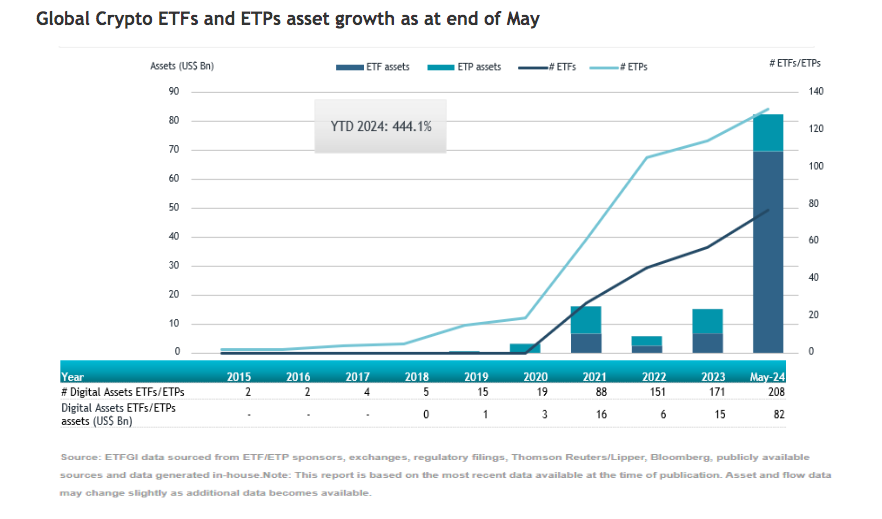

The universe of passive cryptocurrency vehicles continues to show its strength. According to data recorded by the analysis and consulting firm ETFGI, cryptocurrency ETFs and ETPs listed globally accumulated $2.23 billion in net inflows in May. This means that inflows into this type of vehicle amounted to $44.5 billion in the first five months of the year, which is much higher than the $135.57 million in outflows recorded in the same period last year.

“The S&P 500 Index increased by 4.96% in May and has risen by 11.30% so far in 2024. Developed markets, excluding the U.S. index, increased by 3.62% in May and have risen by 6.09% so far in 2024. Norway (10.84%) and Portugal (8.72%) saw the largest increases among developed markets in May. The emerging markets index increased by 1.17% during May and has risen by 4.97% so far in 2024. Egypt (11.82%) and the Czech Republic (9.44%) saw the largest increases among emerging markets in May,” says Deborah Fuhr, managing partner, founder, and owner of ETFGI.

According to the firm, the global cryptocurrency ETF and ETP industry had 208 products, with 551 listings, assets of $82.27 billion, from 47 providers listed on 20 exchanges in 16 countries. After net inflows of $2.23 billion and market movements during the month, assets invested in cryptocurrency ETFs/ETPs listed globally increased by 16.7%, from $70.47 billion at the end of April 2024 to $82.27 billion at the end of May 2024.

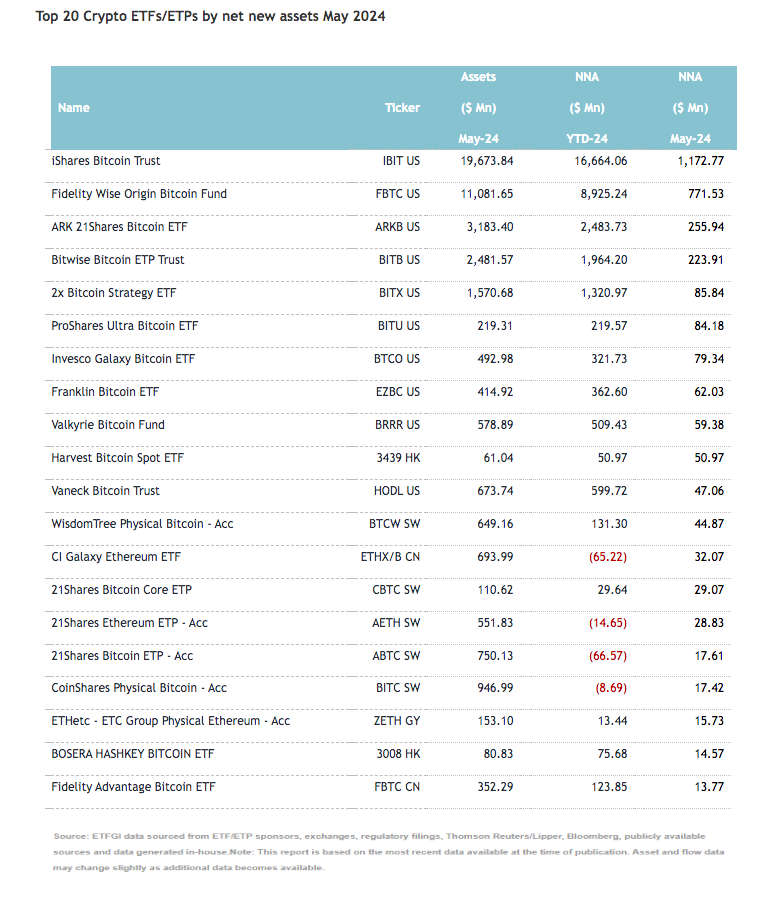

Additionally, it highlights that inflows into sustainable vehicles can be attributed to the top 20 ETFs/ETPs by new net assets, which collectively accumulated $3.11 billion during May. Specifically, the iShares Bitcoin Trust (IBIT US) accumulated $1.17 billion, the largest individual net inflow.