The final quarter of 2024 has started with significant tension. According to international asset managers, the coming months will be dominated by volatility and geopolitical risks. However, theoretically, the predictability of the major central banks, particularly the Fed and the ECB, should provide confidence and security for investors. What are the main outlooks for the end of the year?

Edmond de Rothschild AM explains that the most notable market movements are due to the worsening conflict in the Middle East: “Concerns over a potential Israeli response against Iran drove oil prices up by nearly 10%, although Saudi Arabia is threatening to increase production to protect its market share.”

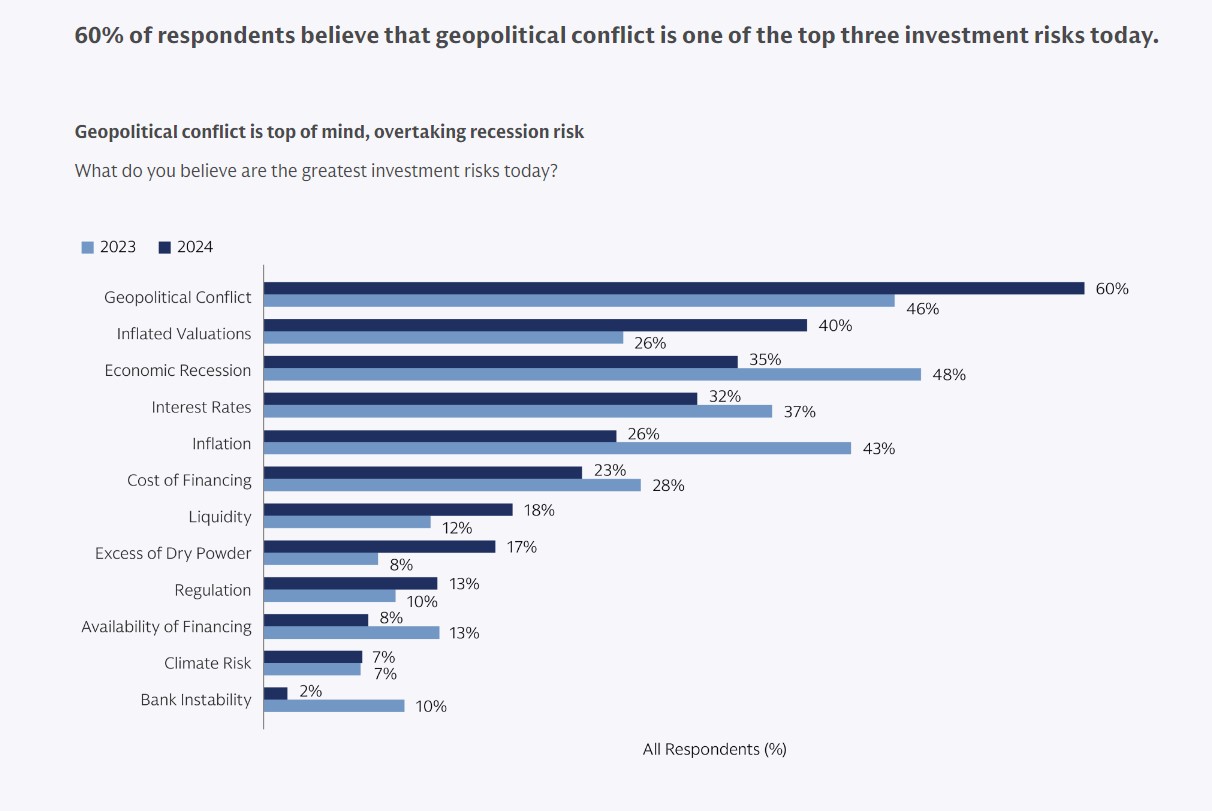

Benoit Anne, Managing Director of the Strategy and Insights Group at MFS Investment Management, believes that geopolitics may be the main challenge to macroeconomic stability. From a macroeconomic standpoint, the “goldilocks” scenario of balance remains the most likely.

“However, the risk pendulum has swung toward the possibility of a no-landing scenario. The main challenge to the goldilocks view comes from the international scene, with a significant risk of escalation in the Middle East crisis. For now, the reassuring signal is that U.S. investment-grade credit spreads, which have fallen to 83 basis points, show no signs of being affected by geopolitical contagion. In any case, fixed income can play a useful role as a defensive asset if the global risk appetite weakens,” says Anne.

Fidelity International also views the current geopolitical risks as very complex. According to Henk-Jan Rikkerink, Global Head of Solutions and Multi-Asset at Fidelity International, the conflicts in the Middle East and Ukraine remain unresolved, with no end in sight, while the U.S. elections loom on November 5. He adds, “The successes of the far-right in Germany and France have caused a seismic shift in European politics, threatening to make decision-making within the EU even more difficult. The policies regarding China and trade that follow will be crucial, as will fiscal policy in a time when the reduction of abundant market liquidity is becoming a reality.”

The Issue of a Soft Landing

Asset managers are keeping an eye on the geopolitical context while also monitoring the actions of the Fed and ECB and their impact on the economy. According to Rikkerink, the economy is returning to normal after five years of substantial public support that kept the global engine running.

“At present, we believe that the recent poor data is more indicative of a phase of weakness rather than a serious slowdown, but investors are reacting, and we are closely watching growth and labor market indicators for signs of further deterioration. We believe the global economy is not heading toward an imminent recession, and we see indications of more of a rotation than a change in direction,” says this expert from Fidelity International.

Asset managers agree that central banks have worked hard throughout the year to control inflation without damaging the environment. MFS IM points out that all central banks are easing their monetary policy, although some faster than others. In the global race to lower official interest rates, the Bank of England seems in no rush. Meanwhile, in the U.S., an interesting debate has recently arisen over whether the Fed’s recent 50-basis-point rate cut was a policy mistake.

Erik Weisman, Chief Economist at MFS IM, believes it was not, as the 5.50% rate was too high to begin with. “It’s more important to think about where the Fed will hit the pause button: above neutral, at neutral, or below. The key risk is that the labor market deteriorates more than desired. After the nonfarm payroll figure, that risk seems less pronounced, but we must not forget that labor data can be volatile, especially given the impact of seasonal adjustments and exogenous disruptions like hurricanes and strikes. Overall, all this central bank easing favors fixed income unless something derails,” argues Weisman.

Quarterly Outlook

As for the implications of this environment for investors, Fidelity International notes that last year’s structural themes still seem relevant. “The commercialization of AI technologies will continue to develop at a strong pace, governments are investing billions in power grid improvements, and healthcare is both a defensive sector and a strong long-term theme. We are in the mid-to-late cycle phase, and there are some significant unknowns. Generally, this situation tends to lead to positive returns, although with greater volatility. We still believe a ‘soft landing’ is the most likely outcome, but from an asset allocation perspective, it’s important to be nimble to seize emerging opportunities,” says Rikkerink.

According to Claudio Wewel, Currency Strategist at J. Safra Sarasin Sustainable AM, the Fed’s rate cut, combined with China’s economic stimulus and falling oil prices, is creating a more favorable backdrop for risk assets. “In September, the rotation between different equity market segments continued. In equities, the changing monetary environment and the increased likelihood of a soft landing will support the shift from growth to value. This perspective also applies to asset classes like commodities, which are undervalued compared to equities in historical terms. For these reasons, we have reallocated funds to companies involved in the extraction, processing, and use of industrial metals,” argues Wewel.

“Given the circumstances, we remain neutral on risk assets and duration. We prefer UK and emerging market equities. Government bonds acted as a safe haven early in the week as geopolitical risks intensified, but yields rose again following some optimistic U.S. data,” adds Edmond de Rothschild AM.

Meanwhile, GVC Gaesco maintains a positive outlook on fixed income and believes that now is the time to focus on specific sectors and geographies in equities. Regarding this asset class, GVC Gaesco analysts still see opportunities but with a more cautious attitude. In this sense, the experts believe it is advisable to focus on specific sectors and geographies with active management rather than a global approach. “Europe and emerging markets seem more attractive to us. By sectors, those that benefit most from lower rates gain importance in our asset allocation,” they add. Specifically, real estate, healthcare, telecommunications, and utilities are the sectors GVC Gaesco is overweighting in their portfolios, although they do not exclude specific companies in other industries such as industrials or insurance, notes Víctor Peiro, General Director of Analysis at GVC Gaesco.

Additionally, in the case of monetary assets, GVC Gaesco estimates that “the most attractive opportunity seems to have passed, and the expectation is that central banks will continue to reduce rates in the coming quarters, so we move from positive to neutral,” says Gema Martínez-Delgado, Director of Advisory and Portfolio Management at GVC Gaesco.