Unfortunately, in recent times, developed markets have been veering on a downwards trajectory as global growth concerns come to the fore once again. In contrast, we believe the Asia-Pacific region is different: there’s a powerful ‘reform’ agenda creating specific catalysts that may drive markets there.

With changes of leadership in China, Thailand, India and Indonesia, a region-wide clampdown on corruption and a drive to improve efficiency, investor perceptions are beginning to shift for the better, along with share prices. The improving backdrop warrants a closer look.

Chinese SOEs – the lumbering giants are getting fit

State-owned enterprises (SOEs) have been instrumental in the Chinese economic growth story. Recently, however, there has been a drive to reshape these bloated structures into companies focused on shareholders rather than market share or job creation.

The hope is those SOEs with improving operating efficiency should contribute to China’s economic growth, reinvigorate private sector investment and help revitalise the economy by creating a more competitive business environment. Coupled with President Xi Jinping’s well-publicised anti-corruption measures, we believe this may improve investor returns in the medium term.

The SOE, PetroChina, is one of our favoured picks. The new management, installed in 2013, is more focused on the returns from invested capital, which should resonate well with external shareholders.

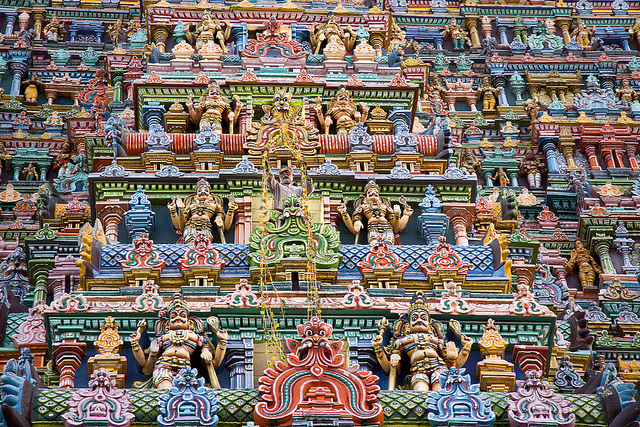

India – powering forward

Across the Bay of Bengal, newly-elected Prime Minister, Narendra Modi, is beginning to drive real change in political and economic attitudes. Expectations are high, and there is already evidence of the new administration beginning to address legacy stalled projects, by simplifying project approval and land-acquisition processes.Coal shortages are a major issue for the power sector and economy as a whole. With the newly-formed government committed to ‘24/7’ power supply across India, augmentation of national coal output is of vital importance.

Coal India is one beneficiary. With a virtual monopoly in domestic coal production, a lot of cash on its balance sheet, an undemanding valuation and increasing commitment to return cash to shareholders (as highlighted by the recent special dividend), we currently view this as an attractive investment proposition.

Korea – tapping reserves

The newly-installed Finance Minister, Choi Kyoung-hwan, announced a raft of tax measures aimed at unlocking billions of dollars in corporate cash reserves. The government plans to discourage companies from hoarding cash by imposing tax penalties on excess reserves after wages, capital expenditure and dividends have been taken into account. Investors hope this will boost the historically low dividend yields of Korean companies, and hence raise share prices.

We exercise some caution however. While there are changes being made at the government level these have not necessarily trickled down to the corporate level yet.

Indonesia – bringing the islands together

The people of Indonesia, and the third largest democracy in the world, chose Jowoki Widodo last July last year as their president following the failure of Susilo Bambang Yudhoyono to push through necessary reforms.

Undeniably a long list – first in line is energy, where fuel subsidies have led to an over-reliance on oil and a 20% strain on the total government purse. It’s not an easy task as, even though the knock-on effect frees money for other reforms (around $30bn), it risks social unrest with the impact felt by many companies and individuals alike.

Other reforms include education and agriculture, and infrastructure investment, where a focus on ports, railways, toll roads, and dams (for farming), should serve to decentralise manufacturing and release pressure from crowded urban areas. In this respect, Telekomunikasi Indonesia, the country’s largest telecommunications provider, is one that may benefit from such renewed investment.

Opinion column by Mike Kerley, manager of the Henderson Horizon Asian Dividend Income Fund.