industrial, ESG, and fiscal policies,” he asserted.

Lastly, Felipe Villarroel, a manager at TwentyFour AM (a Vontobel boutique), offered a clear reflection on not being swayed by today’s headlines: “In our opinion, the macroeconomic consequences are unlikely to be as significant as some of the headlines following the elections might suggest. While it is very likely that the average MEP will shift to the right, that does not mean that macropolitics will change drastically. Without a doubt, there will be microeconomic consequences for sectors heavily affected by climate policy, for example, if some policies are reversed. But we tend to think that most macroeconomic variables and aggregate company data, such as leverage or default rates, will not change too much as a result of the elections. The most disruptive theoretical macroeconomic impact would be a scenario in which European integration is questioned. Even if the far right achieves a massive victory next week, they will not have nearly enough seats to seriously threaten this. There may be incendiary headlines after the elections, but we believe that from a macro perspective and fixed income portfolio management point of view, the headlines will not translate into facts.”