We explained last week that more and more signs point to an acceleration in the cooling of the labor market, which would stimulate savings, discourage consumption, and later, investment.

As an immediate consequence, the nascent recovery in manufacturing activity experienced since the beginning of the year—largely due to the resilience of the U.S. consumer and the fiscal push from the Joe Biden administration—would be threatened.

Although GDP has been slowing since the third quarter of 2023 (4.9% vs. 1.3% for the first quarter of 2024), preliminary data from the S&P PMI indices indicate that the United States remains in the lead in June, despite investors betting on a globally synchronized GDP growth scenario. The composite indicator (manufacturing and services) for the eurozone, the UK, or Japan points in the opposite direction.

In fact, other surveys, both regional and national (ISM, LCMI), anticipate that the U.S. may end up following in the footsteps of those other economies.

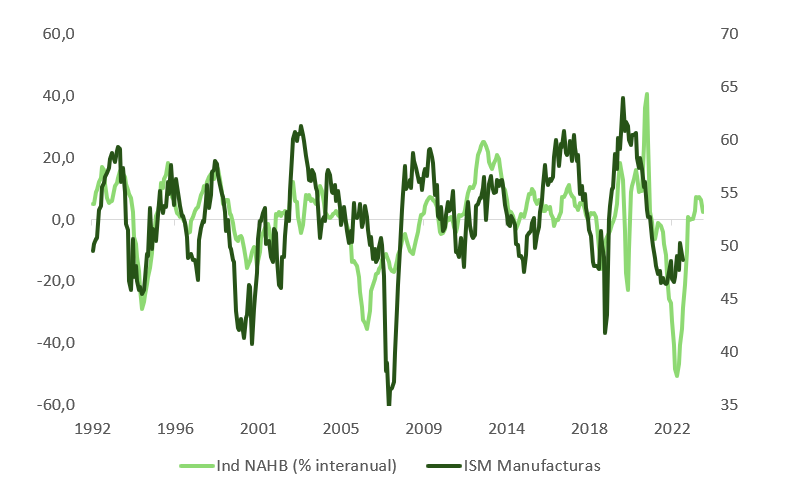

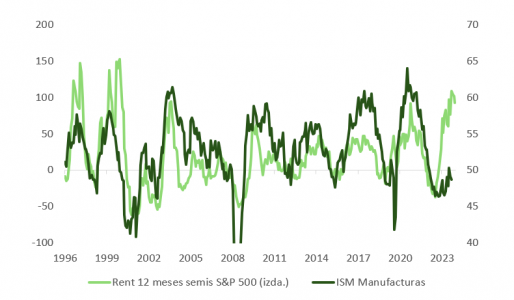

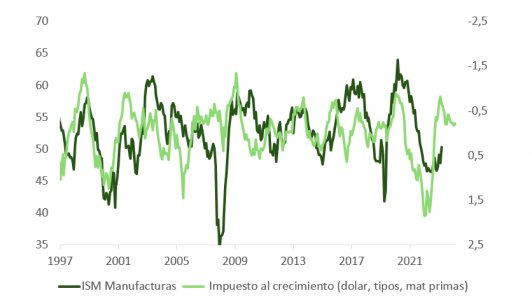

Leading indicators of industrial activity, such as confidence in the residential property sector (NAHB), financial conditions and their effect on production costs, or sentiment in the semiconductor sector (measured by stock prices), are showing signs of fatigue. Similarly, the recovery cycle in the new orders subcomponent of the ISM survey takes an average of 18 months to travel from trough to peak, which is the time that has passed since the last valley to the most recent peak.

As we can see in our regression model, U.S. manufacturing momentum could begin to slow over the summer. Likewise, it is worth monitoring the situation in Europe: the German IFO (manufacturing), worse than expected, may be an early sign that the U.S. consumer push and fiscal support are beginning to fade. And although in Europe, unlike on the other side of the Atlantic, households still have a savings cushion, they are also more sensitive (especially in Italy or Spain) to interest rate hikes, which will increase the cost of about a third of the loans they are currently enjoying over the next few months.

The nascent signs of this weakness may explain the optimism of CEOs of large companies regarding the business environment their firms will face over the next 12 months, which would imply an increase in investment. Interestingly, the perspective of SME managers or that reflected by the sub-indices is quite different and points in the opposite direction. The tug-of-war between the restrictive monetary policy implemented by the Fed and the public spending expansion driven by the Democratic Party has an amplified effect on medium and small-sized companies, which are responsible for two-thirds of the new jobs created in the country. Lower-income households, but with a higher propensity to consume, are shown to be the most sensitive in this situation. In fact, recent news and behaviors from companies like NKE (Nike), KRUS (Kura Sushi), WBA (Walgreens), H&M, and L’Oreal suggest that consumers are beginning to suffer.

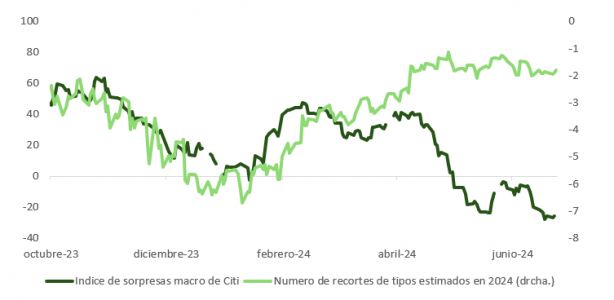

Meanwhile, Bloomberg’s macro surprise index has dropped to its lowest levels in the past five years, while Citi’s is one standard deviation below its 20-year average. Despite this, expectations for rate cuts remain stable and point to a 0.25% cut by the Fed on November 7 (with the U.S. presidential elections two days later?), and a 76% probability of an additional adjustment in December.

This perspective makes some sense given the Fed’s dependence on the publication of macro data, which sometimes reflect what has happened rather than what may happen, and a macro context—which, in our opinion, is quite uncertain—as evidenced by the distribution of “dots” among central bank members who only foresee one action before the end of the year, those who foresee two, and those who would not act until 2025 (7, 8, and 4 bankers, respectively).

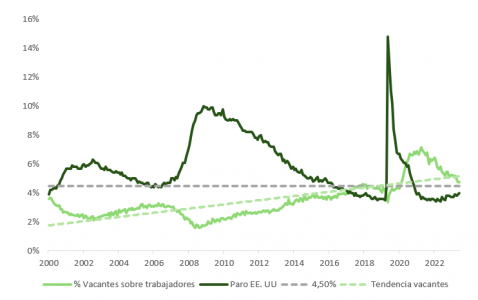

Several governors and presidents of regional Federal Reserve banks have shared a range of scenarios regarding the evolution of the labor market and inflation in the coming months. Christopher Waller, for example, warned months ago of an increase in unemployment once job vacancies exceeded 4.5%. As shown in the graph, it is at 4.7%, and decreasing.

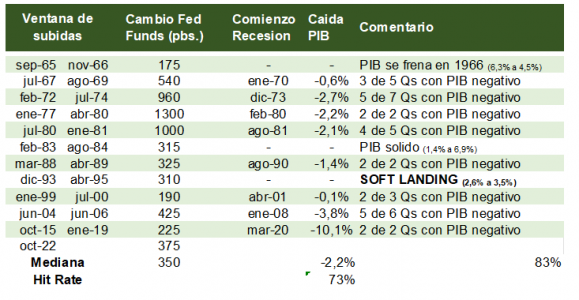

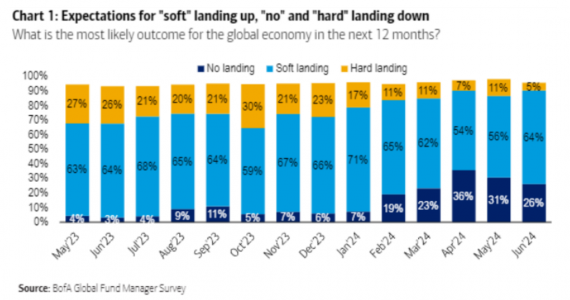

As we can see in the graph of the latest BofA survey among managers (FMS), the consensus remains a soft landing, although looking back, this is the least plausible alternative. Since 1965, the United States has experienced 12 monetary tightening cycles, resulting in 8 recessions and only one true “soft landing.”

With a gradual decline in inflation series but growth close to or slightly above trend, the Fed could afford to be patient in initiating the rate cut cycle.

However, the lack of consensus within the U.S. central bank is similar to that shown by the BofA report and reflects the lack of visibility in the macro environment we have been discussing from this column.

Recent comments from Mary Daly (San Francisco Fed), Patrick Harker (Philadelphia Fed), or Michelle Bowman show the weak conviction of their positioning: “In my view, we should consider possible scenarios that could unfold in determining how monetary policy decisions [of the Federal Open Market Committee] may evolve,” Bowman recently explained.

And although other colleagues of Jerome Powell (Lisa Cook or Alberto Musalem) skew their discourse towards a “no-landing” scenario that would again dust off the possibility of rate hikes, the fact is that the objectives for core inflation (PCE) and the unemployment rate for the end of 2024 outlined in the latest Summary of Economic Projections have already been reached, and the risk is that they will be exceeded in the coming months.

At the time of publishing this comment, we are still awaiting the release of the May figures for personal spending and income and core PCE inflation. The next Fed meeting, where they will update their forecasts, will be on September 17-18. There are three months of employment, inflation, and growth data between now and then, which, if they follow the trajectory of April and May, will undoubtedly result in a “dovish” surprise.

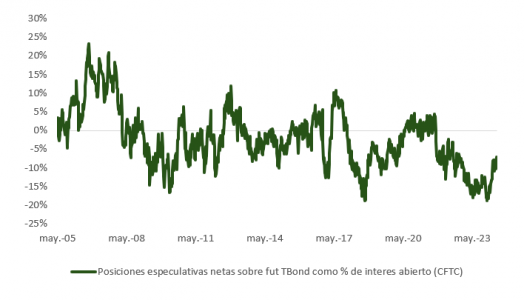

The divergence in the RSI of the weekly graph of the yield on the American bond, the macro surprise index, and the shift in speculative positions may continue to appreciate public debt.