Each asset management firm has a star portfolio manager or at least a manager who’s held as the role model. This is typically a PM with years of experience, a track record to die for, and a renowned reputation within the industry. If at Franklin Templeton we have Mark Mobius and Michael Hasenstab, or at Matthews Asia Andy Rothman, we must not forget Russ Koesterich when speaking of BlackRock, or Greg Saichin of Allianz GI.

They lead teams with good results and are in major mutual fund firms. For years, their management attracts clients, and therefore increase the flow of capital. The problem comes when they want to start new projects, change companies, or retire without further ado.

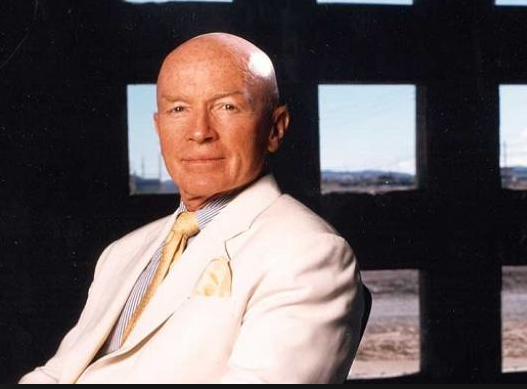

What for years was a sweet dream for any company suddenly becomes its nightmare overnight. The most recent example is Bill Gross, who after years as a star manager at PIMCO, a company which he helped to establish, he decided on a change of scenery and joined Janus Capital.

The Allianz subsidiary then experienced capital outflows amounting to $176 billion worldwide in 2014, i.e. 26% of the assets it managed in 2013. The losses of the PIMCO Total Return, Gross strategy, amounted to over $96 billion dollars in just five months. A genuine catastrophe.

Something similar happened in Spain with Francisco Garcia Paramés’ departure from Acciona Group’s Bestinver, after 25 years of service to the company. Known as “Europe’s Warren Buffett”, he achieved a placing for the company’s funds at the top of the rankings within their class. When he decided to start a new project, however, the outflow of funds began. Assets under management fell by about 30%, especially with the exit of institutional clients.

The capital outflow requires companies to react quickly in searching for the most suitable replacement, but, even so, prefer to choose other managers with similar reputation. The damage to the company is twofold. Not only do they leave, they also do so to join the competition.

Recently, Morningstar left the door open to hope by giving an example of an orderly transition with low impact for the company when placing Jupiter UK Growth in the hands of Steve Davies, who replaced Ian McVeigh after his departure. Among the lessons to be learnt from this is that the longer the star manager and the manager who shall replace him work together, the less impact on the firm.