Lyxor ETF has a new route for sustainable investment. The firm argues for the expansion of this type of investment and how ETFs have become a remarkable vehicle to invest under ESG criteria. A trend that the firm believes will continue to grow given that so far only 1% of European ETFs follow these investment criteria.

According to the management company’s assessment, these figures show great potential for growth. In addition, in terms of investment strategies, and taking Europe as a reference, it is observed that all strategies increased since 2013. As an indication, Lyxor ETF points out that just those strategies with exclusion criteria grew by 22% in 2015, as compared to 2013. This trend is compounded by the popularity and demand for passive strategies, which leaves the ideal framework for the development of sustainable investment through ETFs.

“ETFs can democratize access to these strategies because it is difficult for an investor to participate in certain assets, such as green bonds, for example. Instead, by using ETFs to diversify the portfolio, this type of asset can be accessed. In addition, it should be noted that they have lower costs, especially those that are contracted through digital platforms,” explains Francois Millet, Head of Product Line Management at Lyxor. Due to these qualities, Millet argues that it will be the millennial investors who will resort more readily to this type of solutions.

In his analysis of sustainable investment, Millet points out that, within the status that sustainable investment has in Europe, “we observe that the strategies that grow the most, investment through exclusion, impact investment, and sustainability issues, are precisely those invested in by passive management,” he says.

At Lyxor ETF, they have addressed this type of investment with two proposals: thematic investment and investment in indices. “In the case of the thematic investment, we have four ETFs that are within the theme of the UN Millennium Goals. They are related to energy, equality, water and green funds. Transforming these objectives into investment strategies is complicated, but it can be done by participating in the market of those megatrends which affect these issues,” says Millet.

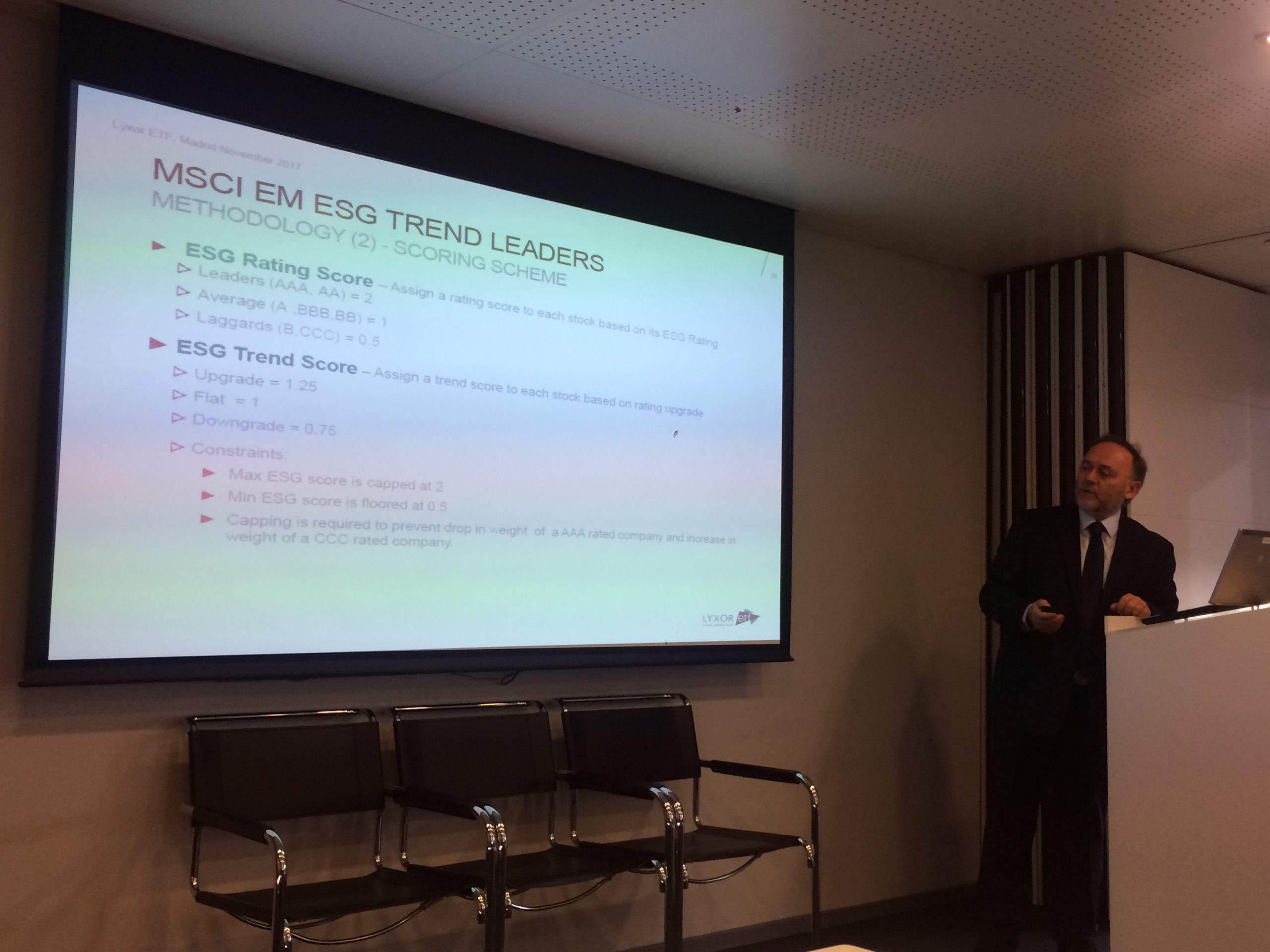

Regarding their second proposal, the indices, he emphasizes that “investment is based on the sustainable rating of the companies. However, in order to consider these indices, data, exclusion strategies by sector or activity, and demonstrating that they prioritize certain objectives, are required”. In this regard, the firm uses the MSCI indexes.

Passive vs. active

At Lyxor ETF, they opt for an active use of passive management or, at least, a smart combination in order to address market needs. “In less efficient market areas, active managers are able to capture greater profitability; while in more efficient markets it is more complicated, and therefore, passive management makes more sense because the active manager has a harder time achieving good investment behavior”, explains Marlène Hassine Konqui, Head of ETF Research at Lyxor, who argues that the conflicting vision of active management versus passive management is wrong.

“For us, it makes more sense for active managers to include passive strategies in their portfolios which allow them to capture returns or help the portfolio to have a certain behavior,” she points out. According to her estimates, the perfect balance between these two management styles would be 70% of passive management and smart beta strategies, and 30% of active management.

By Fórmate a Fondo

By Fórmate a Fondo