On October 25, the investment regime for Afores was updated, increasing the investment limit in structured instruments from 20% to 30%, according to CONSAR’s press release. This expansion is subject to conditions set by the regulator in the Circular Única Financiera (CUF).

In the coming weeks, criteria are expected to be defined regarding the allocation of these resources. They may be directed toward strategic infrastructure projects in Mexico or subject to prudential limits for investments in local and international alternatives to diversify portfolios and enhance workers’ retirement fund returns.

Currently, 10% of assets managed by Afores equates to approximately $35 billion, a significant amount. However, allocating this new capacity will be gradual. Over the past six years, the proportion of investments in structured instruments has grown by just 2.2 percentage points, from 6.1% in 2018 to 8.3% in September 2024, reflecting an average annual increase of only 0.4%.

As of September, Afores manage approximately $345.762 billion, distributed as follows:

- 64% in debt (50% in government securities, 13% in corporate debt, and 1% in international debt);

- 20% in equities (14% international and 6% local);

- 8% in structured instruments, including alternative investments such as CKDs and CERPIs, with an estimated 4% in local and 4% in international investments. Including committed resources, this percentage rises to nearly 18% in alternatives.

Of the 4% in local investments, approximately 2% is in CKDs focused on sectors like infrastructure and energy.

Despite the progress in diversification since Afores were established in 1997, when 100% of resources were invested in debt, the journey toward full diversification remains ongoing.

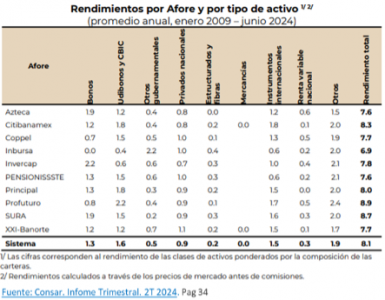

From the launch of the first CKD in 2009 to June 2024 (Source: CONSAR, Quarterly Report, 2Q 2024, p. 34), the average return for Afores has been 8.1%, with structured investments contributing 0.2%. While increasing the investment limit from 20% to 30% will take time to materialize, how these resources are allocated will be critical for Afores’ long-term profitability.

Currently, among 89 active managers, 64 manage 135 CKDs, often with a single manager but occasionally two. 25 manage 212 CERPIs, with over 50 funds spread across various sectors, though exposure varies by Afore.

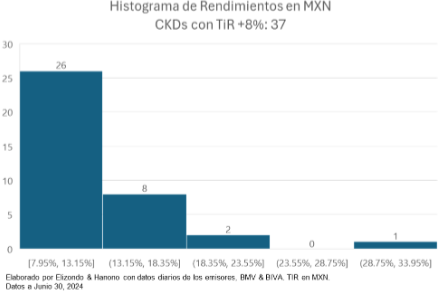

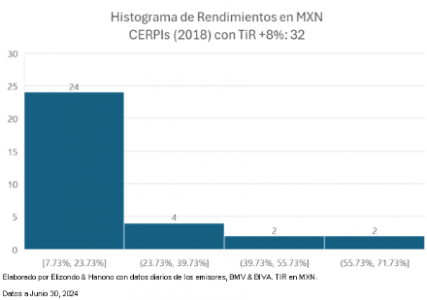

37 of 133 CKDs launched since 2009 report an IRR exceeding 8%. 32 of 210 CERPIs, primarily international investments since 2018, exceed this benchmark. Of the 13 CKDs that have matured (market value zero), five achieved an IRR above 8%.

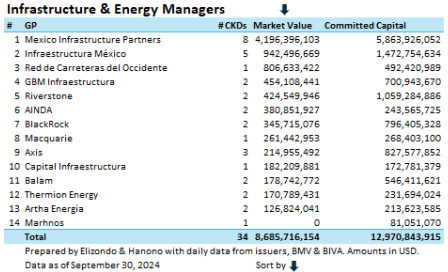

Currently, 14 managers oversee CKDs in infrastructure and energy, managing $8.686 billion with commitments totaling $12.971 billion. Ten managers handle at least two CKDs.

The diversification of Afores gains importance considering reforms to worker contributions in 2020, which are expected to increase assets under management.

According to JP Morgan Asset Management’s February 2024 analysis, “Mexico Pension Fund System Overhaul: Afores in the Spotlight”, Afores are projected to manage $451 billion by 2026 and $659 billion by 2030.

The decision on how to invest the additional authorized 10% will be crucial in determining the future performance of workers’ retirement funds, presenting a significant opportunity to optimize Afores’ returns.

Expert Column by Arturo Hanono for Funds Society