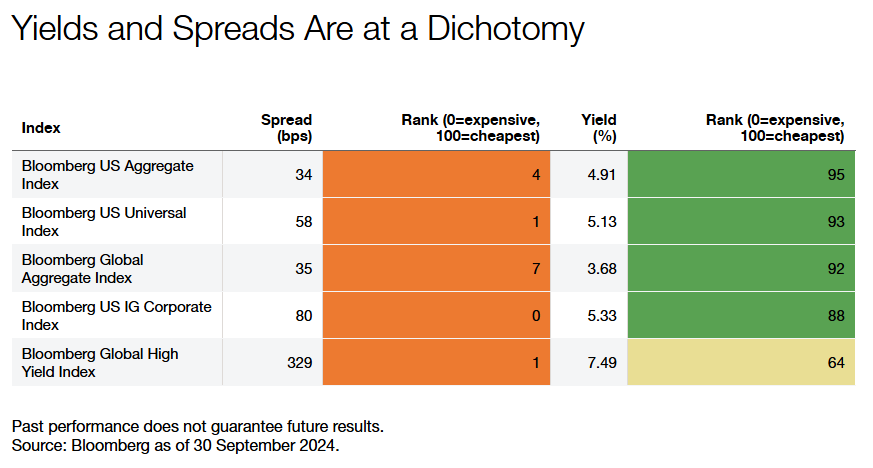

As we kick off the new year, fixed income markets present a mixed picture. Spreads across sectors are at their tightest levels since the global financial crisis (GFC), with investment-grade corporate spreads not this narrow since 1997. However, yields remain in the highest decile of cheapness post-GFC. This dichotomy is likely self-reinforcing as investors, drawn to elevated yields, accept lower spread compensation.

Drivers of Tight Spreads and Elevated Yields:

- Macro Factors: Investors remain optimistic about the U.S. economy’s growth trajectory, buoyed by the latest GDP data (3.1% quarter-over-quarter annualized), resilient nonfarm payroll growth, and continued strength in manufacturing. These factors have supported risk appetite.

- Fundamental Factors: Corporate and consumer balance sheets remain strong. High-yield default rates, at just 1.1% (per JP Morgan), are well below the historical average of 3.4%. Consumer debt, relative to GDP, is at its healthiest level since the GFC.

- Technical Factors: Fixed income markets have experienced robust inflows during 2024, with mutual fund inflows reaching a decade high of $425 billion. Additionally, net negative issuance in the high-yield corporate space in prior years has left the sector modestly smaller, contributing to a favorable supply-demand dynamic.

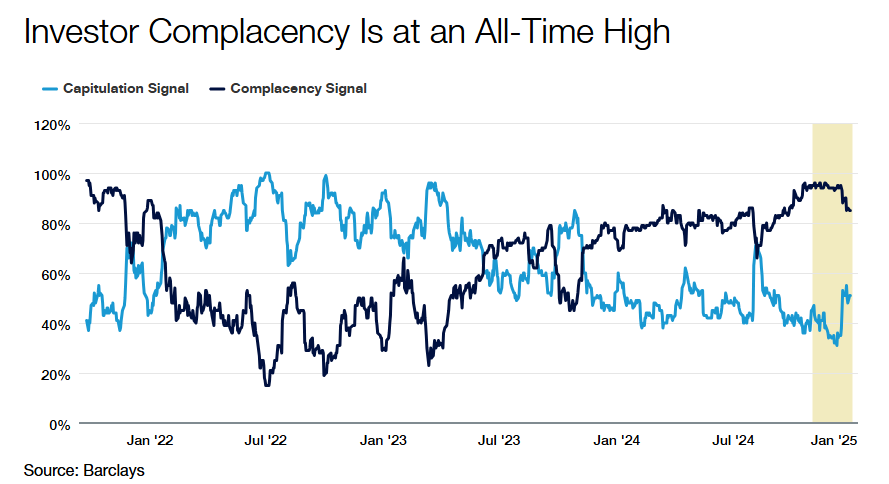

Despite these supportive conditions, historical patterns suggest caution. While there is little indication that a recession is imminent – if so, investors would price this risk into credit spreads immediately. We observe that the current environment resembles past environments where complacency was preceded by an unforseeable shock.

Historical Lessons in Volatility and Complacency

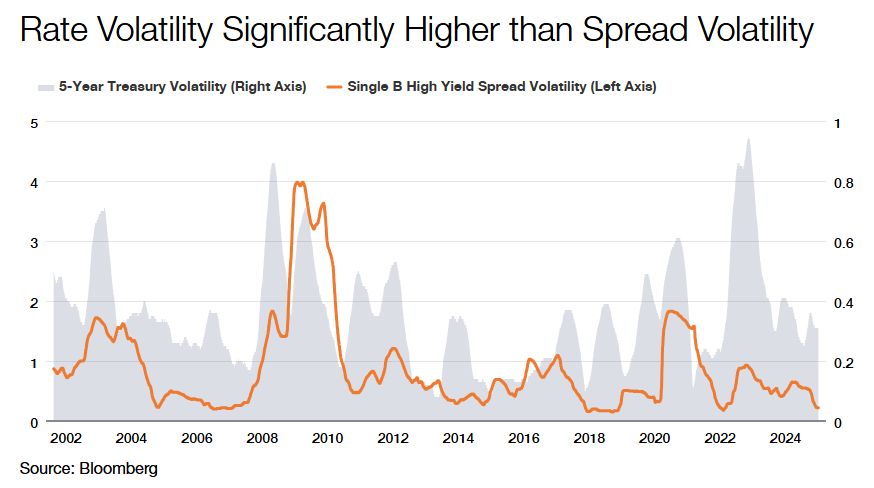

A look back in history at the difference between rate and spread volatility (chart above) reveals that the current environment resembles other periods of complacency, such as 2005–2007 and 2018–2020, both of which preceded significant shocks to the global economy. During these times, tight spreads, combined with declining volatility, masked underlying risks that later emerged with substantial market dislocations.

In a similar vein, Barclays’ “Complacency Signal”—which tracks several market-based factors including high-yield realized volatility, high-yield and bank loan fund inflows, and the price of high-yield tail hedges—indicates that markets are at their highest level of complacency since September 2021. This signal underscores a growing risk that investors may not be adequately pricing the potential for disruption, particularly in credit-sensitive areas.

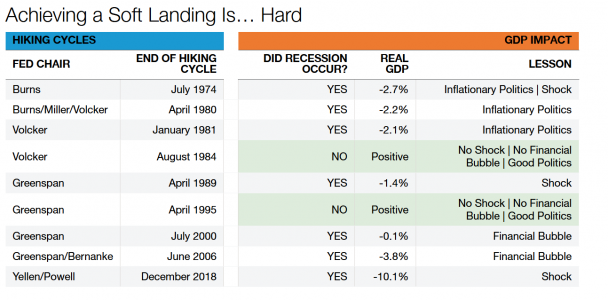

Soft Landing: Historical Challenges and Modern Risks

The current pricing of risky assets reflects a market that has declared victory over recession. The Federal Reserve’s current communication suggests the risks to inflation and employment are roughly equal, which is a favorable place for the central bank to be. Rates that appear to be above neutral give the Fed the leverage it needs to keep inflation in check while having the ammunition to deliver cuts in the event that nonfarm payrolls trend lower.

However, history suggests that avoiding a recession after a rate-hiking cycle is the exception rather than the rule. Over the past 50 years, achieving a “soft landing” has typically required three conditions:

- No Shocks: Past shocks, such as oil price spikes, war, and the COVID-19 pandemic, have often derailed economic stability.

- No Financial Bubbles: Financial excesses, such as the dot-com bubble in 2001 and the housing bubble in 2008, have historically led to recessions.

- Good Politics: A combination of responsible fiscal policies and independent monetary policy is critical.

Source:Bloomberg and Thornburg as of 30 September, 2024.

The mid-1980s and mid-1990s were rare periods when all three conditions aligned, enabling soft landings. Today, the risk of shocks remains unpredictable, but political/fiscal dynamics present a notable headwind. Addressing significant budget deficits could constrain growth, reducing the government’s contribution to economic expansion.

Opinion article by Christian Hoffmann, head of Fixed Income and Managing Director at Thornburg IM, and Adam Sparkman, manager, client portfolio manager and managing director

Important Information

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This document is for informational purposes only and does not constitute a recommendation or investment advice and is not intended to predict the performance of any investment or market. It should not be construed as advice as to the investing in or the buying or selling of securities, or as an activity in furtherance of a trade in securities.

This is not a solicitation or offer for any product or service or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by Thornburg or its affiliates. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein. The views expressed herein may change at any time after the date of this publication. There is no guarantee that any projection, forecast or opinion in this material will be realized.

Investments carry risks, including possible loss of principal.