Following the stock market rally in 2023, family offices are shifting their portfolios, reducing cash holdings, and positioning in risk assets with the expectation of gains in the coming year, according to Citi Private Banking’s report, *Global Family Offices 2024. Survey Insights*.

“We are delighted to share the results of this year’s survey, which offers an inside look at the investments and priorities of some of the most diverse and sophisticated family offices in the world. Over the last two years, we have seen the number of participants grow from 126 to 338 globally, highlighting the increasing need for unique perspectives on the main challenges and opportunities family offices face today. The broad-ranging questions cover the most current global topics, revealing significant shifts in concerns and interests. We look forward to continuing our close collaboration with family offices to provide access to all areas of Citi that support the ambitious goals and needs of the world’s most global and sophisticated investors,” said Hannes Hofmann, Head of Citi Private Bank’s Global Family Office Group.

**Top Concerns for Family Offices**

The survey results show that the preservation of asset value is the top concern for families, followed closely by preparing the next generation to be responsible stewards of their wealth.

Citi highlights that this underscores the dual priorities of family leaders: preparing wealth for their families and preparing family members to manage that wealth. Furthermore, the adoption of formal governance systems is uneven among family offices. While over two-thirds have governance systems for investment functions, less than half rely on formal governance for other family office and family-related matters.

“While family offices are inherently unique, our survey demonstrates that there are many similarities in their concerns and behaviors. Findings like these reveal the new ways they are managing their wealth, diversifying portfolios, and implementing sophisticated investment approaches while preparing families to achieve both financial and familial well-being,” emphasized Alexandre Monnier, Head of Family Office Advisory for Citi Private Bank’s Global Family Office Group.

Key Findings

Amid ongoing market volatility and geopolitical challenges, the report highlights key challenges and areas of potential opportunity for the year ahead. Among the most notable conclusions of this year’s edition is that asset preservation and preparing the next generation for future responsibilities are top concerns for families. Respondents also noted that meeting family members’ expectations is their biggest challenge.

The report reflects how family office portfolios are shifting and what concerns investors have. “Family offices are moving cash into significant portfolio changes, shifting from liquid resources to fixed income and both public and private equity,” the report concludes.

Additionally, there has been an increase in exposure to artificial intelligence, which “likely contributed to the strong returns last year.” However, the report notes that the adoption of AI technology in family office operations remains slow.

A notable finding is the continued optimism about portfolio performance over the next 12 months, with 97% of respondents expecting positive returns. However, the report shows that the future of interest rates is the primary concern, followed by geopolitical issues such as U.S.-China relations and the conflict in the Middle East.

Regarding the family office business itself, the report confirms that investment approaches are becoming more sophisticated. Sixty percent of family offices now have investment teams led by a CIO, investment committees, and formal investment policy statements, with a strong commitment to alternative asset classes.

“As they professionalize, family offices are increasingly collaborating with external partners. Investment management (54%) and reporting (62%) are the only two services most family offices manage internally; all other services are either outsourced or handled jointly,” the report points out.

The report also revealed changes in portfolio allocations. Equities and fixed income saw an increase in their weightings, rising from 22% to 28% and from 16% to 18%, respectively. Private equity declined from 22% to 17%, potentially due to delayed revaluations compared to public equities. North America received the highest allocations (60%), followed by Europe (16%) and Asia-Pacific excluding China (12%). Allocations to China nearly halved, dropping from 8% to 5%, due to economic challenges and market uncertainty in the country. The share of North American allocations increased from 57%, driven by a strong equities market.

Expert Analysis

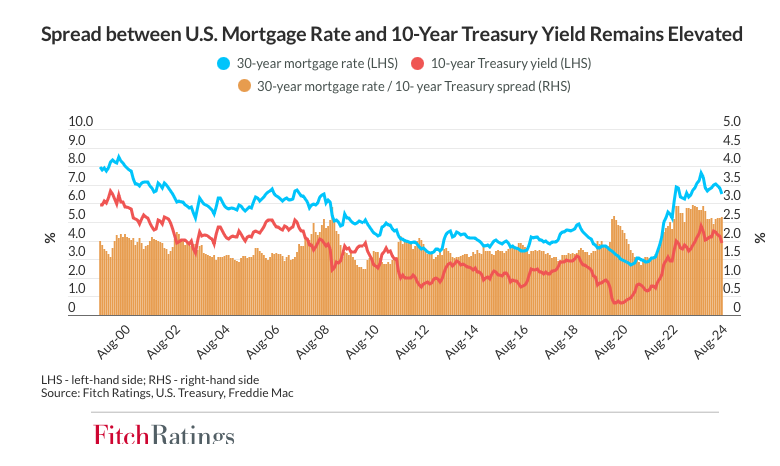

For Citi, it is notable that for the first time since 2021, inflation is no longer the top short-term economic concern for respondents. Instead, interest rate expectations became the top priority for more than half of respondents, followed by U.S.-China relations and market overvaluation. Concerns about the Middle East conflict are now more prominent than those regarding the war between Russia and Ukraine.

Looking ahead, sentiment towards asset classes was more positive compared to last year’s survey, with increased confidence in direct private equity, private equity through funds, and global developed market equities.

Compared to the 2023 report, positivity towards developed global investment-grade fixed income dropped from 45% to 34%, reflecting an increased appetite for risk. Regarding portfolio returns, nearly all respondents (97%) expected positive returns, with almost half anticipating returns above 10%.

“Our family office clients are becoming increasingly global as they seek to create and preserve wealth amid new challenges and opportunities in the markets. As interest rates evolve and geopolitical challenges persist, investors and their families are mobilizing their cash and shifting their portfolios towards public and private equity. Family offices are focused on the future as they navigate evolving markets around the world,” concluded Ida Liu, Head of Citi Private Bank.

The survey was launched during Citi Private Bank’s 9th Annual Family Office Leadership Program in June 2024 and later distributed to Citi’s global family office clients. With 50 questions aimed at capturing investment sentiment, portfolio positioning, family governance, and best practices, the survey received responses from 338 participants, which were included in the report.