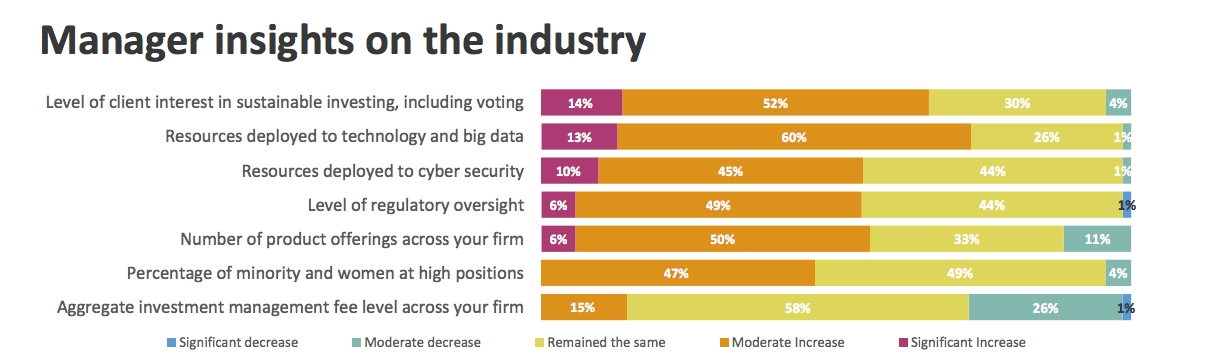

According to the report, regulation—55% of companies experienced an increase in regulatory oversight—and sustainability are fundamental aspects transforming their business. For example, 66% of the surveyed firms reported a rise in client interest in sustainable investments, including voting, while 73% boosted resources allocated to technology and big data, and 55% to cybersecurity. Additionally, 47% increased the representation of minorities and women in senior positions.

In business terms, 56% of the surveyed companies reported an increase in their range of product offerings, while 27% noted a decline in aggregate investment management fees, and 15% experienced a moderate increase.

When it comes to sustainability, investment firms believe the effort starts internally. While this approach has been widely integrated regarding environmental sustainability, it has not been as prevalent in terms of governance. One key area of focus for asset managers has been increasing the presence of women within their companies and industry.

“Among the 79 asset managers who provided data on workforce diversity, an average of 24% of senior management positions are held by women, who represent 41% of the total workforce. Women and minority groups still have relatively low representation in senior leadership roles, despite a slight increase since 2022,” the report notes.

Environmental Commitment

If we focus solely on environmental aspects, it becomes evident that the commitment to net zero emissions by 2050 has been adopted by much of the industry. “A net zero commitment is a pledge by a company, country, or organization to reduce their greenhouse gas emissions to the point where the amount emitted is balanced by the amount removed from the atmosphere. The goal is to achieve ‘net zero’ carbon emissions by a specific target year, meaning that any emissions produced are offset through actions like carbon capture, reforestation, or purchasing carbon credits, resulting in no net increase of greenhouse gases in the atmosphere. This is a key strategy to combat climate change and limit the rise in global temperatures,” the report explains.

In this regard, the commitment of asset managers varies by region. For example, although the Americas region has the lowest proportion of companies with ‘net zero’ commitments, it holds the largest share of assets. Considering only those companies with ‘net zero’ targets for their portfolios, the committed assets stand at 18% in EMEA, 13% in the Americas, and 3% in APAC.

Additionally, according to the document, specific country regulations in Spain (90%), Netherlands (82%), United Kingdom (80%), Switzerland (80%), France (79%), and Germany (77%) drive high adoption rates. Other notable mentions include Japan (90%) and Australia (71%), both with ‘net zero’ commitments for 2050 supported by policies and strategies rather than legally binding mandates.

The Use of AI

Lastly, the report offers a brief overview of the integration of artificial intelligence (AI). According to the survey, AI enhances decision-making, increases efficiency, solves complex problems, and offers scalability. In fact, as AI technology continues to advance, its role in industry transformation will become even more critical.

This sentiment is reflected in the responses of the surveyed companies: 64% of firms classified from Japan and South Korea invest in AI, while 82% and 72% of firms classified from India and Japan use AI. Additionally, approximately half of the companies using AI incorporate it into their investment processes (20% overall).