In two days packed with keynote speeches and discussions about opportunities in the Andean region, Credicorp Capital once again demonstrated its strength in capturing both regional and global dynamics from an investment perspective. Monetary policy, AI, mining, the U.S. economy, emotional management, one-on-one meetings… the eleventh edition of the Lima Investor Conference also featured a major announcement: for the first time, in 2025, the event will take place in Santiago, Chile.

The event was held in the halls of the Swissôtel hotel, in Lima’s San Isidro neighborhood, and brought together the firm’s top executives and representatives from companies issuing public offering instruments. The conference also featured specialized workshops on various asset classes, focusing on asset management and capital markets, as well as one-on-one meetings with dozens of companies from Chile, Colombia, Panama, and Peru. Additionally, it was announced that the next Investor Conference will be held outside Peru for the first time in its decade-long history, moving to Chile’s capital, Santiago.

After the opening remarks by the CEO of the Peru-based firm, Eduardo Montero, the stage saw a steady stream of speakers over the following two days, including the president of the Central Reserve Bank of Peru (BCRP), Julio Velarde; senior executives from three mining companies operating in Peru: Southern Copper, Buenaventura, and Nexa; and molecular biology PhD, Estanislao Bachrach.

The Rise of AI

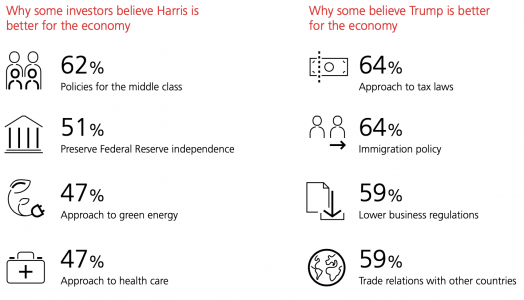

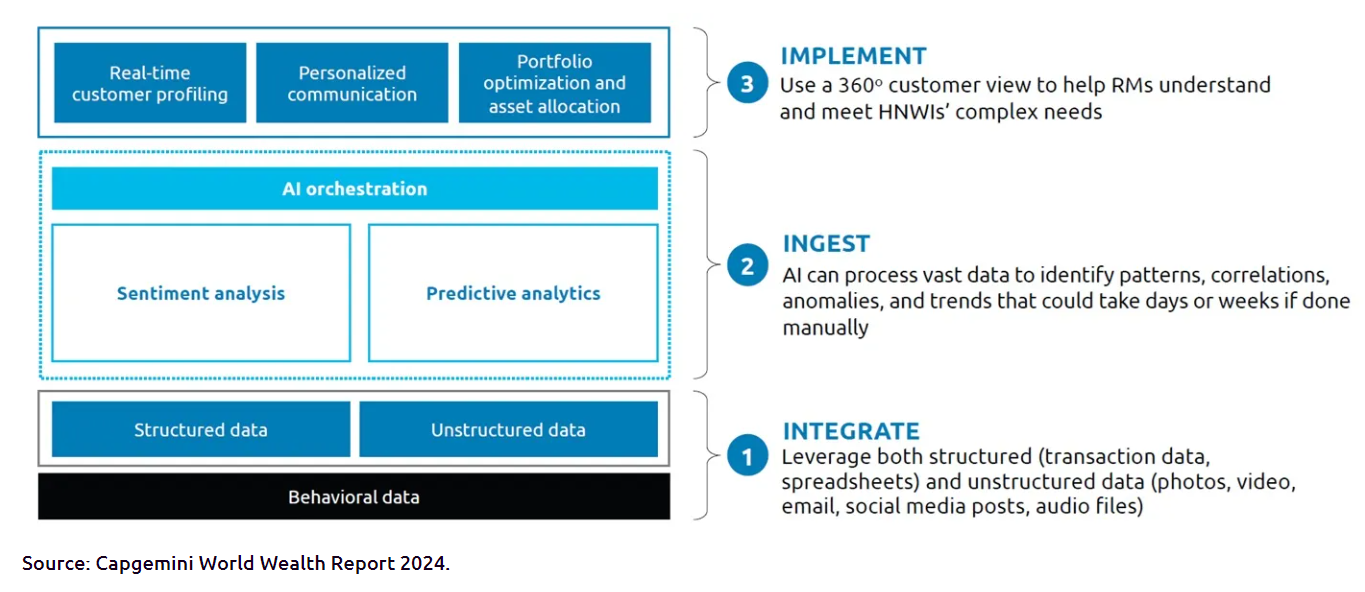

Given that technological advances in artificial intelligence have investors excited this year, with the promise of a productivity revolution that some compare to the Industrial Revolution, it’s no surprise that Credicorp’s event featured more than one segment dedicated to the topic. The main panel included James Chen, portfolio manager for Global AI Strategies at Allianz Global Investors, and Mario Rodríguez, Country Manager for Peru at Microsoft, who outlined some applications of this technology, such as data management, customer insights, cost reduction, and process optimization.

“It’s a reality. It’s no longer the future,” said Rodríguez, urging attendees “not to fear change.” This includes the presence of AI in personal spheres, with the executive predicting that people will soon have access to a permanent personal assistant.

Chen, for his part, asserted that we are at “the beginning of a significant moment” and that “this evolution is going to transform the world.” “These tools are just starting to enhance various businesses,” he said, adding that there are variables in all economic sectors where AI can contribute, making it important to identify the winners and losers of this trend.

Peru, According to Velarde

The president of the Central Reserve Bank of Peru, Julio Velarde, was the star guest of the first day of Credicorp Capital’s Investor Conference. His leadership in managing Peru’s monetary policy over the past 18 years has made him something of a rock star in the Peruvian financial scene, and his success was reflected in his presentation at the seminar.

“We have a monetary policy that has managed to contain inflation without a recession,” Velarde emphasized, adding that there is a downward trend in the fiscal deficit, the country has the lowest public debt in Latin America, and significant recoveries are evident across various sectors of its economy. “Change is noticeable. All indicators point to improvement,” the monetary authority said.

Velarde also touched on a couple of recent legislative milestones. He praised the rejection of a judicial reform attempt—“it would have been a disaster,” he noted—and highlighted the approval of the pension system reform. “If it can stop withdrawals, this is the best law,” he said.

Mining Perspectives

Mining, one of the most significant industries in the Andean economy, also had its moment to shine at the Credicorp Capital conference, with a specialized panel. Raúl Jacob, CFO of Southern Copper; Daniel Domínguez, CFO of Buenaventura; and José Carlos del Valle, CFO of Nexa, shared their perspectives on the precious and industrial metals markets, zooming in on key variables.

Domínguez described the elements behind the good moment for gold, emphasizing that “the sociopolitical issue is a risk,” which has led international central banks to buy the precious metal. And while demand from the Chinese central bank, for example, has decreased, the executive believes this has been offset by higher demand from institutional and retail investors. Silver, on the other hand, could continue to rise in price, given its industrial use, especially in solar panels.

Regarding the copper market, Jacob pointed out that the recent decline in the metal’s price is linked to rising inventories, especially in China. However, looking ahead, the outlook appears favorable. The Southern Copper executive noted that, while a year ago a surplus was projected for 2024, now a deficit of about 100,000 tons is expected. Although “it’s a small deficit,” the executive said, it’s a positive sign for the commodity.

Finally, Del Valle of Nexa discussed the zinc markets—which share drivers with copper—and lead. With 2024 shaping up to impact refinery profitability, leaving the industry focused on maintaining operations, the outlook is one of high costs, low reserve availability, and limited supply, alongside rising demand. “We are quite positive about the fundamentals,” he remarked.

Macroeconomic Outlook

Daniel Velandia, executive director of Research and chief economist at Credicorp Capital, outlined the economic and political landscape of Latin America—declaring himself an “optimist” from the outset—and his international vision. For the economist, we are currently at an “inflection point in the global economy,” with greater volatility and “anxiety in the markets.”

However, Velandia highlighted that the long-awaited rate cuts by the U.S. Federal Reserve have finally arrived. Furthermore, the market has spent “two years forecasting a recession that has yet to materialize,” suggesting that, although a recession could still happen in the future, it may be a technical recession.

In the region, the economies of Chile, Peru, and Colombia are experiencing technical recessions, with certain improvements in areas such as political uncertainty—particularly in Chile and Peru, Velandia noted—and some persistent challenges, such as investment. Looking ahead, the economist predicted that the “political pendulum” could swing back towards pro-market policies, with a coincidence in 2026: all three countries will have new presidents, and their stock exchanges will have already integrated.

Equity and Fixed Income Recommendations

After Velandia refreshed the firm’s economic outlook on the second day, the leaders of the equity and bond research teams took the stage to deliver the key points of the 2025 Andean Investor Guide.

Stefanía Mosquera, regional head of Equity Research at Credicorp Capital, highlighted the effects of the Andean economies’ recovery cycles on their respective stock markets, while identifying the firm’s top picks in each sector. The firm’s top picks include Chilean companies Cencosud, Empresas Copec, and Latam Airlines; Colombian companies PF Bancolombia and GEB; and Peruvian companies Inretail, Ferreycorp, and Buenaventura.

Meanwhile, Josefina Valdivia, head of Fixed Income Research at the firm, discussed the prospects for Andean fixed income, noting that greater optimism about growth has pushed risk premiums lower. With yields that have fallen but remain above the levels of the past ten years, and a more dynamic pipeline of issuances, she recommended focusing on companies without heavy capex plans. “Maintain financial discipline,” she emphasized.

Emerging Markets and LatAm

In a panel dedicated to emerging markets, Credicorp Capital Asset Management’s CIO, Gino Bettocchi, described a slightly decelerating environment, where estimates for Latin America outpace those of other emerging markets. In a scenario where they foresee a “soft landing” for the U.S. economy, Bettocchi recommended monitoring U.S. consumer behavior, the Fed, the Chinese economy, and the U.S. elections.

Axel Christensen, head of Investments for LatAm at BlackRock, added that it is crucial to pay attention to public debt—in the U.S. and globally—which could affect long-term rates. “It seems that fiscal discipline disappeared with the pandemic,” he said.

Despite the challenges of the global outlook, the “megaforces” identified by BlackRock as key opportunities—geopolitical fragmentation and supply chain redesign, the energy transition, demographic changes, artificial intelligence, and the future of finance—favor emerging markets. Within this segment, some places are better positioned: “India has dethroned China as the largest emerging market with the highest growth,” said Christensen, while Mexico is set to benefit from nearshoring.

Credicorp Capital Asset Management shares the positive outlook for the region. “We are relatively optimistic about LatAm,” said Santiago Arias, director of Equity at the asset manager. In this regard, the executive noted that “friend-shoring,” the energy transition, and digitalization and innovation are three trade trends that benefit the region. Additionally, he pointed out that since the region is ahead in monetary normalization, countries have “room” to continue lowering rates.

Managing Emotions

After a morning of numbers, projections, and economic outlooks, Estanislao Bachrach’s presentation on the first day felt like a breath of fresh air. The international speaker, an expert in creativity, innovation, leadership, and change, focused on the fundamentals of emotions and how they impact people’s attitudes and decision-making in all areas, including the workplace.

“We hardly think when making decisions,” the biologist said, claiming that more than 90% of decisions are emotional. And it is these emotions that shape “attitude,” understood as the way people think and interpret life. The goal, Bachrach advised, is to move from a “fixed mindset,” which favors innate traits like talent or intelligence, to a “growth mindset,” which focuses on progress, effort, and processes.

The speaker’s advice is that regulating emotions improves decision-making. For everyday situations, he recommends replacing thoughts that trigger negative emotions with “accurate thoughts” through visualization.

Workshops and One-on-One Meetings

In addition to the presentations, the Credicorp Capital event featured two parallel series of workshops, dedicated to asset management and capital markets.

On the asset management side, there was a session on the invoice market, with the participation of Ricardo Gallo, president of APEFAC; Guadalupe Melendez, head of Factoring at BCP; and Alfredo Harz, managing partner of Sartor. Additionally, a segment on the energy transition and the “distant” 2045 included insights from Christian Roquerol, Co-Head of Iberia and MD;

Pierre Abadie, Group Climate Director and Co-Head of the Group’s Private Equity Decarbonisation Strategy; and Rosmary Lozano, VP of Sustainable Investments at Credicorp Capital. Finally, a panel on real estate investments brought together Alejandro Camino, CEO of Parque Arauco Peru; Claudio Chamorro, CEO of Megacentro; and Ana Cecilia Galvez, from the Peruvian Association of Real Estate Companies.

On the capital markets side, the first discussion was about investment recommendations, featuring Velandia, Mosquera, and Valdivia from the Research team. Then, a session on the integration of the Chilean, Peruvian, and Colombian stock exchanges was led by Miguel Ángel Zapatero, corporate manager of Clients and Businesses at Nuam Exchange, the parent company of the three exchanges. Finally, Diego Mora, Country Manager for Colombia, Peru, and AC at BlackRock, shared his perspective on the evolution and trends of the ETF market.

Throughout the two-day conference, one of the central elements was the one-on-one meetings with corporate representatives, focusing on companies and institutions. This included big names from various sectors, such as banking, retail, pulp, mining, and energy, among others. In total, according to the event’s website, 60 companies participated in this initiative. Of these, 26 were from Chile, 19 from Peru, 13 from Colombia, and the remaining two from Panama.