The new Donald Trump administration brings uncertainty to emerging markets. However, investment firms believe it is essential to look beyond this and remember that these regions have stronger markets and that the Federal Reserve‘s monetary policy continues to favor risk assets.

According to Kirstie Spence, portfolio manager at Capital Group, many of the major emerging markets can leverage various tools: higher reserve volumes, positive real interest rates with room to decline, fewer imbalances than developed markets, and exchange rates that are fairly valued or undervalued.

“They have policy flexibility to weather the storm if needed. Except for the less consolidated economies, external balances are solid. Additionally, inflation is trending downward in a restrictive monetary policy environment. Fiscal indicators are often a weak point for these markets, but most major emerging markets have extended their debt maturity profile and are now issuing more in local currency,” argues Spence.

She also notes that a Federal Reserve less inclined to cut rates could put pressure on central banks in less developed emerging economies, making it difficult for them to maintain higher interest rates, especially in countries concerned about inflation and financial stability risks. “In more developed emerging markets, particularly in the Asian region, central banks have shown greater confidence in getting ahead of the Federal Reserve, given the absence of systemic pressures on financial systems and the development of deeper, more liquid domestic markets,” she adds.

According to Claudia Calich, Global Head of Emerging Debt at M&G, it is interesting to analyze that the disinflation story in emerging markets is practically complete, with few exceptions in high-inflation countries such as Argentina, Turkey, Egypt, and Nigeria. “It is remarkable how poorly Latin America performed in 2024, affected by both currency depreciation and rising yields. There is much less room for rate cuts, given the expected inflation path in most inflation-targeting economies. However, there is potential for a yield rebound if country-specific concerns ease, such as improved fiscal prospects in Brazil or greater clarity on trade between the U.S. and Mexico, and if currencies stabilize or recover some of the depreciation seen in 2024,” says Calich.

Implications for Investors

Given this backdrop, asset managers are looking for investment opportunities in emerging markets, with debt being one of the most analyzed areas. According to M&G’s expert, local currency bonds in emerging markets remain underappreciated, which could be a good signal for contrarian investors willing to step in and endure some volatility. “However, high short-term interest rates in key markets like the U.S., U.K., and, to a lesser extent, the Eurozone, remain a hurdle for this asset class, and global macroeconomic uncertainty doesn’t help. Local currency bonds in emerging markets still face strong competition from high short-term rates in the U.S., U.K., and Eurozone. This could improve in the future as central banks continue easing, but the risk of ‘higher for longer’ rates remains, especially if U.S. inflation expectations deteriorate due to tariffs,” she explains.

Additionally, M&G acknowledges that they remain selectively constructive on emerging market currencies, as their valuations have become even more attractive after last year’s sell-off. “However, timing the right moment to act is complex, as the fate of the U.S. dollar will largely depend on the policy mix adopted by the new administration,” Calich notes.

The Heavyweights

When discussing investment opportunities, Chris Thomsen, portfolio manager at Capital Group, highlights two “heavyweights”: India and China. In his view, both emerging markets have followed very different trajectories over the past five years, with Indian equities significantly outperforming Chinese equities.

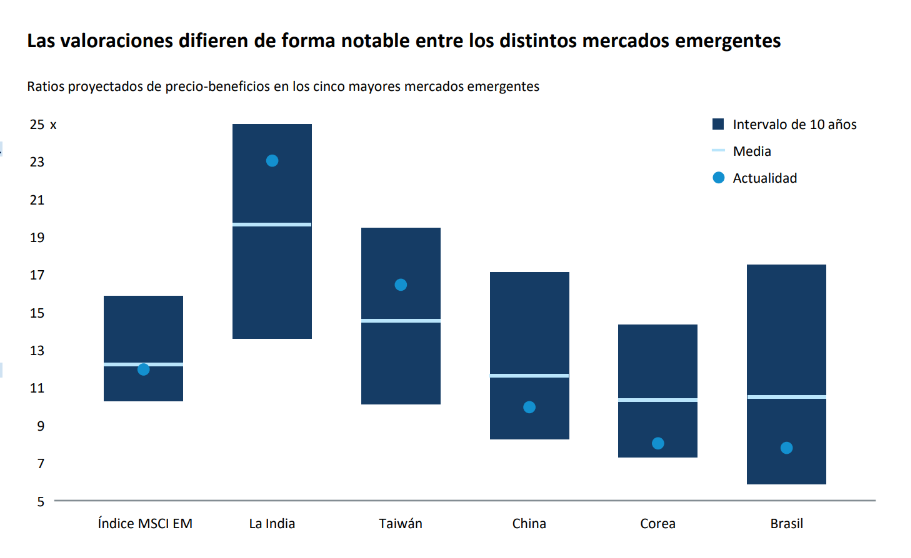

“Valuations reflect these differences. While both markets offer attractive opportunities, they come with their own risks and investment drivers. The increasing penetration of mobile phones among India’s young and vast population has benefited telecom companies like Bharti Airtel, but the high valuation levels make selectivity crucial,” explains Thomsen.

On the other hand, he points out that China’s massive domestic consumer market could be boosted by government stimulus measures, creating opportunities for well-positioned digital companies. “Some companies like Tencent and NetEase hold dominant positions, have strong cash flows, and high-quality management teams. However, investing in China remains risky due to ongoing tensions with the U.S. and the trade priorities of the new Trump administration,” says the Capital Group manager, adding that the reconfiguration of global supply chains presents opportunities in Brazil, Mexico, and Indonesia.