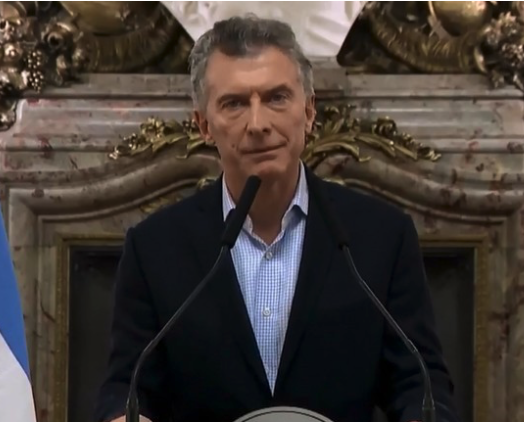

Mauricio Macri, President of Argentina, announced on Tuesday that he has begun talks with the International Monetary Fund (IMF) to receive a “financial support line” for the situation which has been generated in that country due to the strong depreciation of the peso against the dollar in a difficult global context, marked by the rise in US interest rates and the potential revaluation of the American currency against some currencies of the emerging world. And mainly against countries that, like Argentina, depend heavily on external financing.

“I have made this decision thinking of the best interest of all Argentines, not lying to them as has been done so many times (…).I am convinced that fulfilling commitments and moving away from demagoguery is the way to achieving a better future,” said Macri yesterday, trying to instill tranquility in the markets. Investors fear that this situation will negatively impact the country’s debt, and may even infect the markets of other emerging economies, and by proximity, those of Latin America

Last Friday, in a new attempt to defend the exchange rate of the peso against the dollar, the Central Bank of the Republic of Argentina (BCRA) decided to raise the reference interest rate to 40%, less than 24 hours after it had raised the price of money to 33,25%. Therefore, the central bank increased the benchmark rate by 675 basis points in less than a day, in what represents the third increase in the price of money last week, thus raising the benchmark interest rate to 40% from the 27, 25% rate of the previous week.

Precautionary measure

The new aid measures aim to alleviate this situation. For Alejandro Hardziej, Julius Baer’s Fixed Income analyst, this is a “precautionary” measure: “It seems that Argentina is negotiating a line of credit as a precautionary measure to cover potential financing needs without having to go to the international debt markets in a scenario of rising loan costs and greater risk aversion of investors to emerging markets,” he explains. In his opinion, the movement”doesn’t reflect an underlying liquidity problem but it’s a government move to calm investor’s fears and reduce pressure on the currency, the Argentine peso”

“The fact that Argentina has gone ahead and asked the IMF for help is a good sign, as it can help because things are being done properly, despite the fact that it damages Macri’s image”Alejandro Varela, Portfolio Manager at Renta 4 Gestora.

For Amílcar Barrios, Tressis analyst, “Argentina resorts to the IMF toget a line of financing that the market is denying it, owing to the extensive and disastrous financial history accumulated by that country, regardless of who governs.”

Claudia Calich, Fund Manager of the M & G Emerging Markets Bond fund, pointed out that, in the last two months, the Argentine peso had become more expensive in real terms, following the strong flows received from international investors in 2017. “These capital flows caused the ratio of nominal exchange to depreciate much less than inflation.” But the tide began to change at the end of last year, when, in her opinion, the country’s Central Bank committed the political error of raising the inflation target for 2018, from 10% to 15%, so that adjustment allowed the entity to cut rates at the beginning of January, something that undermined its credibility and raised concerns about whether monetary policy is free from government interference. “Another political error was the announcement of the 5% tax on Treasury investments in Argentine pesos, which had an impact both on local and international investors and led to a reduction in investments in public debt in pesos,” the expert explains.

A higher reading of inflation and a stronger dollar generated strong pressure on the country’ currency, explains the asset manager, so the Central Bank realized the need to restrict monetary policy, with three emergency increases, until the 40% mentioned above. “I think that monetary authorities will now be successful in slowing down the depreciation of the currency,” she explains. Calich argues that the overvalued peso is also contributing to expand the country’s current account deficit by up to 5% but, in this situation, she expects it will begin to reduce as the peso moves towards equilibrium. “The implications will be higher inflation this year and possibly the next one, lower growth, and a further decline in Macri’s popularity.”

But without default…

On whether or not it’s a default situation, she believes that “not yet. I see this as a re-pricing of Argentina’s risk, which had started at the beginning of the year, along with sales in the emerging debt market in both local and strong currency,” she explains.

She also speaks of two glimmers of hope for Argentina: First, the next elections will not be held until January 2019, so authorities have time to take their “bitter medicine” this year, but it will lead to a readjustment of the economy in 2018. Secondly, the IMF can intervene with an aid program if the Latin American country loses access to the capital market or if there is some type of crisis caused by the outflow of capital (unlike other markets such as Venezuela), something that it considers positive. “Argentina and the IMF have had a tumultuous relationship in the past but the objective this time would be to ensure stability so that Argentina does not return to its failed populist policies under a new administration,” she adds.

A Warning Sign?

However, we must not lose sight of the situation of emerging markets… especially those with fundamental weaknesses. This advice comes from Paul Greer, Asset Manager at Fidelity, who explains that the South American country has reached this point largely due to the strengthening of the dollar and the increase in the profitability of US fixed income.

“As with the caged birds that serve as a warning for gray gas in the mines, Argentina is a wake-up call to investors positioned in emerging markets with weak fundamentals. These types of assets do not get along well with an increasingly strong dollar. The recent price situation illustrates how quickly [investor] sentiment can change,” he says.

Impact on Spain

Luis Padrón, an analyst at Ahorro Corporación, believes that Argentina’s problem “seems to be more structural than a currency problem.” Regarding Spain’s exposure to this market, he points out “how much the situation regarding the exposure that Spanish companies have had in this market has changed”, going from being one of the countries with greater exposure to having a very reduced exposure in the business of the companies.”Only Día, Centis and, to a lesser extent, Telefónica are ‘suffering’ the impact of this situation”, he adds (see Ahorro Corporación’s table below).