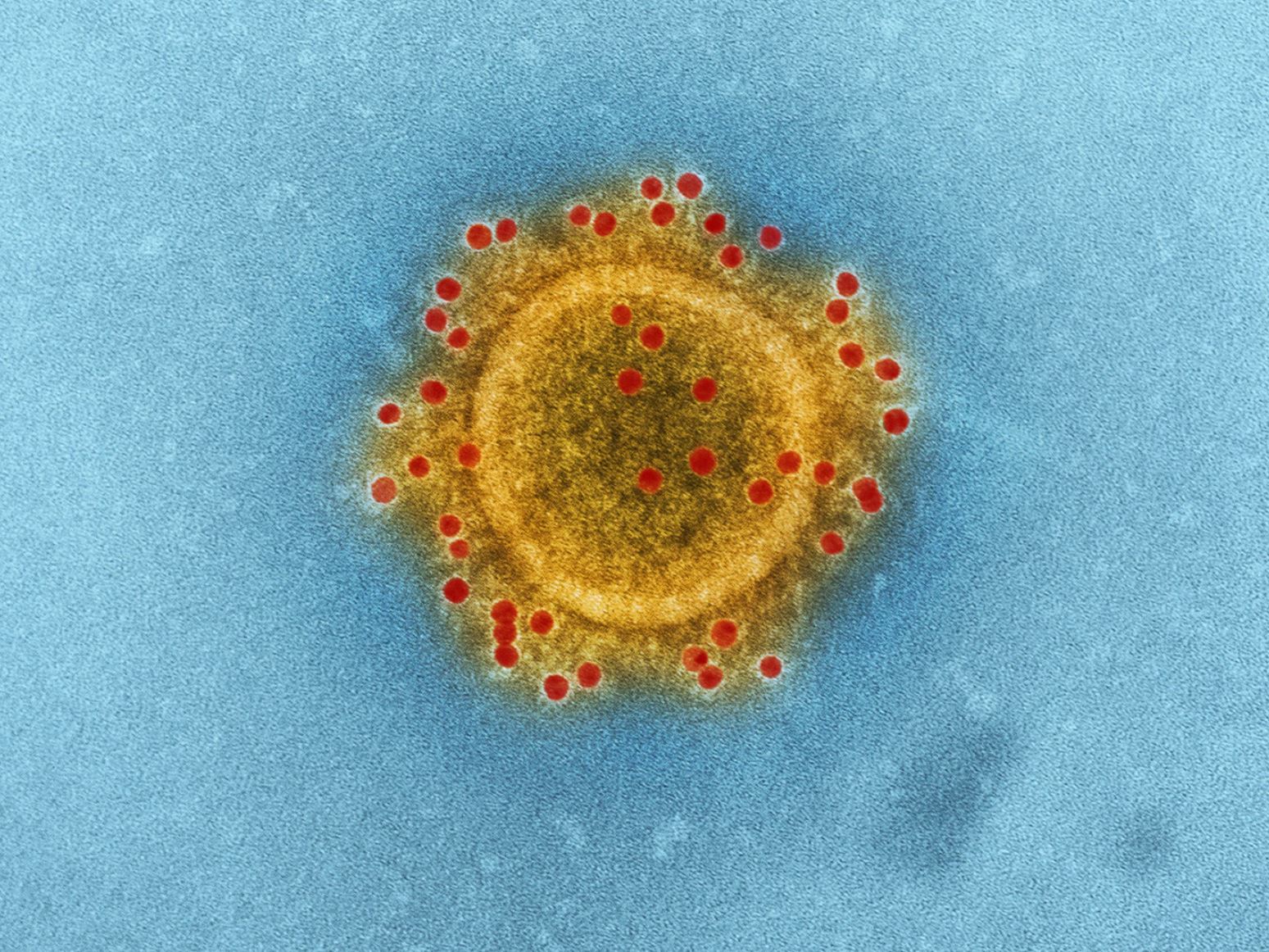

Get used to children screaming in the middle of a work call, incorporate over the course of a week remote work systems that otherwise would have been implemented in months, try new tools and test existing ones… As in many sectors, the Latin American financial system is undergoing accelerated changes due to the spread of the coronavirus.

Large Latin American Firms Adapt

From Credicorp Capital, Rafael Castellanos, Executive Director of Asset Management, points out that “following the states of emergency in the different countries in which we are located, our support teams organized a fairly comprehensive business continuity plan where the majority of people are working from home. We are using technological tools with VPN to access our files, Bloomberg everywhere, videoconference systems, emails, all in order to continue making the necessary coordination. We have focused on being close to customers, which is very important in these volatile markets, to closely inform them of our analyzes and results.”

The effort is enormous, as SURA Group‘s statement shows: “Preventive isolation and remote work of more than 90% of the 30,000 SURA employees in Latin America; flexible conditions for underwriting policies and handling claims; advance payment of pensions and digital transactional channels; expansion of capacities in health services (Colombia) and contributions to strengthen hospital infrastructure and improve health care. These are some of the actions undertaken by Grupo SURA, its subsidiaries Suramericana and SURA Asset Management, and the SURA Foundation to help contain and overcome the situation generated by COVID-19.”

Aiva has announced a series of measures such as the suspension of trips or visits to its offices. The Latin American firm based in Montevideo has opened a new communication channel “Aiva MarketWatch”, to share the latest market news and provide support to its clients. “We maintain all of our customer services remotely. 5.50% of our staff is already working remotely and we will continue to increase this measure gradually,” the firm says on its website.

Miguel Sulichin, CEO of Advise Wealth Management, explains that more than two weeks ago a home office policy was decided for everyone: “we enhanced communications, sent the report to the regulator, the team is adapting and the trading systems are working good.”

Sulichin points out that these days companies in the sector are fighting two battles: “The main one, which is the disease and the spread of the coronavirus, and then the fall of the markets, the worst we have experienced since 2008 and the Lehman Brothers crisis.”

At Chile, LarrainVial has just launched its Spotify channel to “to be closer to our customers and the public with timely information inlight of Covid-19.”

The New Normal

Giovanni Onnate, Head of Mexico Institutional Business at BlackRock summarizes the immense transition that is taking place in companies in the sector.

“We have been adapting to this new dynamic of working from our homes and around our families. So while we are far away and operating virtually with our clients and with our work teams, we are more connected than ever. For the past couple of weeks we have been coordinating a series of calls with our clients around different topics such as market prospects, investment strategies in moments of volatility, and more,” he points out.

“Personally, I try to follow a routine, we divide the living room and dining room as work spaces between my wife and me. We try to do yoga everyday and take turns to take care of our daughter at specific times. It is normal now to hear a dog bark or a baby cry while on calls, and it feels good. It is the new normal, for now”, adds Onnate.

Mauricio Giordano, Country Manager of Natixis in Mexico explains that Natixis IM has a presence in various countries in Europe, Asia and Latin America, “so remote work is part of our day to day.”

“On this occasion we knew that it required a greater commitment, especially so as not to jeopardize the health of our collaborators or that of their families, which is why we started working remotely two weeks ago. Although in Mexico an extreme situation was not yet been reached, after having a conversation with our colleagues from other countries we decided to take preventive measures and start working from home as soon as possible,” Giordano points out.

“With clients we have weekly calls to know their concerns and to be able to give them the certainty that we are here to support them. Although we are going through difficult times we know that this too, shall pass, we are not sure how long it will last, but if we all do our part, things will move faster.”

According to Simon Webber, Lead Portfolio Manager at Schroders, “The behavioural changes that the coronavirus is forcing on people in such dramatic fashion are likely to lead to a re-evaluation of the necessity of many face-to-face meetings. Many businesses have moved to remote working, and business meetings and conferences are being switched to virtual ones.

Here at Schroders, for some time now we’ve had an emphasis on video conferencing where viable, instead of business travel. This underpins our focus on sustainability.”

Chilean AFPs with Reduced Hours

In Chile, the quarantine became mandatory on Thursday, March 26 at 22:00. But many companies already had a first experience with teleworking after the social outbreak in October, when public transport was clearly affected.

The 4 main Chilean AFPs, which control most of the market share, are promoting the use of remote channels, have closed the branches affected by the quarantine and those that they keep open do so with reduced hours.

Individual strategies differ slightly by entity, for example, AFP Habitat has extended the hours of its call center from 8:30 to 23:00 at night from Monday to Friday and Saturday mornings and AFP Cuprum recommends changing the modality of cash payment by the bank account to avoid risk of contagion.