On Wednesday, the Fed published the hypothetical scenarios for its annual stress test, in which 22 banks will be tested against a severe global recession, increased strain in commercial and residential real estate markets, and corporate debt market stress, according to a statement.

While the scenarios are not forecasts and should not be interpreted as predictions of future economic conditions, the test incorporates various macroeconomic data points.

For example, the test assumes that the U.S. unemployment rate rises by nearly 5.9 percentage points, reaching a peak of 10%. This increase in unemployment is accompanied by high market volatility, widening corporate bond spreads, and a sharp decline in asset prices, including an approximate 33% drop in home prices and a 30% decline in commercial real estate prices, according to the Fed‘s statement.

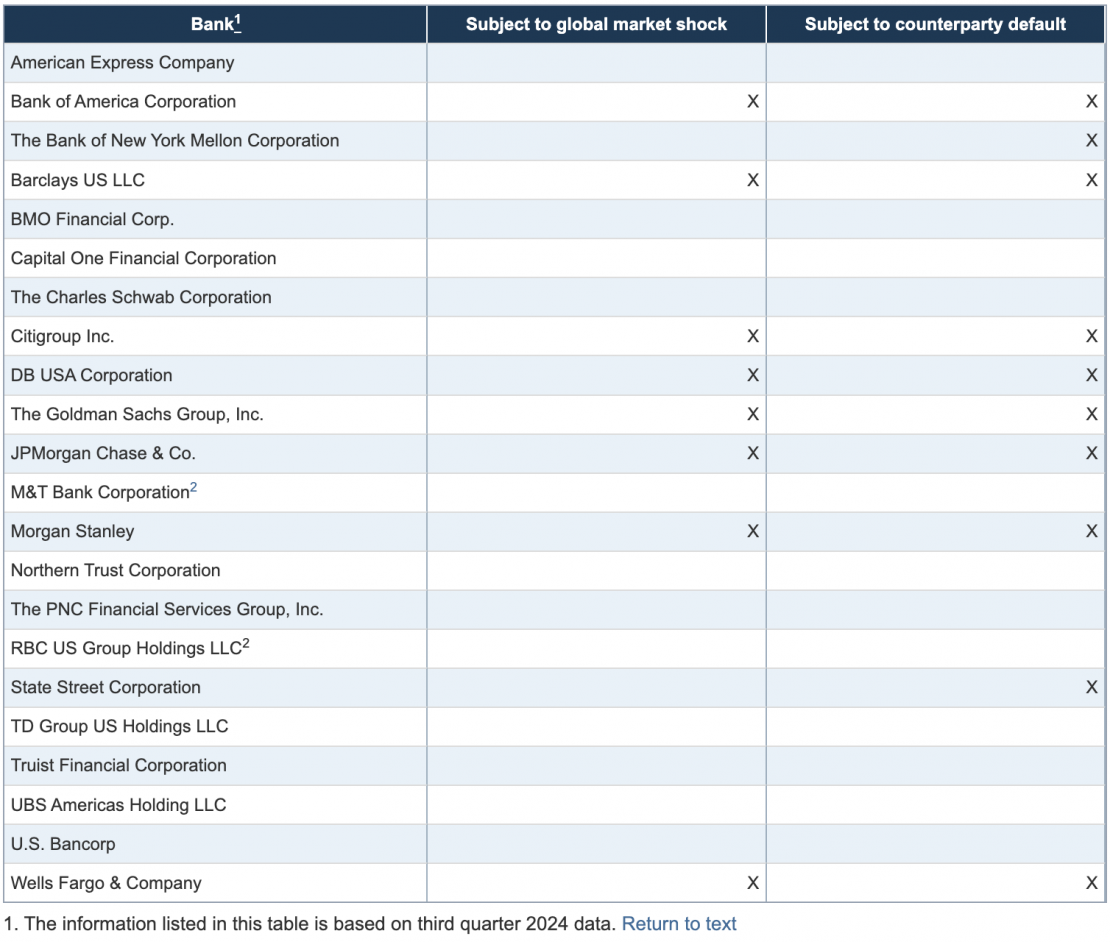

Additionally, “large banks with significant trading or custody operations are also required to incorporate a counterparty default scenario component to estimate potential losses from the unexpected default of the firm’s largest counterparty amid a severe market disruption.” Meanwhile, banks with major trading operations will undergo a test featuring a global market shock component, primarily affecting their trading positions and related activities.

The following table outlines the components of the annual stress test applied to each bank, based on data from the third quarter of 2024:

This year’s exploratory analysis includes two separate hypothetical elements designed to evaluate the banking system’s resilience to a broader range of risks. One element examines how banks would respond to credit and liquidity disruptions in the non-bank financial institution sector during a severe global recession.

The second component of the exploratory analysis involves a market shock scenario that will apply only to the largest and most complex banks. This scenario hypothesizes the failure of five major hedge funds, combined with a decline in global economic activity and rising inflation.

Unlike the stress test, the exploratory analysis is designed to assess additional hypothetical risks to the banking system as a whole, rather than focusing on the specific outcomes for each individual bank. The Fed will publish aggregated results from the exploratory analysis alongside the annual stress test results in June 2025.

The Fed plans to take steps soon to reduce the volatility of stress test results and begin improving the transparency of the models used in the 2025 tests. Additionally, the Fed intends to initiate a public comment process this year regarding its comprehensive changes to the stress testing framework.

The annual stress test evaluates the resilience of large banks by estimating their losses, net income, and capital levels—which serve as a buffer against losses—under hypothetical recession scenarios that extend two years into the future.