Investors who obsess and fret about China’s slower headline gross domestic product (GDP) growth may be missing valuable individual equity investments. China is growing at a more measured pace than in the past and in 2015, China will continue to balance the competing needs of growth, reform and deleveraging. As such, official GDP growth targets may need to be revised down. However, a myopic vision that correlates GDP growth to investment returns overlooks the bright prospects for many companies, particularly those that are genuinely innovative, globally competitive, and those companies experiencing multi-year improvements in demand dynamics driven by demographics.

Bright stars

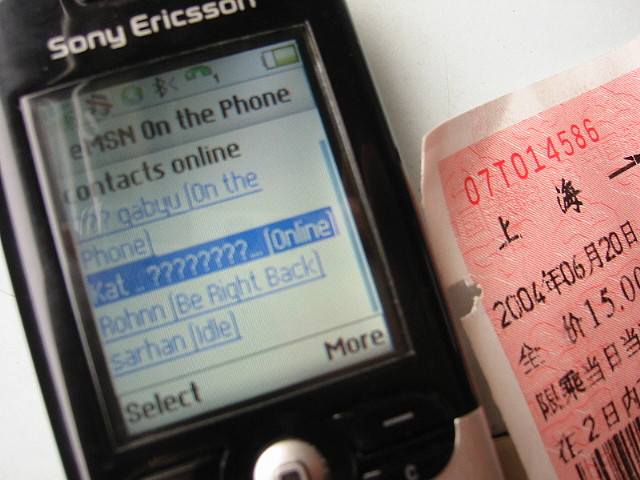

Many Chinese companies have a proven track record of delivering profit and cash-flow growth irrespective of the Chinese economy. The technology sector, particularly internet and software, is one of the few industries in China where research and development (R&D) is a priority. R&D has already led to growing profits, as companies develop products that increase user loyalty, generate incremental revenue and create valuable user bases that attract online advertising expenditure.

Tencent and Alibaba are arguably more innovative than Amazon, Facebook and Twitter as a result of their onnovative applications, huge user communities and early development of payment facilities. Tencent was founded in 1998 and now has more than 815 million monthly active instant messaging accounts. In 2013 it spent CNY 5.1bn on R&D (£0.5bn), which was 8.4 per cent of sales.

Recent IPO Alibaba was founded in 1999 and is now the world’s largest ecommerce company by revenues, in the financial year ending March 2014.

Companies in China’s technology sector are experiencing significant growth. The market capitalisations of internet firms Tencent and Alibaba now rank alongside some of the largest companies in China.

Another bright technology star is Lenovo, a Chinese PC company that through stable and strong management, international acquisitions, and the development of a global manufacturing footprint has become a recognisable global brand. It has been the world’s largest PC vendor for over a year, with a current market share of 19 per cent.

Demographic drivers

The Communist Party controls China but one thing it cannot control is demographic change, where past decisions can lead to future trends. China has had a one child policy since 1979 and consequently China’s population is rapidly ageing just as it is getting richer. This is triggering a multi-year boom in demand for healthcare drugs, therapies and services. China has probably underspent on healthcare, and with greater life expectancy and insurance provision we expect supportive industry tailwinds to benefit domestic healthcare companies such as CSPC Pharma and China Medical Systems.

So do not be frozen in the headlights of China’s macroeconomic slowdown, instead appreciate how far some Chinese companies have come and how the outlook varies dramatically on the ground.

Opinion column by Charlie Awdry, Chinese Equities Portfolio Manager at Henderson Global Investors.