The assets under management in the digital investment market, including robo-advisors and neo-brokers, have snowballed in recent years, growing from $3.8 billion in 2017 to $2.26 trillion in 2023. According to data analyzed by AltIndex.com, it is estimated that the assets in this business will continue to grow, but possibly at a slower pace.

According to AltIndex.com, the assets of robo-advisors and neo-brokers will reach $2.8 trillion in 2024, 30% less than previously forecasted. Growth projections for the robo-advisors sector decreased by 46%; however, the neo-brokers market is expected to increase by double the previous forecast. “Thanks to robo-advisors, neo-brokers, and trading apps, people can invest in stocks, bonds, and other assets without actively managing their portfolios, with algorithms adjusting their risk preferences, making data-driven decisions, and maximizing returns. This approach offers, in principle, a broader range of investment options and lower fees, attracting millions of people to the market,” explains the platform.

Between 2017 and 2023, the number of people using these services multiplied by 35, increasing from approximately 15 million to over 500 million. Thanks to this enormous user base, the entire market has experienced five consecutive years of triple-digit growth. And although market forecasts remain optimistic, the latest Statista survey showed a significantly lower annual growth rate than expected last year.

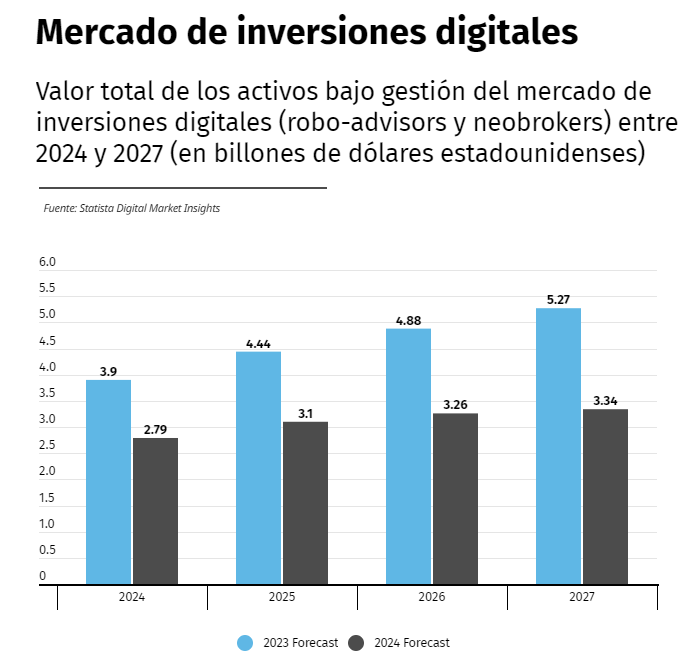

According to Statista’s 2024 Market Insights, the total transaction value in the digital investment industry will grow by 23% and reach $2.79 trillion this year, nearly 30% less than the $3.9 trillion expected in the 2023 market forecast. Most of that decline will come from the robo-advisors segment. Last year, Statista projected that the robo-advisors segment would reach a transaction value of $3.39 trillion in 2024; now, that figure is 46% lower, standing at $1.8 trillion.

On a positive note, the neo-brokers market is expected to grow much more than anticipated last year. In May 2023, Statista data showed that this sector would reach a value of approximately $500 million in 2024. However, growth projections have become much more optimistic since then. The latest data shows that the total value of assets managed by neo-brokers will reach $980 billion in 2024, nearly double the previous year’s expectations. Statista expects this figure to continue growing, reaching $1.07 trillion by 2027, or 75% more than the 2023 forecast.

Nearly 600 million people will use digital investment services in 2024. Despite a 30% decline in the projected growth rate, the digital investment market continues to demonstrate its resilience. The market is expected to welcome an impressive number of users this year, proof of the efficiency, speed, and low service fees it offers.

By Fórmate a Fondo

By Fórmate a Fondo