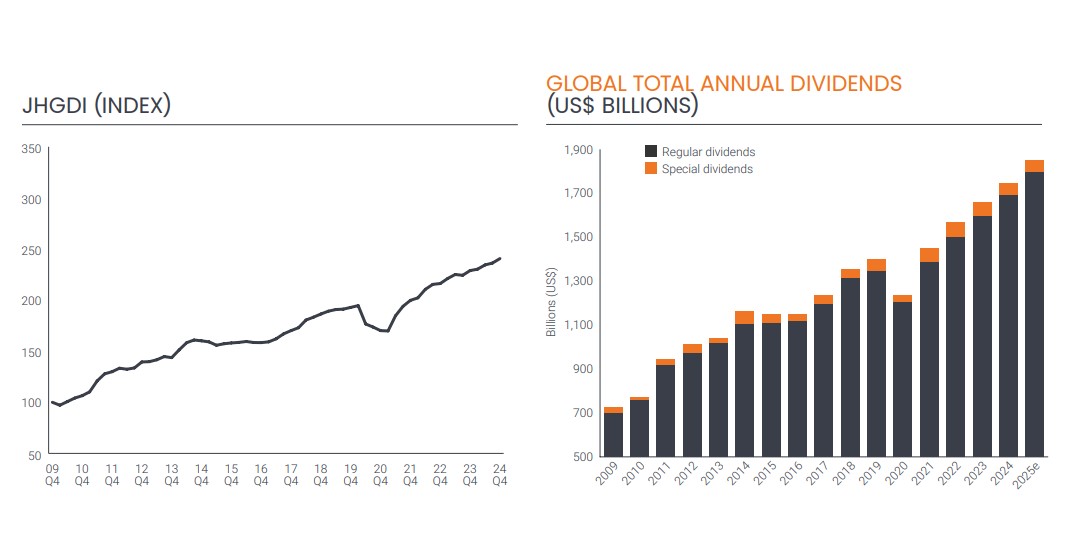

Global dividend payouts reached a record $1.75 trillion in 2024, representing underlying growth of 6.6%, according to the latest Janus Henderson Global Dividend Index. The asset manager explains that, at a general rate, growth was 5.2%, driven by lower special dividends and the strength of the dollar.

The year’s results slightly exceeded Janus Henderson’s forecast of $1.73 trillion, mainly due to a better-than-expected fourth quarter in the U.S. and Japan. In Q4, dividend payouts increased by 7.3% on an underlying basis.

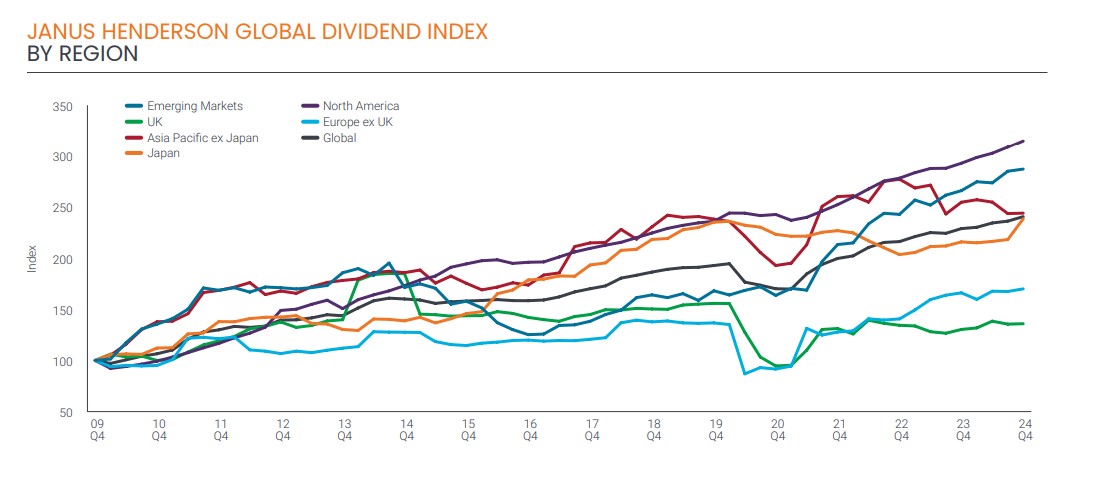

According to their assessment, overall growth was strong across Europe, the U.S., and Japan throughout the year. Some key emerging markets, such as India, and Asian markets like Singapore and South Korea, also recorded decent growth. In 17 of the 49 countries included in the index, dividend payouts hit record levels, including some of the largest distributing nations like the U.S., Canada, France, Japan, and China.

When analyzing the source of this growth, the Janus Henderson report highlights that several major companies distributing dividends for the first time had a disproportionate impact.

“The largest payouts came from Meta and Alphabet in the U.S. and Alibaba in China. Together, these three companies distributed $15.1 billion, representing 1.3% of total dividends or one-fifth of global dividend growth in 2024,” the report states.

Another key finding is that 88% of companies either increased or maintained their payouts globally, while the median dividend growth—or typical growth rate—stood at 6.7%.

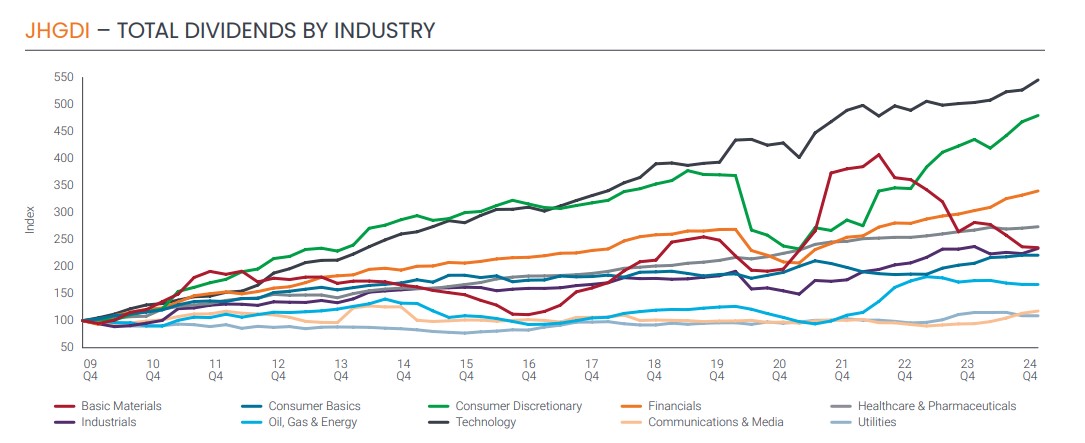

By sector, nearly half of the dividend increase in 2024 came from the financial sector, primarily banks, which saw underlying dividend growth of 12.5%.

According to Janus Henderson, dividend growth in the media sector was also strong, doubling on an underlying basis, largely due to payouts from Meta and Alphabet. However, the increase was broad-based, with double-digit growth in telecommunications, construction, insurance, durable consumer goods, and leisure.

In contrast, mining and transportation were the worst-performing sectors, paying a combined $26 billion less than in 2023.

The report also highlights that, for the second consecutive year, Microsoft was by far the world’s largest dividend payer. Meanwhile, Exxon, which expanded its portfolio with the acquisition of Pioneer Resources, climbed to second place—a position it hadn’t held since 2016.