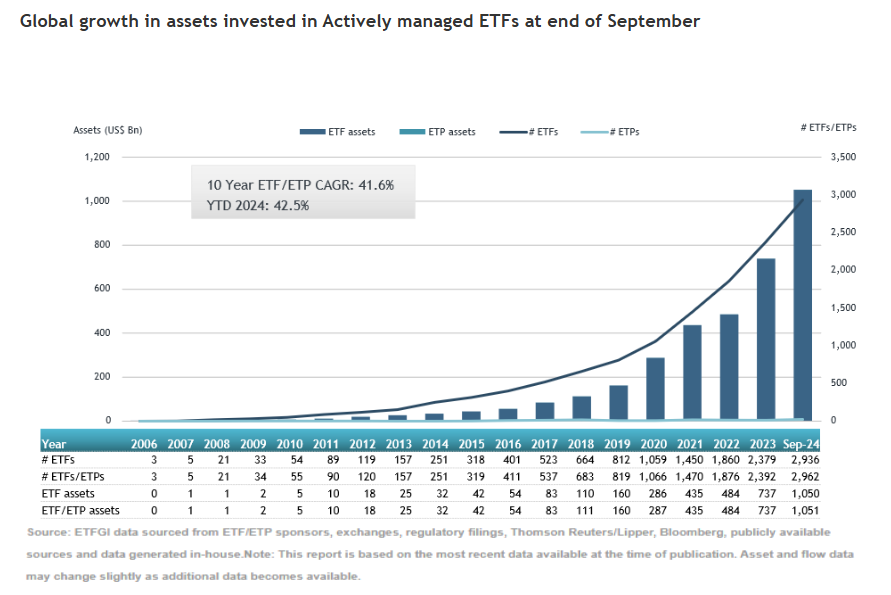

The ETF market shows great strength worldwide, as do actively managed ETFs, which achieved assets of $1.05 trillion as of the end of September, surpassing the previous record of $1.01 trillion set at the end of August 2024. This figure indicates that assets have increased by 42.5% so far in 2024, rising from $737.06 billion at the end of 2023 to $1.05 trillion.

According to ETFGI, flows show that this type of vehicle recorded net inflows of $26.50 million in September, bringing total inflows for the year to $240.14 billion. “This year’s record cumulative inflow of $240.14 billion is followed by cumulative net inflows of $113.80 billion in 2023, and the third-highest record was $106.90 billion in 2021. This was the 54th consecutive month of positive net inflows,” the report states.

Additionally, the report highlights that in the United States, where actively managed ETFs can use semi-transparent or non-transparent models, only 52 of the 1,659 actively managed ETFs use a semi-transparent or non-transparent model, representing only $14 billion of the $791 billion invested in these strategies.

In light of this data, Deborah Fuhr, managing partner, founder, and owner of ETFGI, notes: “The S&P 500 index rose 2.14% in September and is up 22.08% so far in 2024. The developed markets index, excluding the U.S., increased by 1.26% in September and is up 12.53% in 2024. Hong Kong, with a rise of 16.51%, and Singapore, with a rise of 7.43%, saw the largest increases among developed markets in September. The emerging markets index rose by 7.72% in September and is up 19.45% in 2024. China, with an increase of 23.89%, and Thailand, with an increase of 12.43%, registered the largest gains among emerging markets in September.”

As of the end of September 2024, according to ETFGI data, the global actively managed ETF/ETP industry included 2,962 ETFs/ETPs, with 3,679 listings, assets of $1.05 trillion, offered by 485 providers across 37 exchanges in 29 countries. By strategy type, globally focused equity ETFs saw net inflows of $15.49 billion in September, raising cumulative net inflows for the year to $139 billion, surpassing the $76.15 billion in cumulative net inflows in 2023. Meanwhile, actively managed fixed-income ETFs attracted net inflows of $10.19 billion in September, bringing cumulative net inflows to $86.36 billion, significantly more than the $36.20 billion in 2023.

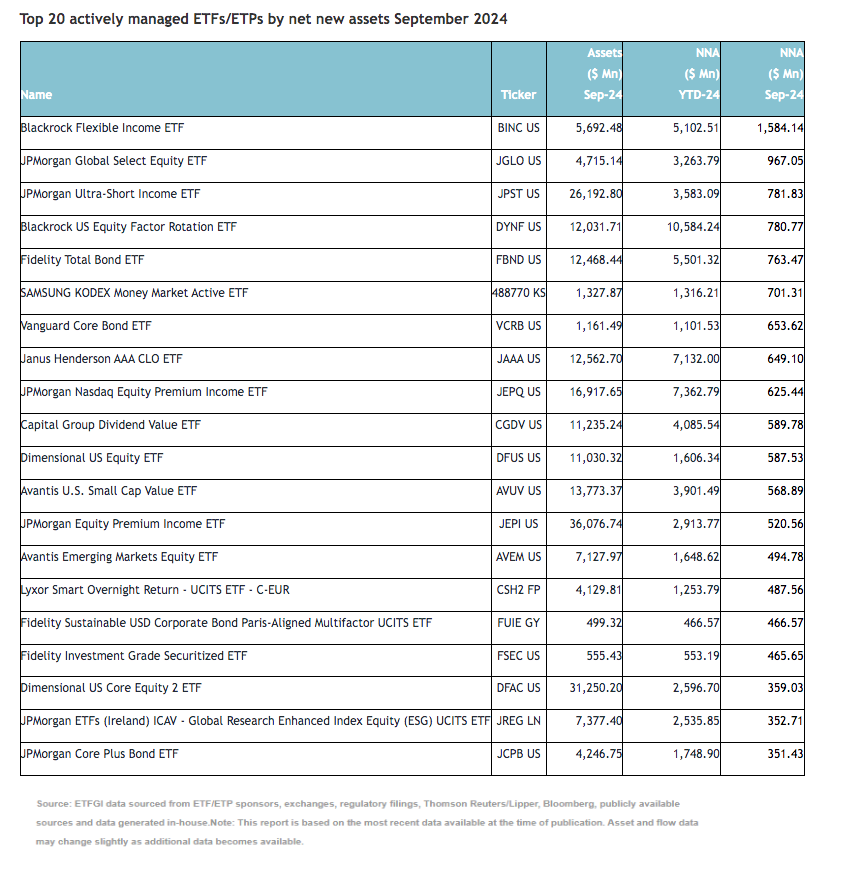

A substantial portion of these inflows is attributed to the top 20 active ETFs by new net assets, which collectively captured $12.75 billion in September. The BlackRock Flexible Income ETF (BINC US) led with the highest individual net inflow, capturing $1.58 billion.