The U.S. presidential election campaign is intensifying. Early voting has already begun, including in some of the key swing states that could be decisive. International asset managers recognize that investors worldwide are analyzing how this close race might impact markets.

“As expected, Vice President Harris’s policies are quite similar to those of President Biden. This suggests that if Harris wins, investors could anticipate a certain level of continuity in the current political and economic environment. Conversely, former President Trump has hardened his stance, reinforcing his ‘America First’ approach. If he wins, we could see a sharp shift towards higher tariffs, deregulation of key sectors, stricter border control, and a more independent foreign policy,” summarizes Greg Meier, Senior Economist at Allianz Global Investors.

The Deficit Issue

So far, we’ve examined what sets the candidates apart and how different election scenarios might affect investors, but we must also consider what unites Harris and Trump. According to a report by Natixis CIB, both Harris and Trump are expected to be big spenders, proposing policies that will further worsen the long-term fiscal outlook. “Harris’s policies provide some revenue offsets but will result in slower growth and less investment. Trump’s fiscal policies will encourage growth but will increase inflationary pressures and worsen the debt outlook,” the study notes.

Joseph V. Amato, President and Chief Investment Officer—Equities at Neuberger Berman, agrees that neither candidate appears willing to tackle the U.S. debt sustainability issue, which he considers crucial. “There seems to be little appetite to cut spending on defense or social security benefits—two of the three largest federal budget items, the third being interest expenses,” he says.

According to Amato, the Penn Wharton Budget Model garnered attention with its estimate that Harris’s tax and spending proposals would add $2 trillion to the primary deficit over the next decade, while Trump’s proposals would add slightly over $4 trillion.

“Economic projections show only a modest difference in each candidate’s deficit over the next five years. Generally, Harris’s proposals reflect a deficit-neutral redistribution from corporate and high-income taxpayers to lower-income taxpayers. Trump’s proposals show a slight reduction in the deficit, assuming that tariff revenues offset lower taxes. Again, a divided government is expected to moderate the impact of either president’s proposals and slightly improve debt prospects,” he explains.

According to Alvise Lennkh-Yunus, Director of Sovereign and Public Sector Ratings at Scope Ratings, unless the winning presidential candidate’s party secures a majority in both the House and Senate, the U.S. will face another debt ceiling crisis in early 2025.

“Both Democrats and Republicans show little appetite for containing or even reversing the government’s expansionary fiscal policy. Harris’s proposed policies would raise the deficit by $1.2 to $2 trillion over the next 10 years, while Trump’s could increase it by $4.1 to $5.8 trillion. Although these estimates are uncertain, it’s clear neither candidate has a concrete plan to consolidate U.S. public finances,” says the Scope Ratings expert.

Contestation and Limbo

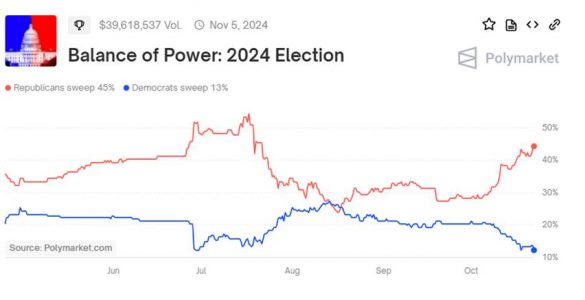

Lombard Odier agrees with most analyses that this election represents the biggest political risk factor for markets. “The close contest between the Democratic and Republican candidates has raised the chances of a contested result after the November 5 election. We believe the race is too close, though our baseline assumption is that the Senate will be Republican and the House of Representatives will be controlled by the winning party. While the vote should yield a clear result, a contested outcome remains a possibility,” they explain.

Few analyses have explored the implications of a contested election. Lombard Odier points out that there have been five contested presidential elections since 1800, the last in 2000. “There are three potential resolutions for a contested vote: Supreme Court intervention, the Electoral Count Reform Act of 2022, or a ‘contingent election.’ All three are open to legal debate. In 2000, the Supreme Court halted a Florida recount, handing the presidency to George W. Bush. Today, the Court would likely avoid deciding who sits in the White House,” they say.

In fact, the S&P 500 fell nearly 12% from Election Day to mid-December after the Bush/Gore election in 2000, though many factors were in play. “But history suggests that once the result is known, a ‘welcome rally’ for the new president is likely,” notes Neuberger Berman’s representative.

In a “contingent election” scenario, the House would elect the next president, while the Senate would select the vice president. “Any electoral dispute in Congress would have to be resolved before January 20, 2025, when the current president’s term ends. This would be problematic, especially if Kamala Harris, as Senate President, were to cast a deciding vote. If Congress cannot decide on a candidate, the Presidential Succession Act stipulates that the Speaker of the House, Republican Mike Johnson, would serve as acting president,” adds Lombard Odier.

Consequently, the firm expects that any political limbo following the November 5 vote and through 2025 would provoke market volatility and negatively impact U.S. assets. “After the 2000 election, U.S. Treasury yields rose 75 basis points between the election and year-end, while gold gained 3%, despite declines in U.S. equities and the dollar index. In a clearer victory for either party, our views on the expected effects on asset classes are outlined in the following table,” they conclude.

A Paradoxical Backdrop

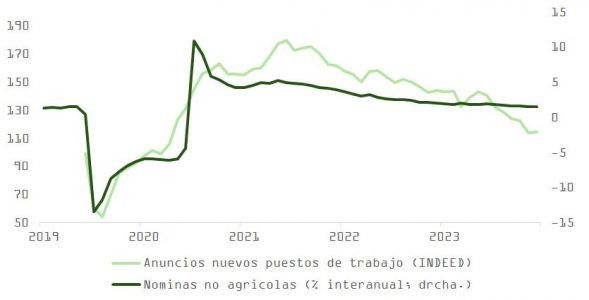

Experts agree that the U.S. has enjoyed the strongest post-pandemic recovery among developed economies. However, in the view of Raphaël Gallardo, Chief Economist at Carmignac, this long expansion has entered a slowing phase as the “adrenaline” from massive COVID-related stimulus fades, a strong dollar weighs on manufacturing, and high real interest rates needed to curb inflation have suppressed demand in interest-sensitive sectors like construction and real estate.

“Consumers continue to drive growth, but despite low unemployment, most dynamism increasingly comes from the wealthiest quintiles, which benefit from continued wealth effects in an already expensive stock market. An aging population, rising social transfers, and subsidies for the energy transition have also widened the fiscal deficit to levels unheard of outside recessions, wars, or pandemics (7% of GDP),” Gallardo explains.

According to Gallardo, this is the paradox of this election: “After eight years of outperformance by the U.S. economy and a stellar stock market, voter frustration with the state of the economy has shaped the platforms of the two main candidates. The next administration will inherit an economy more vulnerable than recent trends suggest, and thus the populist measures both candidates advocate could have outsized repercussions on financial markets.”

For Gallardo, the real “elephant in the room” is that, regardless of the outcome, “these elections could alter the engine of an economy that has been the envy of the world for decades.”