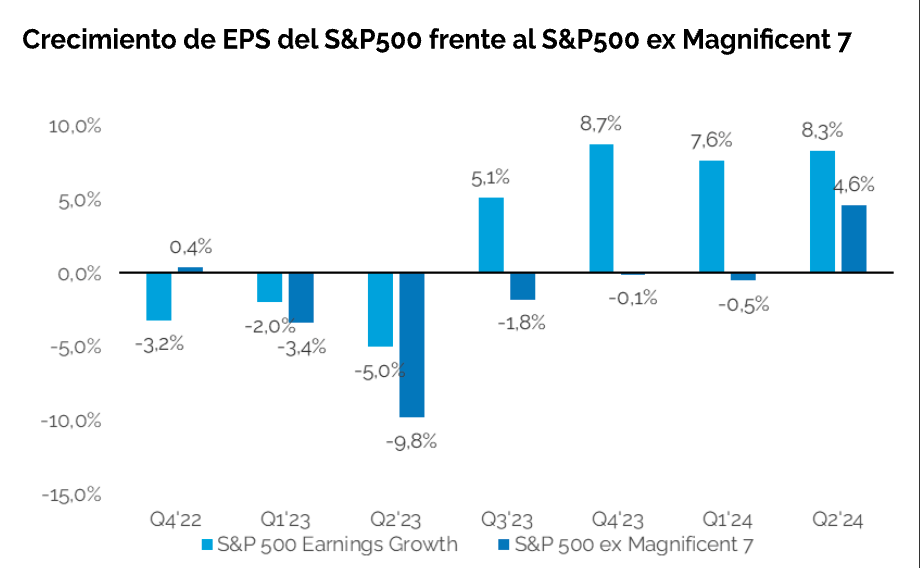

The second-quarter earnings season in the U.S. is coming to an end. So far, results have surprised to the upside, with earnings per share (EPS) growth of 8% year-over-year, exceeding market estimates by 4%. A noteworthy aspect of this season is the broader participation in earnings growth, as the EPS of the S&P 500 has shown an increase even when excluding the large tech companies (Mag-7) for the first time in five quarters, notes Felipe de Solminihac, Investment Analyst at Fynsa.

In terms of sector performance, the highest earnings growth continues to be seen in technology-related sectors. In fact, the earnings growth of the Mag-7 has been 26% year-over-year.

Solminihac explains that despite the strong growth shown by the Mag-7 companies this quarter and exceeding market expectations by 6% (vs. +11% on average over the last four quarters), this has not been rewarded by investors, as the prices of all the stocks—except Meta—fell by an average of 8% in the three days following the earnings reports. In other words, when you have a sector with such high valuations in historical terms and so much implicit earnings growth, it is not enough to simply beat the current quarter’s estimates; it must exceed what had been surprising in previous quarters and also offer a strong forward-looking guidance.

For the Fynsa analyst, another risk factor is that the proportion of companies exceeding sales estimates has significantly decreased across the S&P 500. This factor could put pressure on margins in the second half of the year, as slower revenue growth combined with persistent costs could affect the future profitability of companies.

“With this background, and already thinking more about 2025, one might wonder if the market’s expected earnings growth of +15% might be a bit optimistic, especially in the context of a clearly slowing U.S. economy and valuations that are at the higher end of their historical range (Today, the market trades at 21.5 times forward P/E, representing a 23% premium compared to its historical average),” says Felipe de Solminihac.

For this reason, the bar by which corporate earnings in the U.S. should be measured is different from when the market was trading at lower valuations and prior to the AI boom.

Finally, the expert observes a crucial differentiation within the equity market: the S&P 500 equal weight trades at a 20% discount compared to its market cap-weighted version. This differentiation could present a better way to gain exposure to the U.S. market.