The Return to the Office Begins: A Step Back in Workplace Flexibility?

| For Amaya Uriarte | 0 Comentarios

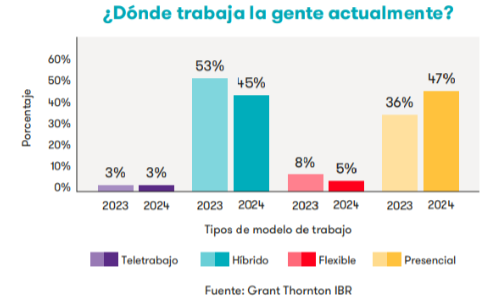

Over the past 12 months, there has been a significant shift towards in-office work: currently, 47% of companies follow a work model focused on in-person attendance, compared to 36% last year, while 45% follow a hybrid model (down from 53% last year). According to a study by Grant Thornton, if companies push too hard for a return to the office, they may inadvertently undermine gains in female representation in key positions that have been made possible through flexible work practices. The study’s main conclusion is that it is essential to ensure that at least one senior female executive is involved in decision-making on diversity, equity, and inclusion.

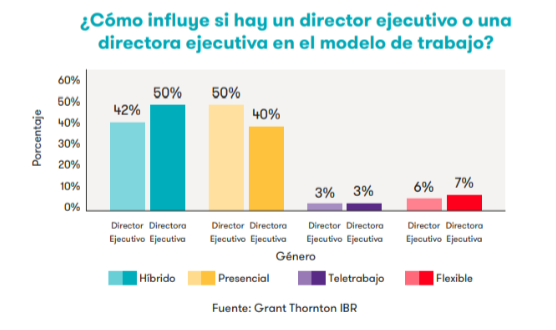

“This shift appears to be driven by male CEOs: 50% of companies led by a man follow a predominantly in-person model, compared to 40% of companies led by a woman,” states Grant Thornton’s Women in Business (WiB) study, based on a survey of around 10,000 business leaders from 28 countries. To foster and retain female talent in the workplace, companies must carefully evaluate the work practices they offer. The research suggests that following certain decisions made by male executives, it is necessary to ensure that a senior female executive is involved in diversity, equity, and inclusion decisions. Pushing too hard for a return to the office could unintentionally undo some of the progress made in promoting women to leadership roles, which was achieved through the adoption of flexible work practices.

Regional differences are also notable. In North America, 39% of companies have adopted a primarily in-office work model, compared to 53% in the European Union. Many large companies have begun implementing guidelines and incentives to encourage employees to return to offices, such as Goldman Sachs’ “office-first” approach, which required employees to attend the office five days a week. Amazon, Disney, and Boeing have also enacted return-to-office policies in recent months, according to a report by *Inc.*

Companies where employees predominantly work in offices are the only ones where the percentage of women in senior leadership positions falls below the global benchmark.

The ability to choose where to work offers substantial benefits to women in companies, not just at the leadership level but also for the talent pipeline. “A work model that combines in-person and remote modalities is great for both men and women, as it allows for a much better work-life balance. On the other hand, it’s also important that younger employees don’t feel neglected, so being available in person when needed is crucial,” says Grant Thornton Chile.

Finally, the study emphasizes, “When female employees have taken maternity leave and are ready to return to work, offering a hybrid model is essential to retaining them and helping them advance in their careers.”