“This will be America’s golden age, it’s an incredible victory.” With these words, Donald Trump, the Republican Party candidate, declared himself the winner of the U.S. presidential elections. Without the official count having ended, Trump reportedly garnered 267 electoral votes compared to the 224 of his Democratic opponent Kamala Harris. Additionally, the Republicans have taken control of the Senate and aim to maintain their slim majority in the House of Representatives.

As expected, following such a significant event, markets have reacted quickly. According to Oliver Blackbourn, multi-asset portfolio manager at Janus Henderson, futures indicate an increase of over 2% in the S&P 500 and 1.7% in the NASDAQ. “However, the most notable parts of the U.S. market are the S&P Midcap 400 and Russell 2000 indexes, with futures showing gains of over 4% and 5%, respectively,” notes the manager.

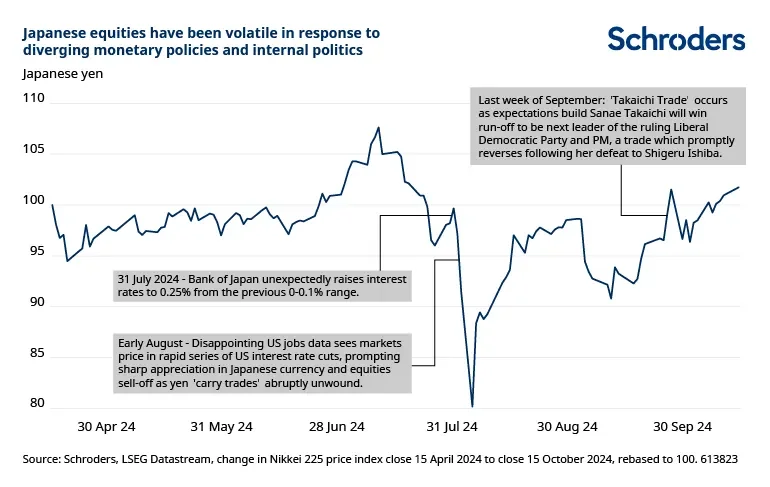

In his view, perhaps the most surprising result so far is the strength of stock markets outside the U.S. “European and Japanese equities are performing well, and the decline in China is perhaps less than many feared, despite the incoming President’s threats to global trade. The U.S. dollar is generally strengthening as markets consider the potential impact of new import tariffs and further discounted Federal Reserve cuts. U.S. Treasury yields have risen sharply due to both evolving interest rate expectations and the possibility of higher inflation,” explains Blackbourn.

Regarding what to expect next, the Janus Henderson manager considers it likely that markets will begin to think about how rhetoric translates into policy and scrutinize every statement over the coming months for clues. “With the widespread view that both parties will continue running budget deficits, it seems likely that the U.S. economy will remain hooked on fiscal stimulus. The effect this will have on the Fed may take some time to clarify, as the FOMC will be reluctant to consider anything until there is greater political clarity. Markets will have to wait to see if the Federal Reserve is willing and able to address a hot economy,” he adds.

In the opinion of Gordon Shannon, manager at TwentyFour AM (Vontobel boutique), so far markets are repeating the 2016 script following Trump’s victory: equities are rising, while long-term U.S. Treasury bonds are retreating due to expectations of fiscal expansion. “I believe the focus will shift to the inflationary implications of tariffs and immigration control. The Federal Reserve has avoided making comments so far to appear neutral and protect its independence, but its reaction to these policies is key to understanding where asset prices are headed,” Shannon states.

For Stephen Dover, Head of Franklin Templeton Institute, the biggest beneficiaries will be sectors and industries that welcome a more business-friendly regulatory environment, including fossil fuel energy companies, financial services, and smaller-cap companies. “On the other hand, the fixed income market is selling off strongly, with ten-year Treasury yields approaching 4.50%. Fixed-income investors are reacting to the likelihood that tax cuts will not be accompanied by significant spending restraint. The fixed income market also anticipates higher growth and potentially higher inflation. This combination could slow or even halt the Fed’s anticipated rate cuts,” adds Dover.

Finally, Martin Todd, senior manager of Global Sustainable Equities at Federated Hermes, believes the immediate market reaction has been one of relief. “On the eve of the election, there was great concern about the possibility of a prolonged and tightly contested election, given how close the polls were. There are many different opinions on which sectors, business models, and geographies are winners or losers under a Trump administration and a ‘red sweep.’ But this depends heavily on the time frame. Understanding the medium- to long-term implications for equities is incredibly difficult, given the many second-, third-, and fourth-order (and so on) consequences of each policy announcement,” Todd argues.

Currency movements

Since yesterday, a segment of the market appeared to lean towards his victory, although investment firms acknowledge that what remains important is how proposed policies are implemented and the power balance between the Senate and Congress. According to Ebury, yesterday’s massive emerging market currency sell-offs and the dollar’s rise were a prelude to Trump’s likely victory.

“The markets are not only positioning for a comfortable Trump win in the Electoral College but also for the prospect of a Republican-controlled Congress, which is key to determining the incoming president’s ability to push for policy changes within the U.S. government,” Ebury analysts note.

Experts from the firm add that “we are witnessing massive emerging market currency sell-offs as investors price in higher U.S. tariffs, elevated geopolitical risks, and greater global uncertainty under a Trump presidency.”

As in 2016, the biggest loser of the night so far has been the Mexican peso, which has fallen more than 2% against the dollar. Meanwhile, according to Ebury, Central and Eastern European currencies are also being significantly affected amid fears over European security, while many Asian currencies closely tied to China’s economy are trading down more than 1% overnight.

“The major currencies seem to have found some footing for now, and the dollar’s upward movement has perhaps been a bit more contained relative to expectations. However, we wouldn’t be surprised to see another episode of dollar strength as European markets open and final results confirm what appears to be a historic election victory for Trump and the Republican Party,” predict Ebury analysts.

Assessing the results

“The question of a Trump victory will be decided in the House of Representatives election, where Republicans are also leading. Voters likely punished the Democratic presidency of Biden due to high living costs, a legacy of the coronavirus pandemic, concerns about Middle Eastern policy, and a perception of Harris’s unclear profile, which failed to garner voter support despite a strong economy,” explains David A. Meier, economist at Julius Baer.

In the opinion of Samy Chaar, chief economist and CIO at Lombard Odier in Switzerland, if Republicans control both chambers of Congress and the White House, we could expect a more dynamic U.S. economy, with growth above potential and inflation higher than the Federal Reserve’s target.

“It is likely that interest rates will also exceed pre-election expectations. The race for the House of Representatives will determine whether campaign promises can be fully implemented. A divided Congress would impose some limits on the President. The issue of tariffs is key for global trade and Fed easing prospects,” states Chaar.

For the Lombard Odier economist, this has major implications for financial markets: “Macroeconomic fundamentals remain a driver for investments. We foresee that high-yield credit and gold will perform well. Global equities, including U.S. stocks, also have potential upside over the next 12 months as earnings rise and margins remain high. In the U.S. market, the financial, technology, and defense sectors are expected to perform well under a Trump administration.”

According to the Julius Baer economist, betting markets have massively tilted in favor of a Trump victory, with implied odds approaching 90%, while the prospect of a Harris victory has almost dropped to zero. “Markets are pricing in the greater likelihood of a Trump victory, with the U.S. dollar strengthening beyond the euro/dollar 1.08 mark and currencies from economies potentially impacted by higher tariffs falling,” he adds.

Implications of a Trump administration

Investment firms are already evaluating the impact of Trump’s return to the White House. For example, David Macià, director of Investments and Market Strategy at Creand Asset Management in Andorra, believes that the most relevant market implication is the promised tax cuts, which should initially boost economic growth, stocks, and the dollar. “Trump’s policies are inherently inflationary and expand the already high deficit, so market-traded interest rates are also expected to rise. The aggressive tariff hikes promised by the Republican candidate should weigh on companies that export to the U.S., especially if they do not have factories on American soil (many European companies may suffer initially). The weight these companies have on European indexes suggests they may again lag behind,” states Macià.

Creand AM sees the potential for stocks to continue on an upward trajectory. “The American economy remains unusually strong, and unlike when he won in 2016, markets now know exactly what to expect. The starting point is the only obstacle, as valuations are high, but this has little correlation with short-term price behavior,” adds the firm’s representative.

For Johan Van Geeteruyen, CIO of Fundamental Equity at DPAM, investors can look to cyclicals (financials, energy, etc.) and certain technology companies as possible beneficiaries, while tariffs and geopolitical tensions pose risks to specific sectors. “Ultimately, Trump’s policies may foster a favorable environment for U.S. equities, especially if deregulation, domestic manufacturing, and fiscal policies create incentives for growth. However, headline risks—ranging from fiscal uncertainties to trade disruptions—could create periods of volatility, affecting both domestic and global markets,” Geeteruyen notes.

Finally, according to a summary by Blair Couper, CIO at abrdn, in the long term, a Trump victory is likely to mean a laxer regulatory environment, an escalation in trade tariffs, and potential attempts to repeal components of the Inflation Reduction Act (IRA). According to abrdn’s expert, it is also likely that the share prices of U.S. companies with supply chains in China will react negatively, while domestic manufacturing and small and medium-sized U.S. companies may perform better.

“With President Trump at the helm, the U.S. also faces elevated inflation risks due to these policies, so we are likely to see a reaction from interest-rate-sensitive sectors and a strengthening dollar. Sectors such as financials (i.e., banks) could perform well if rates remain elevated for a longer period. While areas like real estate and growth stocks could be negatively impacted by longer duration, this may be offset by a generally positive market outlook driven by his policies, so we still need to see whether these sectors are negatively impacted or not,” Couper concludes.