Pension Funds Will Increase Their Allocations to Private Assets and Asian Emerging Markets

| For Amaya Uriarte | 0 Comentarios

Western markets are reaching all-time highs, stock buybacks continue at a steady pace, and IPOs are becoming more irregular. This highlights the need for pension plans to find new growth drivers, according to a new report published by CREATE-Research and the European asset manager Amundi.

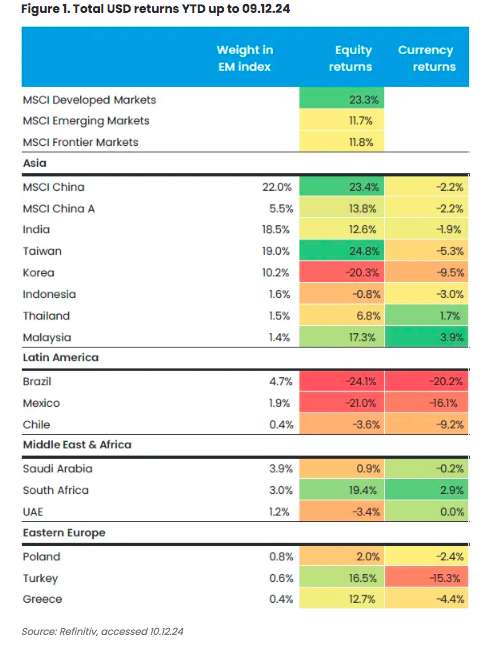

The survey is based on responses from 157 pension plans worldwide, managing assets worth €1.97 trillion. The study sheds light on the areas pension funds are targeting for sustained returns over the next three years. In this new regime, the two underinvested asset classes offering the most attractive opportunities are private markets and Asian emerging markets (MEA).

Currently, three-quarters (74%) of pension plans invest in private market assets, and just under two-thirds (62%) invest in MEA.

According to Vincent Mortier, Group Chief Investment Officer at Amundi, “Private markets and Asian emerging markets have had to adapt to a new era with sharp interest rate hikes and a new geopolitical landscape. However, both continue to offer diversification, attractive returns, and are well-positioned to capitalize on the more predictable sources of value creation from secular megatrends. It’s encouraging to see new allocations to historically underinvested areas.”

Private Markets’ Slower Growth Has Not Diminished Their Appeal

Private markets have faced scrutiny as the era of market-driven returns fueled by cheap money has ended, according to the Amundi survey. While returns in private markets are likely to be lower than in the recent past, their appeal remains strong, with 86% of respondents expecting to continue investing in them within three years.

This increased interest is driven by the search for risk-adjusted returns in a low real-yield environment (72%), potential interest rate cuts (54%), more growth companies in private markets (53%), and the fact that fast-growing firms are staying private longer (51%).

The survey indicates varying interest among respondents in different asset classes over the next three years. Private debt leads the list (55%), focusing on direct lending, real asset financing, and distressed debt. Key sectors include healthcare, real estate, renewable energy, carbon capture technology, and social infrastructure.

The second preferred asset class is private equity (49%), specifically growth equity, followed by leveraged buyouts to a lesser extent. Infrastructure ranks third (40%), bolstered by policy measures such as the U.S. Inflation Reduction Act and the European Green New Deal. Real estate (38%) comes next, where narrowing price expectation gaps between buyers and sellers is improving valuations and creating attractive opportunities.

Venture capital ranks last (28%), viewed as the riskiest option in the current private market environment.

Private Assets Seen as Ideal for Capturing Megatrends

The energy sector is undergoing a profound transformation, driven by four megatrends known as the “four Ds” (decarbonization, decoupling, digitalization, and demographics). This “4D revolution” is spotlighting businesses whose models focus exclusively on these transformative themes.

Such companies dominate private markets, providing the potential to outperform their public counterparts by investing directly in selected themes with a higher likelihood of positive impact. One respondent noted, “Our impact investments are primarily based on ‘pure play’ companies, which are often in private markets.”

To future-proof their portfolios, pension plans are focusing new private market investments on themes shaped by these transformative forces.

Opportunities for Growth in Asian Emerging Markets

Assets in Asian emerging markets remain underrepresented despite their collective 46% share of global GDP. Over a third (38%) of respondents currently have no exposure to MEA, half (51%) have allocations up to 10%, and only 11% have allocations above 10%. Geopolitical issues are cited as the primary reason for these limited allocations by 68% of respondents. Other factors include growing trade frictions (58%), high market volatility (53%), and governance opacity in these markets (51%).

However, the region’s growth prospects remain promising, with policymakers implementing reforms to attract foreign capital. As a result, 76% of respondents expect to invest in MEA within three years. Thematic investing will dominate MEA markets, with India, South Korea, and Taiwan being the primary beneficiaries.

Monica Defend, Head of the Amundi Investment Institute, stated, “As geopolitical rivalry between the U.S. and China intensifies and two rival trade and monetary blocs solidify, other Asian markets are becoming increasingly attractive to investors. Increased intraregional trade and connectivity have strengthened regional resilience, and we expect allocations across almost all asset classes to rise.”

Thematic investing will shape the next wave of investment in MEA, offering “good buffers in the era of geopolitical risk,” according to one respondent. Half of the respondents plan to increase allocations to thematic funds covering renewable energy and high technology over the next three years. On the ESG front, green, social, and sustainability-linked bonds (49%) are favored as the region seeks foreign capital to build greener, more inclusive economies and societies.

Bonds Now Seen as a Value Opportunity

Strong currency bonds are expected to be more attractive to 48% of respondents now that the U.S. has begun cutting rates. Local currency bonds appeal to 45% due to the robust anti-inflationary policies implemented by independent central banks across Asia and healthier public finances.

Professor Amin Rajan of CREATE Research, who led the project, remarked, “Private market assets and Asian emerging markets have long been underweighted in pension portfolios. Now, the winds of change are clear.”