Is This Portfolio Rebalancing Movement Sustainable?

| For Amaya Uriarte | 0 Comentarios

The attempted assassination of Donald Trump increased his lead over Joe Biden by 7 points (from 60 last Saturday to 67 today) according to betting houses. In the average polls compiled by RealClearPolitics, it has remained much more stable, rising from 47.2 to 47.4.

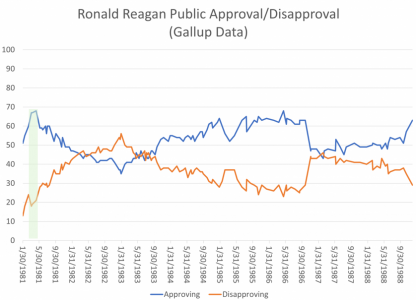

Although gauging the impact that the assassination attempt may have at the polls next November is mostly a matter of speculation, there is a clear effect on sentiment reflected in the bets of Americans (PredictIt, Polymarket), consistent with historical precedents such as the attacks suffered by Teddy Roosevelt in 1912 or Ronald Reagan in March 1981, which were not very long-lasting.

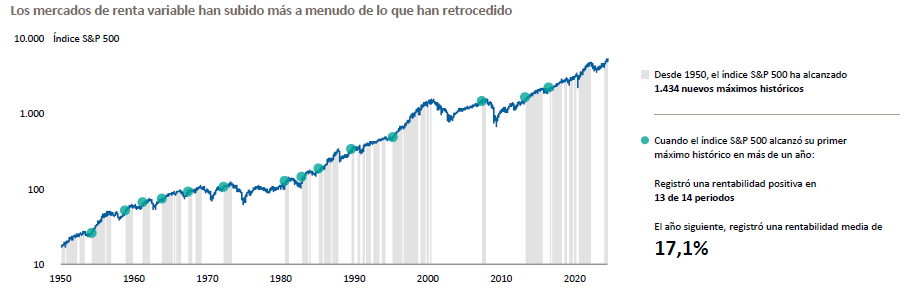

The adjustment of perspectives at the political level and in the macroeconomic sphere following the digestion of macro data, which point to a reasonable moderation in the pace of expansion (confirmed by the surprising retail sales figures) and the return of the disinflationary trend in price indices, are justifying a repositioning of institutional investors’ portfolios. Gold has hit a new high, the yield curve has steepened, and stock market bets are being reassigned.

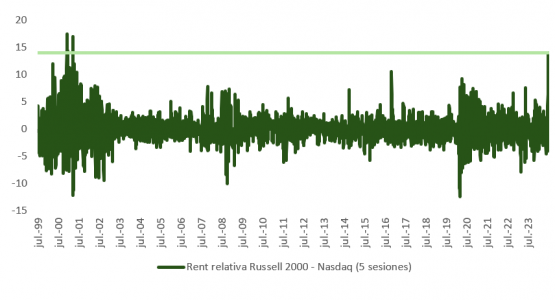

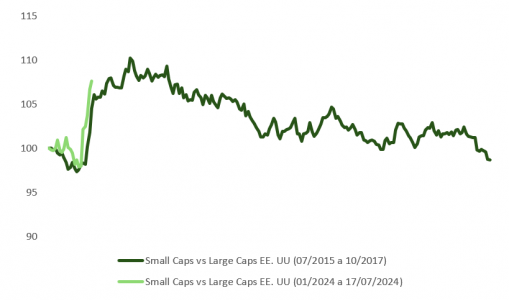

With uncertainty in the geopolitical and international trade spheres on the rise and the monetary policy cycle declining, the rotation from megacap companies to small and mid-cap companies has gained momentum in recent sessions, as demonstrated by the 12% lead of the Russell 2000 over the Nasdaq in the last five days. This is a mark not seen since April 2001 (against the S&P 500, the movement has no historical precedent) and leaves the technology and communication services sectors trailing in terms of profitability in a global context.

These price movements show that investors support the idea that interest rate cuts, which could be larger than the market anticipates, will sustain this cycle for a little longer to the benefit of companies that have suffered the most from the 2022-2023 monetary tightening cycle.

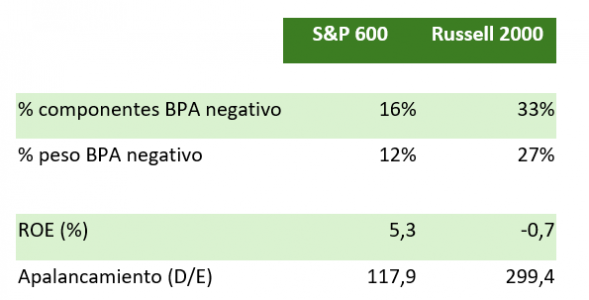

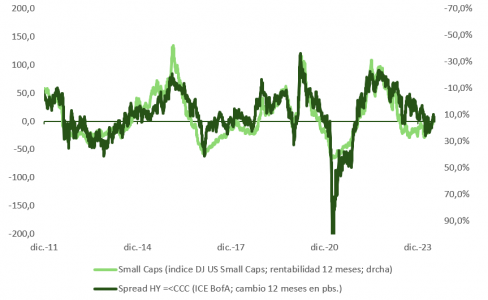

However, to confirm this thesis, we will need to see not only a turning point in monetary policy (U.S. small caps are ~3x more leveraged in Debt/EBITDA than large companies and more dependent on variable-rate bank loans) but also a recovery in EPS, which is not assured if, as we think, the cycle is more likely to be ending than extending.

The publication of second-quarter results will provide information in this regard, but as we see in the chart and according to SME surveys, it is unlikely that high-yield credit spreads will support the excessive price increases of the past few sessions for much longer.

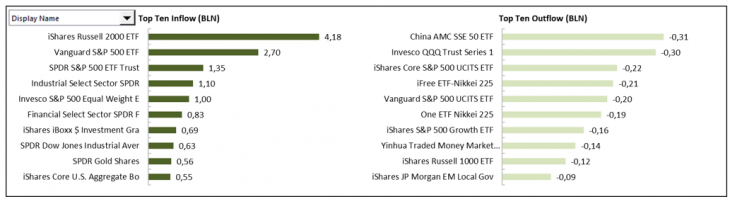

Behind the momentum in small-cap prices, we find the hot money of retail investors who have rushed en masse to buy ETFs and the gamma short positions of traders. As we can see in the table, and consistent with what we explained above, in the last 5 days there have been net purchases worth more than $4 billion in the Russell 2000 ETF and notable increases in other ETFs associated with a recovery in economic activity (industrials, financials), gold, and the equal-weight S&P 500 ETF, which dilutes the influence of tech megacaps.

In summary, an excessive gap between large-cap indices (S&P 500 and Nasdaq) and small-cap indices (S&P 600, Russell 2000, Russell 2500), in the context of June macro data supporting the soft landing scenario (employment, retail sales, industrial production, inflation), has led to a shift in the rhetoric of several Fed members and investors’ perceptions of interest rate trends (adding a -0.25% adjustment to their expectations from a week ago, moving the first cut from November to September).

The coincidence, moreover, with the increased likelihood of a “red wave” in the November presidential elections and Trump’s choice of a vice president who will not discomfort him at all, has led U.S. fund managers and retail investors to rush to buy cyclical/value/small-cap stocks while unloading what has risen the most (growth/semis/AI).

The question is: Is this portfolio rebalancing movement sustainable? Given the uncertainty about which scenario will prevail in 8-12 months (with a higher probability for a slowdown/mild recession than for a soft landing in our opinion), it is difficult to make a forecast with conviction.

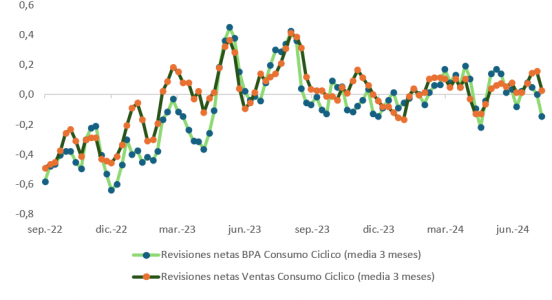

The retail sales figure, which posted the strongest rise in three months in June, one of the catalysts for what happened this week, seems actually taken out of context: the inertia in EPS and sales revisions for consumer companies (Nike, Pepsi, Delta, Chipotle, Starbucks) in the U.S. has accumulated 10 consecutive weeks of downward adjustments. We recently commented in this column on how lower-income households have been more concerned about their finances and are concentrating their spending on essentials and moving towards store brands.

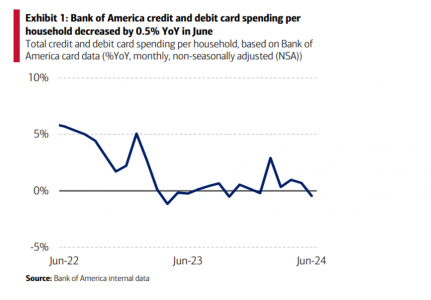

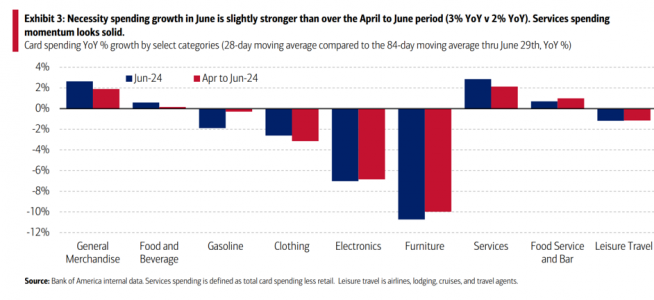

The savings rate as a percentage of disposable income is below 4%, and credit card and consumer loan delinquencies have skyrocketed. Similarly, according to the U.S. Consumer Behavior Study compiled monthly by Bank of America, credit card spending contracted by 0.5% in June, and the series has shown a negative trend since February. Additionally, the labor market will continue to cool in the coming months.

The update of the “Beige Book,” which at first glance supports the soft landing scenario (less inflation, growth moderation), also provides a perspective that contrasts with the retail sales data.

Of the 12 Fed districts participating in the compilation of the Summary of Current Economic Conditions (or Beige Book), 5 point to flat or declining activity this time: three more than in the previous report. The report also shows moderation in labor demand and more selective hiring by employers. And, in line with our comments and the Bank of America document’s conclusions, most districts report an increase in discount campaigns by retailers in response to more price-sensitive consumers, focusing mainly on essential goods and willing to buy lower-quality but cheaper products.

Regarding the Fed’s plans, it is very likely that cuts will begin in September (the market assigns a 95.5% probability). The yield curve is steepening, which is implicitly favorable for value themes, cyclical bets, and small businesses. The trend towards the 2% inflation target will become more evident as service prices continue to moderate and the housing cost components of CPI/PCE more clearly reflect the decline in rental costs in the market.

There could even be a positive surprise in the amount of cuts by the end of the year (3 instead of 2?), but this would come with a more pronounced deterioration in the labor market, negatively affecting credit and therefore harming small caps. Moreover, if history is a guide, the bullish momentum of these types of stocks following Trump’s unexpected victory in 2016 did not take long to deflate.

As for Trump’s return to the White House, it is the most likely bet, but things can happen between now and November. The announcement of Joe Biden’s departure (and his replacement on the ticket by Kamala Harris, accompanied by Ray Cooper, Mark Kelly, or Andy Beshear as vice-presidential candidate) could happen in a matter of days, following the sharp turn in the polls after the debate and the fundraising collapse on the Democratic side.

Clearly showing this, polls give Trump a two-point lead in Virginia, a traditionally Democratic stronghold that Biden easily won in 2016 (+10 points). With Biden’s departure, undecided Democrats about his ability to lead the country for another four years could support another candidacy, diluting the potential for large Republican majorities in the House and Senate.

And regarding the betting advantage, it has almost vanished (from 69 to 62), in line with what happened in 1981 after the attempted assassination of Ronald Reagan (3/30/1981).

Although Trump would still be the favorite, it is possible that the market is exaggerating the benefits a new mandate would bring to investors. Trump has learned in the past four years that inflationary policies have severely damaged his opponent’s image. Additionally, his 2016 victory was a surprise, whereas it is now partially priced in.

Then, the prospects of rising inflation were one of the main causes of the “bear steepening,” which would initially favor portfolio repositioning; this time, the cycle is much more mature, and disinflation prevails. Finally, the room for fiscal aggression is significantly reduced: debt-to-GDP is at 99% (76% in 2016), and interest payments on GDP are almost triple (3.1% vs. 1.4%).

Extending the 2016 TCJA tax cuts will have a lower fiscal multiplier than Biden’s expansive plans (IRA, CHIPs, infrastructure). If he manages to impose his project of a 10% tariff increase on imported goods, it will initially

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.

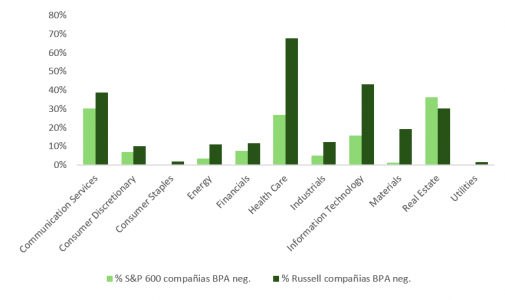

Despite everything, for those looking to jump on the small business bandwagon, it is important to note the differences between the indices: S&P 600 offers more quality, while Russell 2000 has more dynamite.