Regarding the behavior of flows, the ETFGI report shows that out of the $207.73 billion in net inflows, equity ETFs captured $151.58 billion, raising 2024 net inflows to $1.11 trillion, far exceeding the $532.28 billion in 2023. As for fixed income ETFs, these vehicles attracted $16.14 billion in December, bringing 2024 net inflows to $314.32 billion, higher than the $272.90 billion in 2023.

Looking at other asset classes, commodity ETFs reported net outflows of $1.11 billion in December, bringing 2024 net inflows to $3.91 billion, better than the net outflows of $16.88 billion in 2023. Meanwhile, active ETFs attracted net inflows of $41.78 billion in December, bringing 2024 net inflows to $374.30 billion, much higher than the $184.07 billion in net inflows in 2023.

According to Deborah Fuhr, managing partner, founder, and owner of ETFGI, “The S&P 500 index declined 2.38% in December but rose 25.02% in 2024. Developed markets, excluding the U.S. index, declined 2.78% in December but increased 3.81% in 2024. Denmark (down 12.34%) and Australia (down 7.90%) recorded the largest declines among developed markets in December. The emerging markets index increased 0.19% during December and rose 11.96% in 2024. The United Arab Emirates (up 6.42%) and Greece (up 4.21%) recorded the largest increases among emerging markets in December.”

Evolution of Offerings

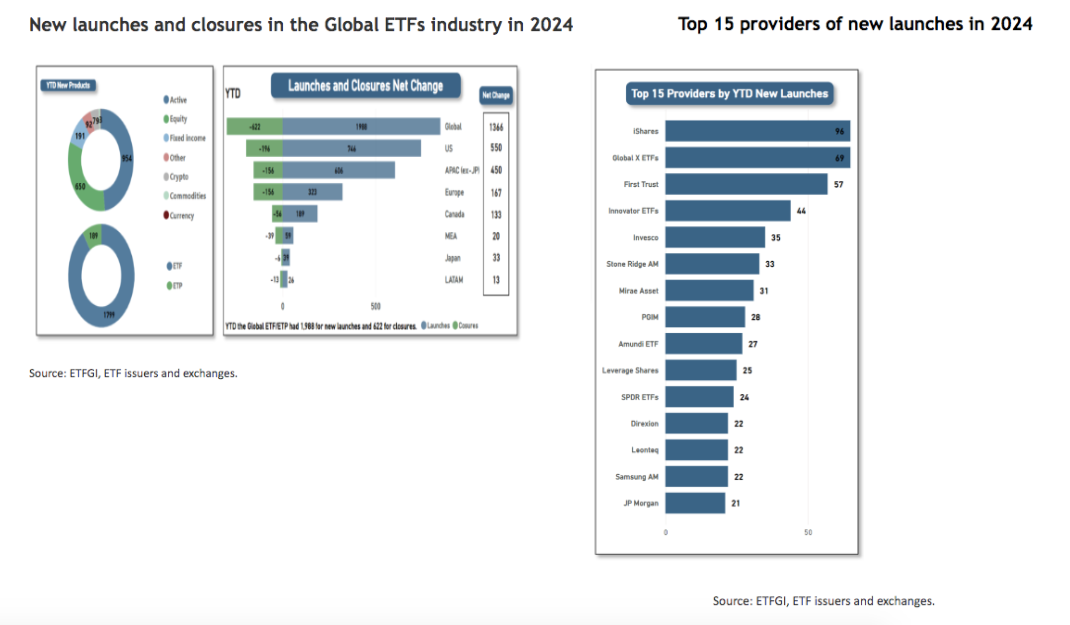

The ETFGI report also highlights that the global ETF industry reached a new milestone with 1,988 new products launched in 2024. It explains that this represents a net increase of 1,366 products after accounting for 622 closures, surpassing the previous record of 1,841 new ETFs launched in 2021.

Specifically, the distribution of new launches in 2024 was as follows: 746 in the United States, 606 in Asia-Pacific (excluding Japan), and 323 in Europe. Additionally, a total of 398 providers contributed to these new launches, which are distributed across 43 exchanges worldwide. Notably, iShares launched the largest number of new products, with 96, followed by Global X ETFs with 69 and First Trust with 57.

“There were 622 closures from 177 providers across 29 exchanges. The United States reported the highest number of closures with 196, followed by Asia-Pacific (excluding Japan) with 156, and Europe also with 156. Among the new launches, there were 954 active products, 650 indexed equity products, and 191 indexed fixed-income products,” noted ETFGI.

Between 2020 and 2024, the global ETF industry experienced significant growth in the number of launches, increasing from 1,131 to 1,988. In 2024, the United States and Asia-Pacific (excluding Japan) recorded the highest number of launches, reaching 746 and 606, respectively, while Latin America had the fewest launches, with only 26. The United States and Canada achieved record numbers of new launches in 2024, with 746 and 189, respectively. Additionally, Asia-Pacific (excluding Japan) achieved its launch record in 2021, with 645; Europe set its record of 434 in 2021; Latin America recorded 41 in 2021; Japan reached 44 in 2023; and the Middle East and Africa achieved 86 in 2020.