Exchange-traded products (ETPs) have become an essential tool for portfolio managers, as highlighted by FlexFunds, offering flexibility, accessibility, and cost efficiency for asset repackaging and management. These financial instruments enable asset managers to efficiently diversify their portfolios, implement tailored investment strategies, and seamlessly adapt to changing market conditions.

What Is an ETP?

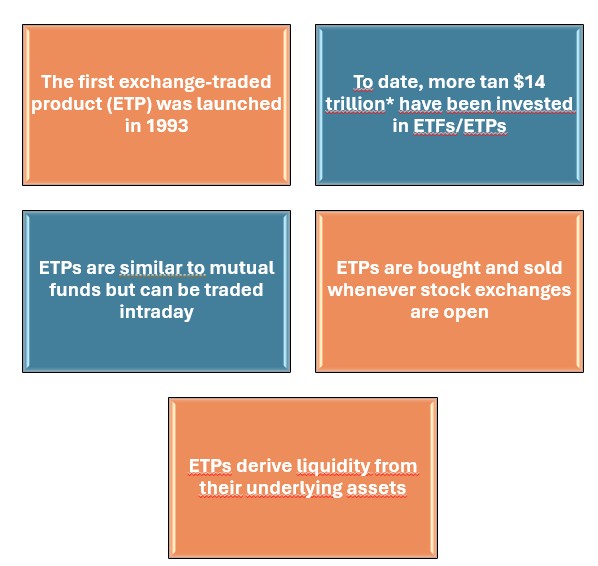

An ETP is a financial instrument traded on a stock exchange, similar to equities. It provides access to a benchmark index or a specific asset class, making it easier for managers to construct diversified portfolios with a single transaction. Most ETPs are passive investments designed to track the performance of an underlying index or asset, generally with lower operating costs than actively managed investment funds or mutual funds.

Characteristics of ETPs

- Passive management: A cost-efficient and transparent option for gaining exposure to an index or asset without the need for constant active management.

- Simplified diversification: Enables managers to access a broad range of assets through single trade.

- Liquidity and ease of trading: Can be bought and sold during market hours, with real-time pricing.

- Flexibility for managers: Can issue shares or debt securities based on demand, adapting to portfolio needs.

- Transparency: ETP components are published daily, providing managers with a clear view of portfolio holdings.

The growing ETP market

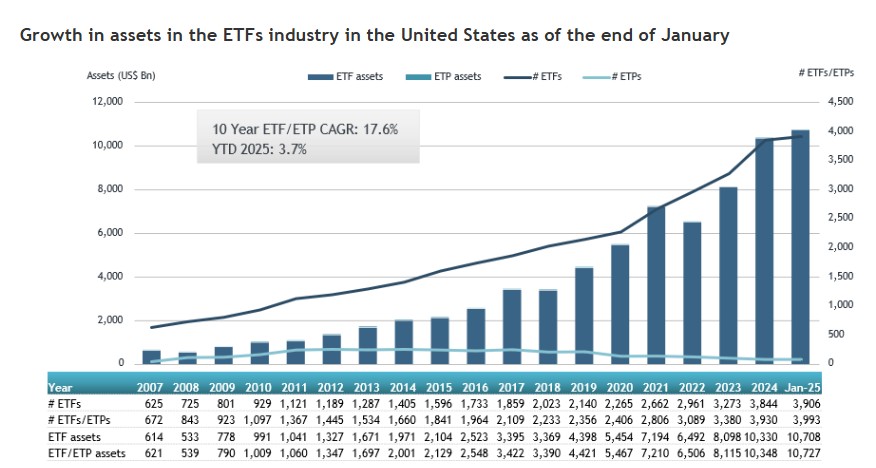

The ETP industry has experienced significant growth since the launch of the first product in 1993. According to independent research and consulting firm ETFGI, as of January 2025, over $14 trillion was invested globally in ETFs/ETPs. In the United States, the market reached a record $10.73 trillion in January 2025, surpassing the previous peak of $10.59 trillion recorded in November 2024. These figures reflect the growing interest in and adoption of ETPs as a key portfolio management vehicle, as illustrated in the following chart:

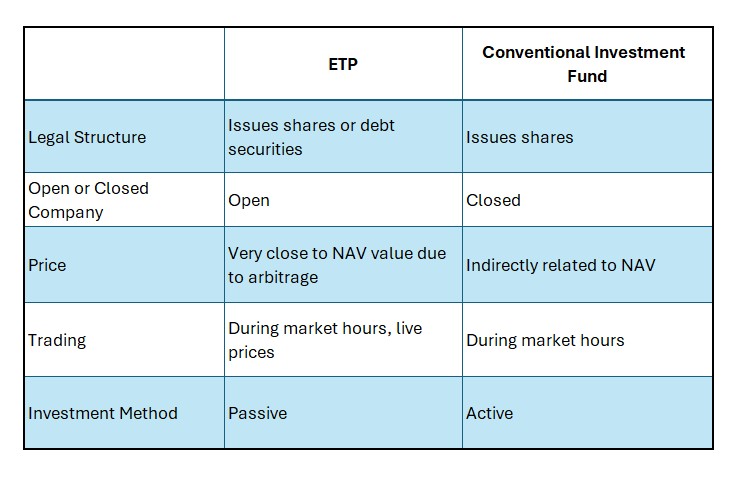

ETPs vs. traditional investment funds

Today, portfolio managers have a wide range of investment vehicles to optimize their strategies. This article focuses on comparing ETPs with traditional investment funds, highlighting their key differences in the table below.

FlexFunds: A global leader in ETP solutions

FlexFunds is an internationally recognized service provider for the issuance and administration of ETPs covering listed assets and alternative investments. These solutions are tailored for investment advisors, hedge fund managers, private fund managers, and real estate fund managers.

FlexFunds’ ETPs stand out for their efficiency and versatility, allowing asset managers to design customized strategies and create exchange-listed products with a unique ISIN code listed on the Vienna Stock Exchange and Bloomberg. Among their key advantages:

- Efficient subscription via Euroclear

- Flexible portfolio composition: Enables the securitization of multiple asset classes, both liquid and alternative.

- Cost-efficient structure: Enhances portfolio profitability and optimizes operational expenses.

- Global access: Products can be acquired from any brokerage account worldwide, facilitating international distribution.

- Integrated administration: Supported by renowned institutions such as Interactive Brokers and Bank of New York, ensuring security and trust.

- Direct reporting and transparency: Pricing is calculated and displayed directly on Bloomberg, Six Financial, and investors’ accounts.

With FlexFunds’ investment vehicles, asset managers can access solutions that securitize multiple asset classes, both liquid and alternative. To learn how these solutions can enhance your investment strategy, feel free to contact one of our experts at info@flexfunds.com.

Disclaimer:

The purpose of content of the above article, blog, or post is only informational, and it is not intended to provide any sort of investment advice, as an offer of solicitation to buy, sell, or hold, or as recommendation, endorsement of any security, investment, fund and / or company. The content and information provided in the above article, blog, or post does not constitute financial, trading, or investment advice of any type. Neither FlexFunds ETP nor FlexFunds Ltd. is a U.S. registered broker-dealer, or an investment adviser registered with the U.S. Securities and Exchange Commission. Our entities do not raise capital for clients or the Issuers. We do not solicit any specific products, nor offer investment advice or make investment recommendations, nor do we offer tax, legal, financial advice or otherwise. Perform your own due diligence and consult a financial advisor prior to making any investment decision.