Fed Rate Cuts Will Ease Pressure on U.S. Real Estate Market, but Mortgage Rates Unlikely to Fall Below 5% Before 2027, According to Fitch Ratings

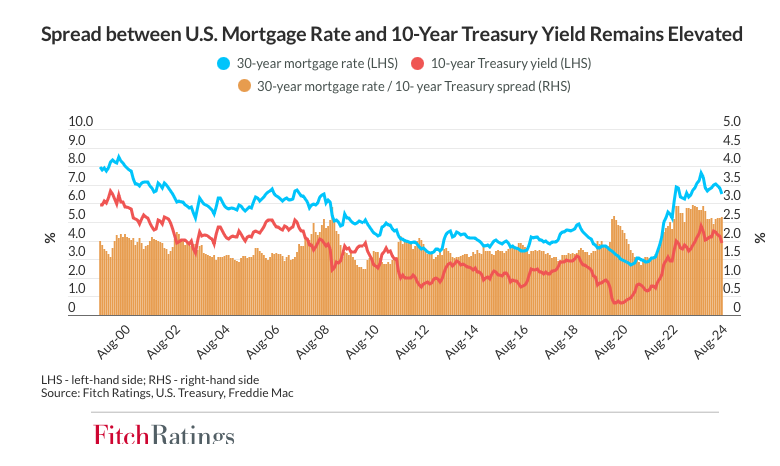

The 30-year fixed mortgage rate and the 10-year Treasury yield have already priced in the Federal Reserve’s 50 basis point rate cut. Even with additional rate cuts, a decline in the 30-year mortgage rate to around 5% depends on the spread with the 10-year Treasury bond returning to the pre-pandemic average of 1.8 percentage points.

Fitch analysts note that the 10-year yield has less room to fall following rate cuts, especially after this summer’s declines in anticipation of monetary policy easing. They expect the 10-year yield to end 2026 around 3.5%, down slightly from its current level of around 3.7%. A 3.5% 10-year Treasury yield plus the historical average spread of 1.8 percentage points results in a mortgage rate of around 5.2%.

The spread between the 30-year mortgage rate and the 10-year Treasury yield has widened relative to the historical average since the Fed began raising policy rates in March 2022. This reflects a higher prepayment risk and the Fed’s reduction in its holdings of mortgage-backed securities (MBS). The spread peaked near 3% in November 2023 when the average 30-year fixed mortgage rate reached a cycle high of 7.8%. It has since narrowed slightly, averaging 2.6 percentage points since January 2024.

Demand Remains Above Averages

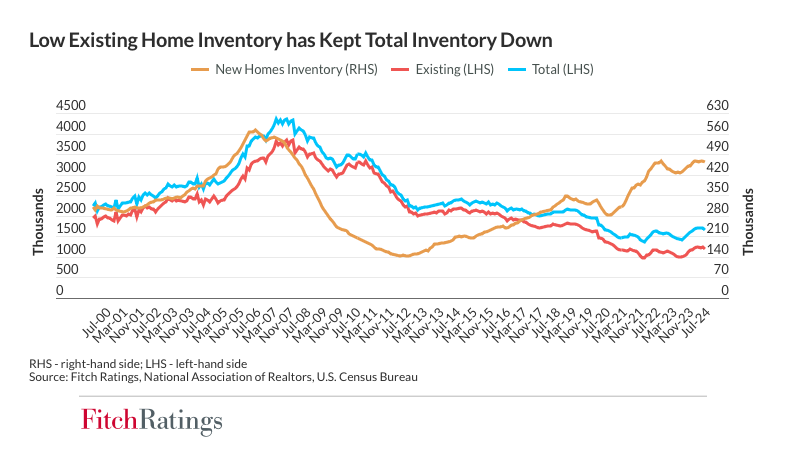

Housing demand, as measured by homes sold above the list price and the average sale price relative to the list price, has softened since August 2023 but remains above long-term averages. A further decline in mortgage rates will help improve affordability and support demand, but low inventory will likely constrain home sales until rates approach 5%.

Around 24% of outstanding mortgages have rates above 5%. As mortgage rates approach that figure, likely by 2026, homeowners with these higher-rate mortgages, along with those with rates between 4% and 5% (around 19% of outstanding mortgages), should become more willing to sell their homes and take on a new mortgage, according to Fitch Ratings.

Housing Supply Needs to Improve

According to Fitch, “Total U.S. inventory has broadly increased this year, but it remains below pre-pandemic levels, driven by a 27% drop in existing home supply since February 2020. While the new home inventory has grown by 29% since the start of the pandemic, the supply of existing homes, which accounts for roughly 80% of home sales, needs to improve in order to enhance pricing and market activity.”

Mortgage originators are already benefiting from higher volumes as refinancing activity has gradually recovered with the decline in mortgage rates. Homeowners with mortgage rates above 6%, representing 14% of outstanding mortgages or roughly $1.5 to $2 trillion, are in a prime position to refinance as the average 30-year rate approaches 6%.