This is highlighted in the “Private Markets Annual Report 2024” by Barclays, which also clarifies that private investors are increasingly recognizing the opportunities offered by private market funds. “In general terms, the motivations of ultra-high-net-worth (UHNW) investors and high-net-worth individuals (HNWIs) to invest in private markets include diversification and lower portfolio volatility; historically higher returns compared to public markets and greater leverage available, which can potentially drive higher growth and profitability,” the report explains.

The report also explains that access to qualified investment managers can also yield dividends for private wealth owners. Commitments can generate higher returns, and communications with general partners (GPs) can provide valuable lessons on due diligence and operational reviews. Since many HNWIs have created their wealth by managing their own businesses, investments in private funds offer the opportunity to share information between partners.

According to some surveys, private investors show a growing preference for alternative assets, particularly private equity. Many of the respondents also indicate that they plan to increase their venture capital investments next year, as confidence improves following the market correction. The study cites an example from the 2023 Campden Wealth and Titanbay survey of 120 UHNW investors, where respondents noted a three percentage point increase in their target allocation for private equity, along with a two percentage point increase for public equities and a four percentage point decrease in their allocation to liquidity. In the same survey, 67% of respondents said their main motivation for investing was the potential to improve long-term portfolio returns.

The total assets under management of family offices more than doubled in the last decade, and the number of private wealth owners worldwide is expected to increase by 28.1% by 2028, representing a growing source of capital.

In the coming years, large private equity firms could receive more contributions from private wealth channels. While institutional investors, such as pensions and sovereign wealth funds, must meet strict investment mandates, private investors may have fewer legal restrictions and can tailor allocations more to their personal profiles and liquidity preferences.

“This opens up greater optionality for investing in private markets,” says the Barclays report, which adds that investment horizons are also less restrictive for personal wealth compared to institutional wealth. Institutional wealth, the report explains, “often requires regular contributions and distributions to support the liquidity needs of institutional investors, but private investors may face fewer restrictions and regulatory obstacles when investing in private markets.”

Private Equity Remains Strong

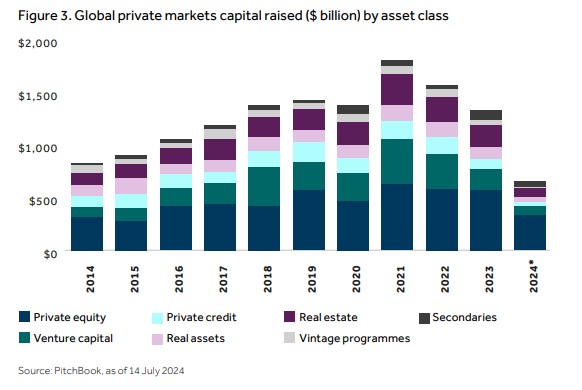

The study highlights that private equity is the main driver of fundraising in private markets. “In addition to being one of the favorite strategies for pension funds and endowments, which require predictable cash flows, private equity funds could be an option for private investors looking to support their own initiatives, including family businesses and philanthropy,” says the Barclays report. The typical 10-year life cycle of private equity funds often aligns with the longer investment horizons sought by these investors for part of their allocations, the report adds.

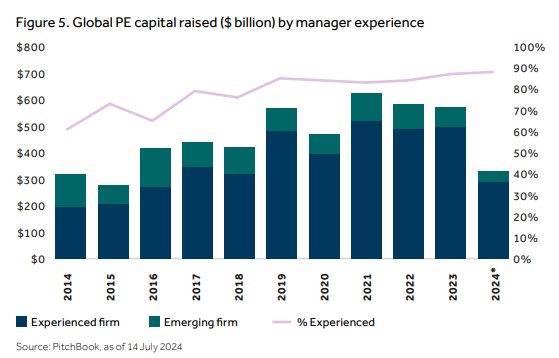

The proportion of fundraising in private markets attributed to private equity funds has increased annually since 2020, reaching a record 50.5% to date. These funds showed resilience against a broader slowdown in fundraising, raising almost as much capital in 2023 as in 2022. However, according to the report, the number of vehicles driving this total was reduced by more than half. With fewer funds maintaining or increasing their purchasing power in the last 18 months, the future flow of private equity deals and returns will tilt toward the stronger funds. This could exacerbate competition among LPs seeking the best GPs.

The selection of managers, according to the report, is as important today as it has always been. The preference of LPs for experienced private equity managers—firms that have launched at least four funds—is also increasing. “Every year since 2019, more than 80% of all new dollars directed toward private equity were closed by experienced managers, and this percentage has risen to 88% annually,” says Barclays, adding that top-tier firms have established LPs who often return for subsequent fundraising rounds, “thus limiting the entry of new investors.”

Venture Capital: Investors Seek Innovative and Sustainable Technologies

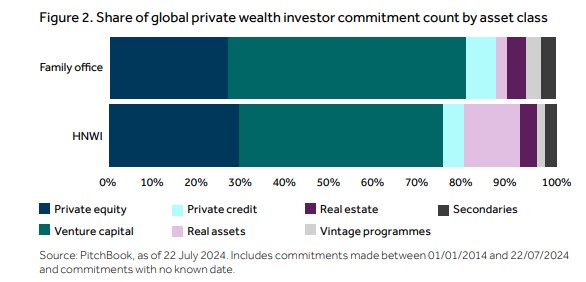

According to data from PitchBook cited by the Barclays study, nearly half of all known private market fund commitments made by private wealth investors in the last decade were with venture capital funds, “highlighting the importance of venture capital and its prevalence in non-institutional portfolios.”

Experienced managers have captured an increasingly larger share of new venture capital commitments due to the demand for managers with the best track records in an uncertain macroeconomic environment. However, with more than 650 venture capital funds successfully raised by July 2024, many opportunities still exist.

Emerging managers may offer a more timely avenue for private investors seeking short-term venture capital allocations, as these managers look for new LP bases. The risk/return profile of emerging managers may be higher without a track record, but taking on more risk for potentially higher returns is, in many ways, the essence of venture capital.

One of the main attractions for venture capital firms is their close relationship with innovative, fast-growing companies. Venture capital allocations can allow an LP to benefit from the rise of artificial intelligence, for example. The upside potential of disruptive technologies is theoretically unlimited, and the potential exposure to future industry leaders is highly valued by wealthier investors with a higher risk appetite.

Sustainability and other impact investment issues are also cited as common interests among private wealth investors. Venture capital investments are a regular financing channel for emerging technologies, such as climate tech, and an increasing number of funds are defined as “impact investors,” catering to the preferences and values of various investors through a dual goal of financial returns and positive social or environmental outcomes.

The 2023 PitchBook Survey on Sustainable Investment among private market investors worldwide revealed that respondents were more divided on the integration of sustainable investment programs between 2021 and 2023, but more than half of the LPs surveyed believe it is “extremely important” or “very important” that their GPs measure the impact in their portfolios.