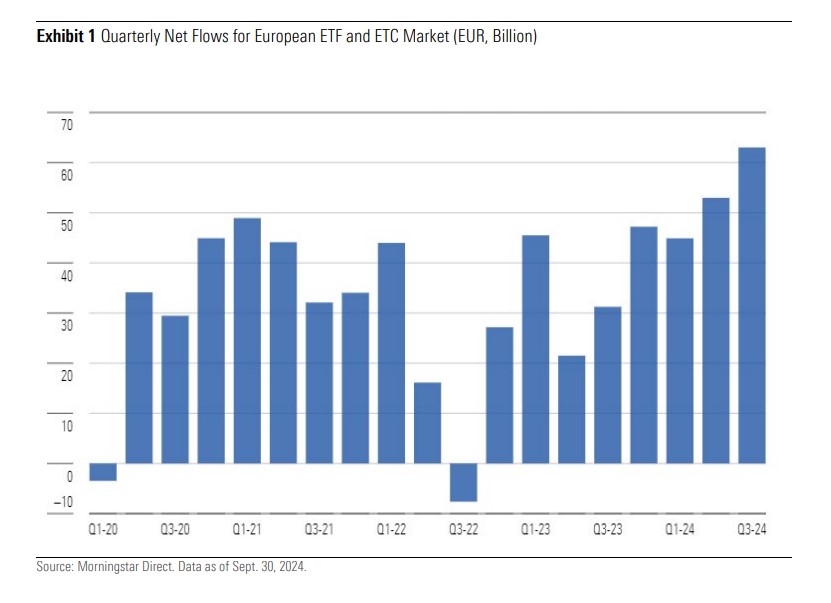

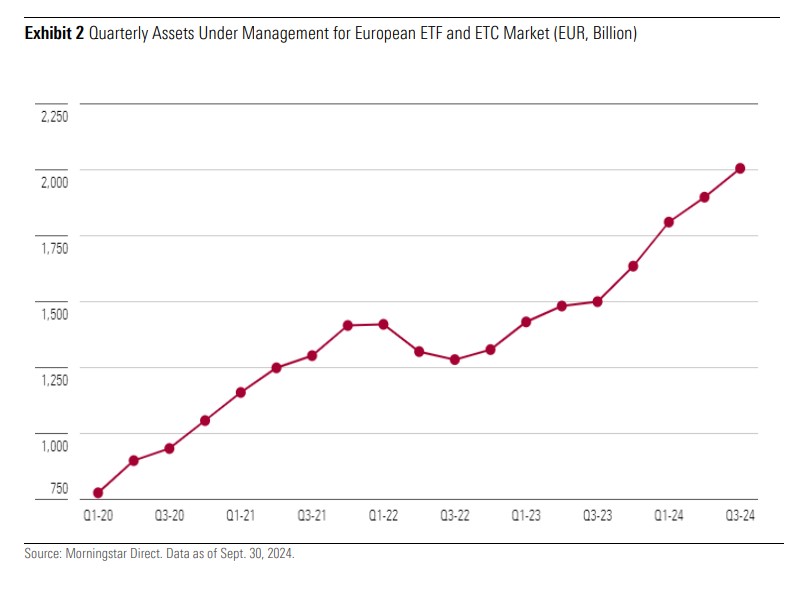

The European ETF industry is on track to reach record numbers in 2024, according to the latest market report from Morningstar. According to its data, the third quarter of the year recorded inflows worth €63 billion, a considerable increase compared to €53 billion in the second quarter. Additionally, assets under management grew by 5.7% during this period, surpassing the €2 trillion mark for the first time. “This increase marks a new quarterly record. Cumulative flows in the first three quarters of 2024 totaled €161 billion, surpassing the 2023 total and the previous annual high of €159 billion recorded in 2021. With one quarter still to account for, 2024 is set to be a record year for the ETF industry in Europe,” Morningstar indicates.

José García-Zárate, Associate Director of Passive Strategies at Morningstar, explains that the European ETF market closed the third quarter with a historic record of €63 billion in net inflows. “Surprisingly, with one quarter still to go, year-to-date cumulative flows have reached €161 billion, surpassing the previous annual record of €159 billion set in 2021. Assets have exceeded the €2 trillion mark for the first time,” he notes.

García-Zárate highlights that most third-quarter flows were directed toward equity strategies, especially U.S. large-cap stocks. “We have observed a substantial increase in interest in equally weighted ETFs in the S&P 500 following market volatility in August. This phenomenon suggests that some investors are concerned about the high concentration in technology stocks in capitalization-weighted indices. There was also an increase in demand for U.S. small-cap ETFs as investors look for tactical opportunities in the context of the interest rate cut cycle, moving away from large-caps. On the other hand, active ETFs, which have gained significant attention, attracted €4.8 billion, representing 7.7% of all ETF flows during the quarter. Although this segment is experiencing triple-digit organic growth rates, it still starts from a very low base: active ETFs represent only 2.2% of total assets in Europe.”

Key Trends

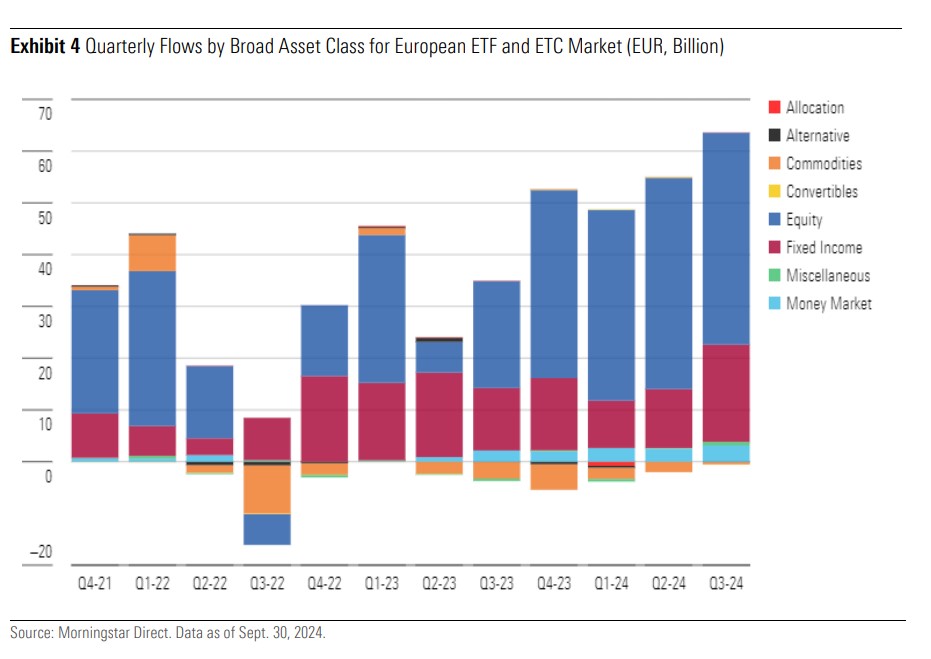

In terms of trends, Morningstar’s report shows that most assets, €1.42 trillion (71%), remain invested in equity strategies. In fact, these strategies captured €41 billion in the third quarter, slightly above the €40 billion in the second quarter. One of the most notable figures is that U.S. large-cap equities remain the most popular market exposure, although there has been a significant increase in interest in ETFs following equally weighted indices, especially the S&P 500. “These ETFs have gained popularity as a risk management tool amid concerns over excessive market concentration,” the report highlights.

Fixed-income ETF assets closed the quarter at €427 billion, accounting for 21.3% of the total. According to Morningstar, bond ETFs attracted €18.8 billion in the third quarter, up from €11.4 billion in the second quarter. “Investment-grade corporate debt ETFs and fixed-maturity bonds were favored, while inflation-linked bond strategies saw outflows,” the report indicates.

Meanwhile, ESG ETFs captured €7.5 billion in the third quarter, compared to €5 billion in the second quarter. According to the report, this increase was driven by a rise in flows toward ESG bond ETFs, while flows into ESG equity ETFs remained practically unchanged at €3.6 billion. “Flows into ESG strategies represented 12% of total ETF flows in the third quarter, up from 9.4% in the second quarter,” the report states.

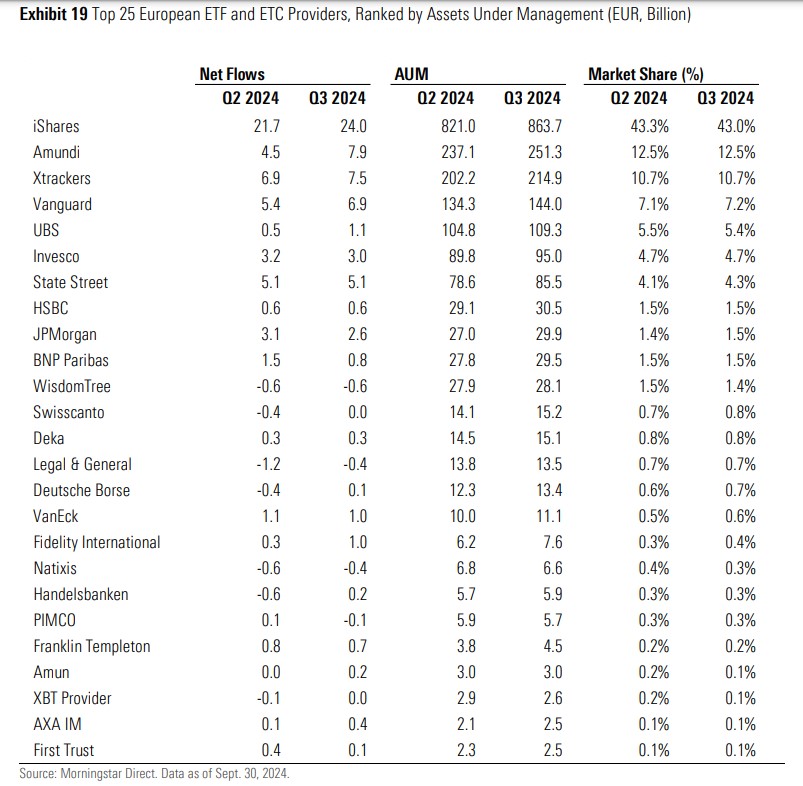

Finally, active ETFs captured €4.8 billion in the third quarter, slightly above the €4.7 billion in the second quarter, representing 7.7% of all ETF flows during the period. “Strategic beta ETFs recorded net inflows of €3.2 billion in the third quarter, led by equally weighted equity strategy ETFs, while thematic ETFs saw outflows of €1.6 billion in the third quarter, with the largest outflow recorded in the energy transition ETF subgroup,” the report notes as other notable trends. One constant trend is the leadership of iShares, which topped the provider rankings in the third quarter with quarterly flows of €24 billion, followed by Amundi with around €8 billion, Xtrackers with €7.5 billion, and Vanguard with €7 billion.