The Republican party’s sweep of the US election is likely to boost equity markets, particularly those in the US, if the pattern of the first Trump administration is any guide. The risks are that either growth accelerates by too much and the US economy overheats, or that large tax cuts prompt a negative reaction from the bond market. We will have to wait until there is more clarity, not only on any policy proposals, but also on what can actually be implemented.

Aside from political developments, developed market central banks are cutting policy rates. This should boost both equities – as shorter-term financing costs fall – and fixed income, as the policy rate component of bond yields declines. Of course, anticipating the reaction of markets is not as simple as that because the other, arguably more important, factor driving asset prices is economic growth.

Investors should initially be circumspect in anticipating positive equity returns during a rate-cutting cycle given that four out of the last five such cycles in the US coincided with a recession. Not surprisingly, the onset of a recession led to negative returns in equities alongside gains for government bonds.

The critical consideration in anticipating returns for next year is whether 2025 will be exceptional in not having a recession.

A preference for US equities

The consensus view has been that the US will indeed see a soft landing – that growth will slow, but remain positive as core inflation moves back towards the US Federal Reserve’s 2% target. Europe has already had a slowdown, but we believe 2025 should see a modest rebound. Economic growth would be supportive of equity markets and earnings, leading to price gains in the year ahead.

Our regional preference remains the US. Enthusiasm for artificial intelligence was the primary driver of rising earnings in 2024; the bulk of earnings derived from the types of stocks making up the tech-heavy NASDAQ 100 index, while the rest of the market saw barely positive growth.

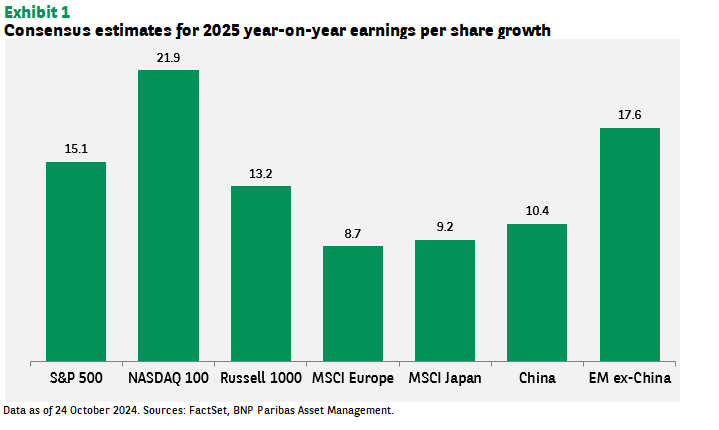

In 2025, the distribution is expected to be more balanced, even if NASDAQ earnings growth is still superior (see Exhibit 1).

European equities should also see market gains, but once again lag most other major markets. The region remains hindered by the overhang of geopolitics and structural challenges facing its largest economy, Germany.

Consumer demand in Europe will need to rebound much more strongly than we anticipate for consumer-linked sectors to thrive. Exporters will benefit from robust US growth, though tariffs remain a worry. China is unlikely to pull in European products the way it has in the past as growth in China slows.

The potential for superior returns in China will depend primarily on actions from the central authorities. China remains distinct in its dependence on government policy to drive economic growth and hence corporate profits.

While we anticipate more stimulus from Beijing, it does not look likely there will be a major change in economic policy; Beijing will probably continue to focus on investment in new, developing industries rather than nurturing household consumption or bailing out property developers.

We question whether these privileged sectors will be able to generate growth for the whole economy at the rate the authorities would like. Without a stronger rebound in the property market, consumer sentiment is likely to remain depressed. Looking to exports to make up the slack may also prove insufficient due to rising global protectionism.

Chinese earnings should nonetheless rise, at more than 10% year-on-year if consensus estimates are correct, though this is not that much more than Europe at 9%. Valuations are low relative to history, but there may now be a permanent discount to multiples versus the past, meaning price-earnings ratios will not necessarily revert to the mean.

Fixed income – Opportunities and concerns

The risk to market expectations for short-term rates in the US comes from the potentially inflationary impact of the new Trump administration’s policies (tighter immigration, tariffs, tax cuts). At this point, however, one can only speculate on what will actually be implemented.

Longer-term Treasury yields could rise to reflect the uncertainty about the outlook for inflation, to say nothing of the US budget deficit. An extension or expansion of tax cuts would only lead to a further deterioration in the fiscal outlook.

As always, however, it is unclear if and when the market will decide to fully price in these risks. We would anticipate ongoing support for gold prices as investors look for alternative safe haven assets.

Investment-grade credit should provide superior returns relative to government bonds as spreads remain contained alongside steady economic growth.

While spreads are narrow – both in the US and in the eurozone, and both for investment-grade and high-yield – they are relatively better for eurozone investment-grade credit, and we see this asset class as offering the best risk-adjusted returns.

Daniel Morris, Chief Market Strategist at BNP Paribas AM

Disclaimer

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. The views expressed herein are those of the author as of the date of publication, are based on available information and are subject to change without notice. Different portfolio management teams may have different opinions and make different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate can go down as well as up and investors may not get back their initial outlay. Past performance is no guarantee of future performance. Investing in emerging markets or in niche or restricted sectors is likely to be subject to higher than average volatility due to a high degree of concentration, greater uncertainty because less information is available, less liquidity is available, or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less certainty than most developed international markets. For this reason, transaction, settlement and portfolio maintenance services on behalf of funds invested in emerging markets may involve greater risk.