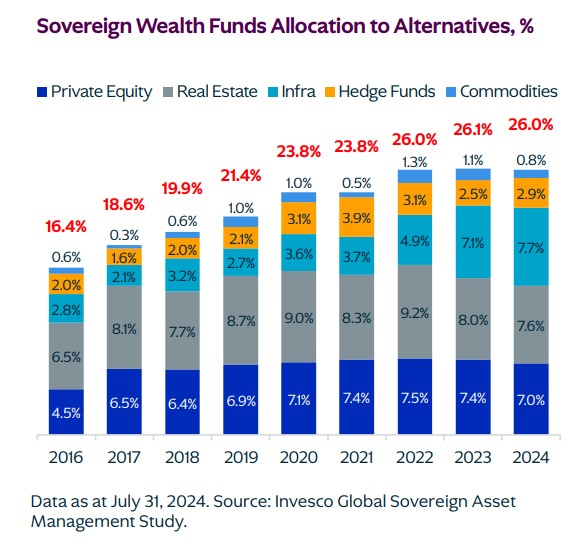

1. Increased Growth of Sovereign Fund Allocations

Over the last decade, the maturity of alternatives as an asset class is evident, as Sovereign Wealth Funds (SWFs) – which the firm estimates to total at least $12 trillion in assets under management – have increased their exposure to private markets from around 16% in 2016 to 26% in 2024. However, conversations with sovereign funds from Latin America, the Middle East, and other parts of the world suggest a healthy desire to do more with alternatives, in addition to using private markets to broaden exposure to both emerging and developed markets.

In particular, “the reach and scale of sovereign funds is rapidly expanding beyond traditional infrastructure and real estate investments to include most private market asset classes across all geographies,” the report states.

At KKR, they believe the reason for this shift is twofold: in many cases, private markets can help boost returns and reduce volatility, especially as the correlation between stocks and bonds has increased. For example, sovereign funds can leverage private opportunities to invest excess revenues or diversify their total dependence on natural resources or their local economies. Alternative investments can also enable sovereign funds to acquire strategic stakes in local companies in economically important sectors.

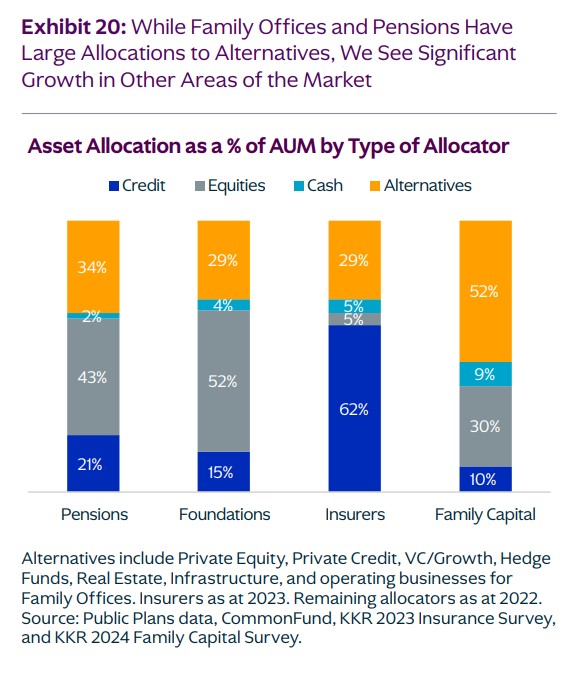

2. Individual Investors Increasingly Turning to Alternative Products

The study notes that the individual investor market presents a significant growth opportunity. “Consider that the consulting firm Cerulli states that only 2.3% of assets from U.S. financial advisor clients invested in alternatives in 2023. However, this estimate pales in comparison to the 60% increase since 2007 in the number of individual investors with between $1 million and $5 million in the U.S., many of whom are seeking to compound their long-term returns more efficiently,” the firm explains.

In line with this view and with some of the customer work and surveys conducted by KKR’s Chief Investment Strategist, Paula Roberts, “allocation to alternative products may increase as private products become more accessible due to lower minimums, greater transparency, and greater liquidity.”

In fact, the report claims that all segments, from Ultra High Net Worth to retail investors, have significant growth potential, as the value of the illiquidity premium also becomes significant in a world where aggregate returns are falling. “We are not the only ones who think this way, as Cerulli also estimates that an additional $1 trillion could be invested in retail alternatives, with the total allocation from retail investors rising from the current $1.4 trillion to more than $2.4 trillion over the next five years,” KKR asserts.

3. Growing Appetite from Insurers

For insurers, the study suggests that uncorrelated private asset classes, especially higher-yielding ones, have gained importance. In a higher interest rate environment, they have created highly liquid asset funds that can offer global returns in support of reserves for claims when underwriting new business – something most want to do more of.

Moreover, the most recent investment environment has created a shift in mindset, allowing CIOs to focus on leveraging both liquid and illiquid allocations to build more resilient and all-terrain portfolios.

“We believe that the value of an uncorrelated asset in one’s portfolio increases materially if we are right in our base-case scenario, which points to the neutral rate for Fed funds now being higher; traditional government bonds can no longer diversify as much as they did in the past and global yields have compressed now that we’ve moved out of a low-rate, flexible monetary policy and restrictive fiscal policy environment,” the report reads.

The firm considers it “important” to highlight that diversification among issuers, sectors, and asset classes contributes to mitigating idiosyncratic risk, while diversification across asset classes helps mitigate systematic risk.

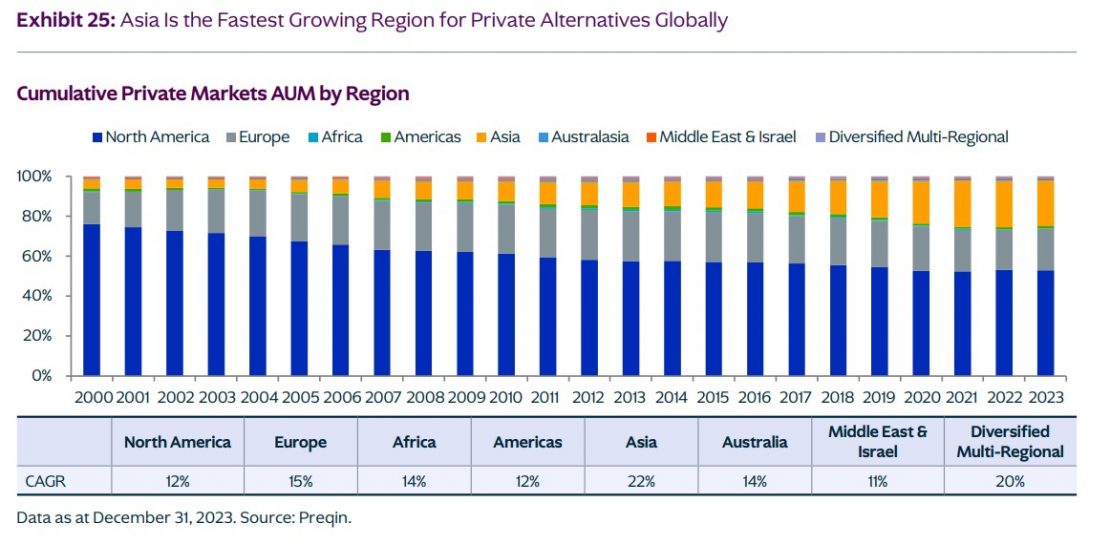

4. Increased Demand for Private Markets in Asia

Investments allocated to alternatives in Asia have grown at an average annual rate of 22% since 2000, nearly double the rate of private alternatives in North America and comparable in size to current private markets in Europe. “These numbers seem especially interesting given that we have seen a retreat in investment in private markets in China – from around 10%-12% to about 5% – while demand for alternatives from Asian clients is on the rise,” KKR explains.

The study also suggests that investment managers in Asia are seeking to diversify beyond equities, fixed income, and listed real estate, toward private equity, infrastructure, and private credit.

In line with the growth of Asian private markets, KKR has been increasing exposure to the region. Over the past five years, the firm’s allocation to Asia has grown from 10% to 16%, with a target allocation of 20% to 30%.

The firm justifies its optimism about Asia by stating that, of all the macro trends it observes, the rise in urbanization in Asia is one of the most powerful tailwinds it is monitoring: between 40% and 50% of the growth in urban population per decade, both in 2030 and 2040, will come from Asia. Additionally, urbanization generates demand for technology and energy efficiency. It also believes that key markets such as China, Japan, and India will spend significantly on a wide range of retirement and healthcare offerings in the future.