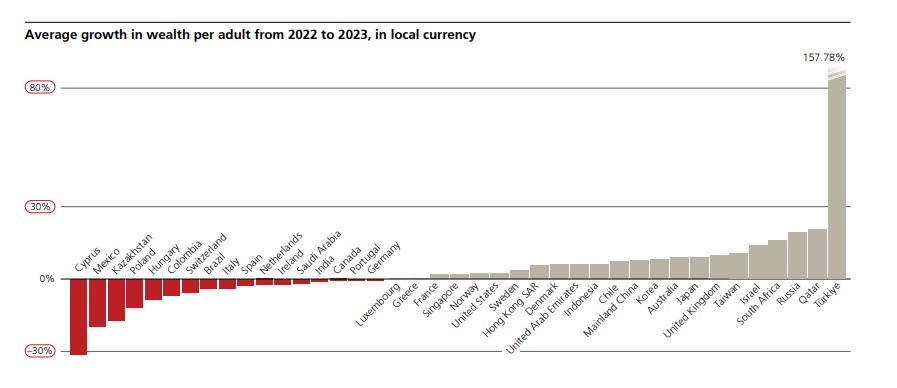

The global wealth growth rebounded in 2023 from the 3% contraction experienced the previous year, largely attributed to the monetary impact of the strong dollar. According to the latest UBS Global Wealth Report, wealth increased by 4.2% in 2023, making up for the losses of 2022 in both U.S. dollars and local currencies. This recovery was driven by growth in Europe, the Middle East, and Africa (EMEA), which saw a 4.8% increase, and the Asia-Pacific (APAC) region, which grew by 4.4%. With inflation slowing down, real growth outpaced nominal growth in 2023, with inflation-adjusted global wealth rising by nearly 8.4%.

The report highlights that wealth growth continues progressively worldwide, though at varying speeds. Since 2008, the proportion of individuals with the lowest wealth levels has decreased, while those with higher wealth levels have increased. The percentage of adults with wealth below $10,000 nearly halved from 2000 to 2023, with most moving up to the broader $10,000 to $100,000 range, which more than doubled. It is now three times more likely for wealth to exceed one million dollars.

On the other hand, the report explains that while inequality has been increasing over the years in rapidly growing markets, it has decreased in several mature developed economies. Globally, the number of adults in the lowest wealth bracket is experiencing a steady decline, while all other wealth brackets are consistently expanding.

Regional Wealth Insights

As the report indicates, this wealth recovery is driven by Europe, the Middle East, and Africa. According to the document, notably, while the global wealth decline in 2022 was mainly caused by the strength of the US dollar, last year wealth recovered above 2021 levels, even when measured in local currencies.

It is highlighted that since 2008, wealth has grown faster in the Asia-Pacific region, apparently driven by debt. “In this region, wealth has grown the most – nearly 177% – since we published our first Global Wealth Report fifteen years ago. The Americas are in second place, with nearly 146%, while EMEA lags far behind with just 44%. The exceptional growth in Asia-Pacific wealth, both financial and non-financial, has notably been accompanied by a significant increase in debt. Total debt in this region has grown more than 192% since 2008 – more than twenty times that in EMEA and more than four times that in the Americas,” they note.

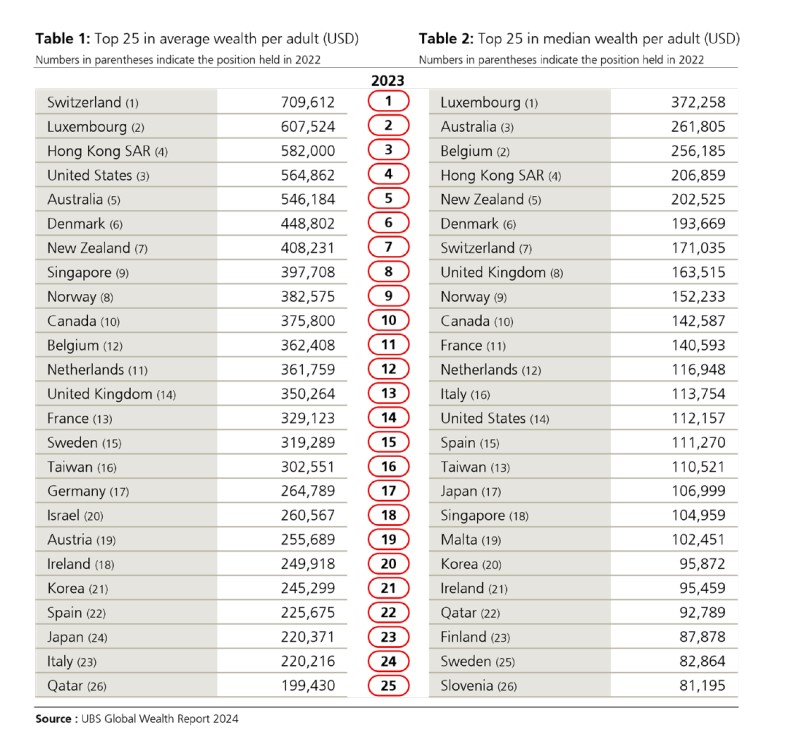

In the case of the United States, it remains one of the few markets where wealth growth has accelerated since 2010 compared to the previous decade. In the US, as well as in the UK, wealth has grown uniformly across all wealth categories. “Our analysis shows that wealth inequality has slightly decreased in the US since 2008; in 2023, it housed the largest number of US dollar millionaires,” they add.

Regarding Latin America, growth was strong, but inequality remains present. Specifically, average wealth per adult in Brazil has grown by more than 375% since the 2008 financial crisis, when measured in local currency. This is more than double the growth of Mexico, at just over 150%, and more than mainland China’s 366%. However, Brazil has the third highest rate of wealth inequality in our sample of 56 countries, behind Russia and South Africa.

Finally, EMEA enjoys the highest wealth per adult in US dollar terms, with just over $166,000, followed by APAC, with just over $156,000, and the Americas, with $146,000. “Growth in average wealth per adult since 2008, expressed in dollars, shows a different picture: EMEA ranks last with 41%, compared to 110% in the Americas and 122% in APAC,” they explain.

Wealth Transfer and Horizontal Mobility

One of the key trends highlighted in the report is that wealth mobility is more likely to be upward than downward. “Our analysis of household wealth over the past 30 years shows that a substantial portion of people in our sample markets move between wealth brackets throughout their lives. In every wealth band and over any time horizon, people are consistently more likely to move up the wealth scale than down. In fact, our analysis shows that approximately one in three people move to a higher wealth band over the course of a decade. And, although extreme moves up and down the scale are uncommon, they are not unknown. Even leaps from the bottom to the top are a reality for a portion of the population. However, the likelihood of becoming wealthier tends to decrease over time. Our analysis shows that the longer it takes adults to appreciably gain wealth, the slower their increase tends to be in future years,” the report states.

In this regard, UBS has detected that “a large horizontal wealth transfer is underway.” According to the document, in many couples, one spouse is younger than the other, and generally, women outlive men by just over four years on average, regardless of the average life expectancy of a given region. This means that intra-generational inheritance often occurs before inter-generational wealth transfer.

“As our analysis shows, the inheriting spouse can be expected to retain this wealth for an average of four years before passing it to the next generation. Our analysis also shows that $83.5 trillion of wealth will be transferred in the next 20-25 years. We estimate that $9 trillion of this amount will be transferred horizontally between spouses, mostly in the Americas. More than 10% of the total $83.5 trillion is likely to be transferred to the next generation by women,” the report concludes.

Millionaires

Another relevant conclusion is that the number of millionaires is set to continue growing. In 2023, millionaires already represented 1.5% of the adult population analyzed by UBS. Specifically, the United States had the highest number, with nearly 22 million people (or 38% of the total), while mainland China was in second place with just over six million, roughly double the number in the United Kingdom, which ranked third.

“By 2028, the number of adults with wealth of more than one million dollars will have increased in 52 of the 56 markets in our sample, according to our estimates. In at least one market, Taiwan, this increase could reach 50%. Two notable exceptions are expected: the United Kingdom and the Netherlands,” the report concludes.