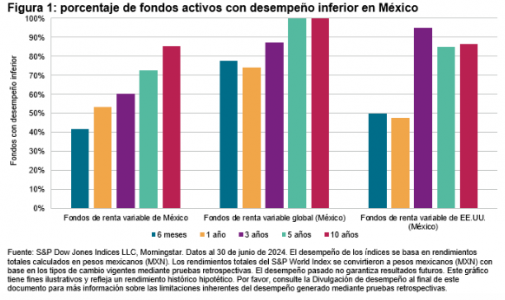

According to SPIVA (S&P Indices Versus Active), a semiannual report comparing the performance of mutual funds to their benchmarks, published by S&P Dow Jones Indices, Mexican equity funds recorded a negative performance of 41.9% in the first six months of 2024. This figure rises to 85.4% over a 10-year period.

Additionally, in the first half of 2024, 50% of U.S. equity funds denominated in Mexican pesos underperformed the S&P 500®. This underperformance rate increases to 85% and 86.7% over 5- and 10-year periods, respectively.

Meanwhile, global equity funds (in Mexican pesos) faced a tougher first half of 2024, with 77.8% underperforming their benchmark. This percentage expanded to 100% over both 5- and 10-year periods, according to the SPIVA report.

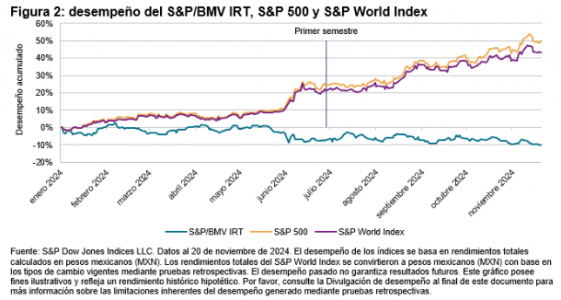

The report also explains that in Mexico, the main index, S&P/BMV IRT, began the year in negative territory and ended the first half of 2024 with a 7.2% decline. Meanwhile, the S&P 500 rose 24.2%, and the S&P World Index increased 21.2% in Mexican pesos during the first half of the year, outperforming local equities.

The Mexican equity market offered ample opportunities for superior returns, with fewer than half of local equity funds failing to outperform the benchmark in the first half of 2024.

The performance of the S&P/BMV IRT was driven by a few significant stocks, resulting in a slight positive skew in stock returns. The average component fell 5.1%, compared to a median decline of 6%.

However, according to the report, 56.8% of stocks outperformed the index during the first six months of the year. In a period when most stocks outperformed the benchmark, the majority of Mexican equity funds capitalized on favorable market conditions for stock selection. As a result, underperforming funds accounted for only 41.9% of the total during the first half of 2024.