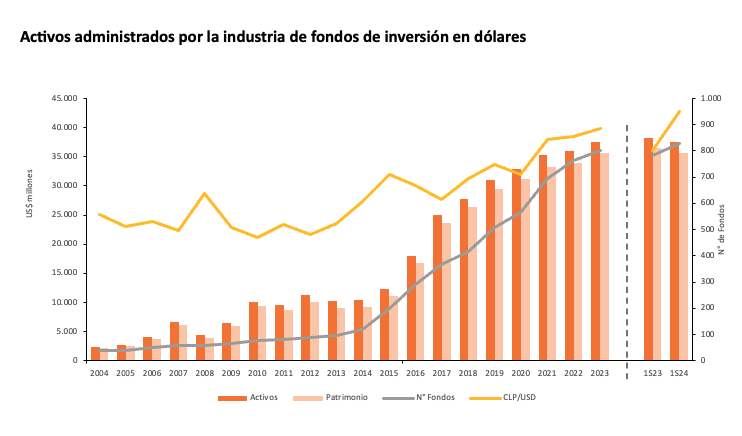

The latest report from the Chilean Association of Investment Fund Managers (ACAFI) reveals that public investment funds reached $37.483 billion at the close of the first half of this year. Of the assets managed by new funds, 86% corresponds to alternative assets.

Despite the industry’s dynamism, the first half of the year saw a 1.9% decline compared to June 2023, mainly due to the evolution of the exchange rate, which posted an annual increase of 18.6% during this period.

However, when analyzing the total figures in Chilean pesos, the industry’s assets grew by 16.3% year-on-year, reaching CLP 35.647 trillion in June.

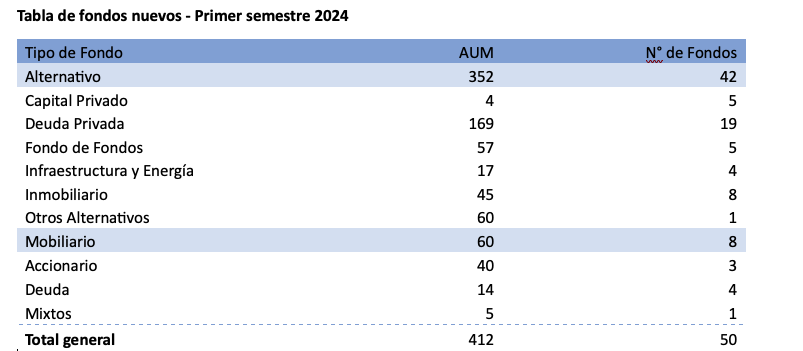

Focusing on just the second quarter of this year, the ACAFI report reveals that 31 funds were created between April and June. As a result, a total of 50 new funds were launched during the first half, representing $410 million in new assets under management.

During this period, alternative assets continued their upward trend. Of the assets managed by new funds, 86% were in this category, with private debt vehicles dominating preferences.

According to Luis Alberto Letelier, president of ACAFI, another key aspect is that half of these 50 new funds invest directly in assets in Chile, primarily in projects that promote development, such as renewable energy plants, loans for entrepreneurs and startups, and initiatives to facilitate access to housing.

Regarding private debt funds, Letelier asserts that the observed increase “demonstrates that they are consolidating as a source of financing for various productive sectors in our country, contributing to Chile’s growth.”

By Emilio Veiga Gil

By Emilio Veiga Gil